I. MARKET ANALYSIS OF THE UNDERLYING STOCK MARKET ON SEPTEMBER 23, 2025

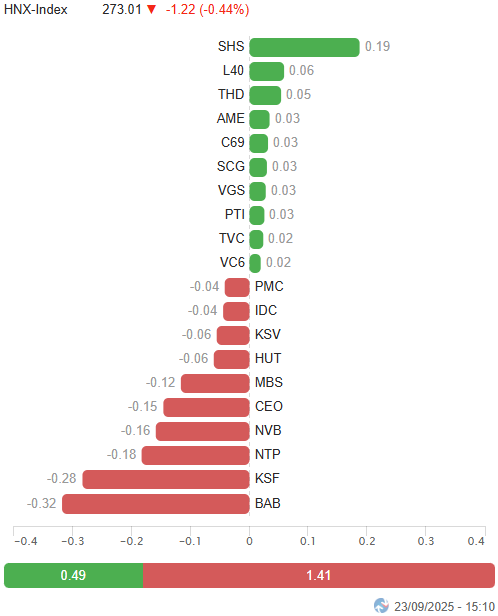

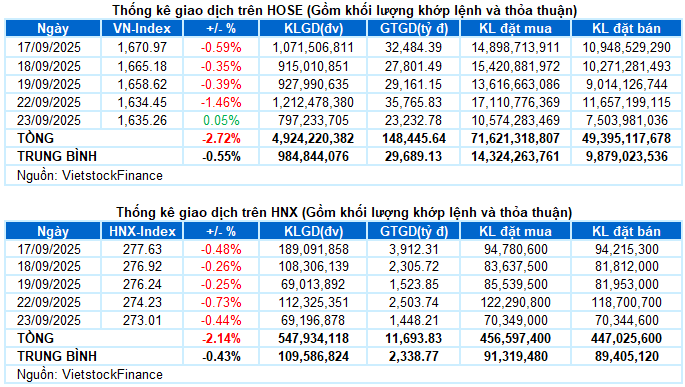

Key indices showed mixed movements during the September 23 trading session. The VN-Index edged up by 0.05%, closing at 1,635.26 points. In contrast, the HNX-Index continued its decline, dropping by 0.44% to 273.01 points.

Trading volume on the HOSE floor plummeted by 42.3% compared to the previous session, marking the lowest level since early July 2025, with over 657 million units traded. The HNX floor saw nearly 57 million units matched, also a sharp decline of 46.5%.

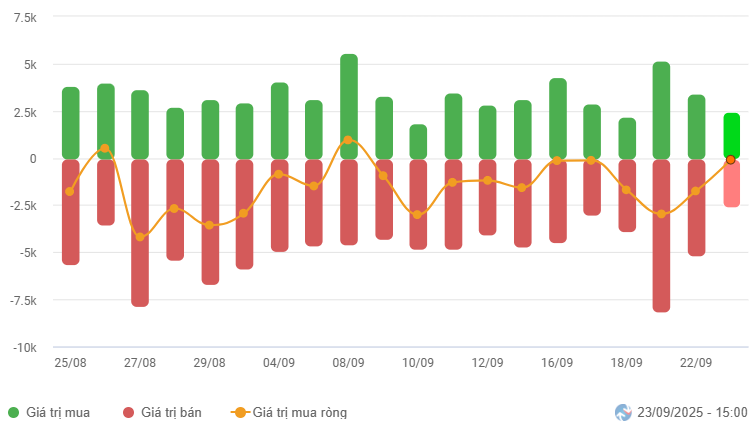

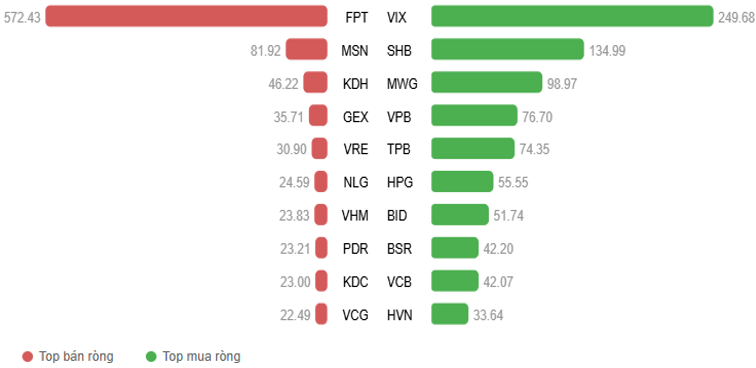

Foreign investors narrowed their net selling, with a value of over 100 billion VND on the HOSE and nearly 8 billion VND on the HNX.

Foreign Investors’ Trading Value on HOSE, HNX, and UPCOM by Date. Unit: Billion VND

Net Trading Value by Stock Code. Unit: Billion VND

The VN-Index began the September 23 session with a recovery as selling pressure eased after five consecutive declining sessions. However, the market’s liquidity plummeted, reflecting investor caution and resulting in a slow and sluggish rebound. The index hovered around the 1,640-point mark until mid-afternoon before weakening and turning red. Late-session efforts helped the VN-Index close just above the reference level at 1,635.26 points.

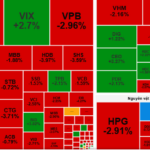

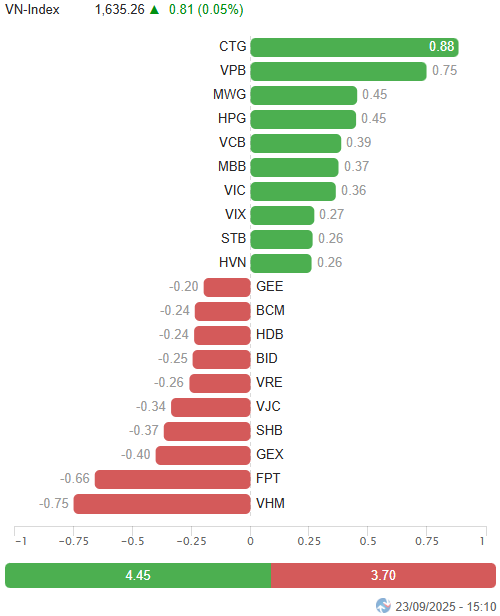

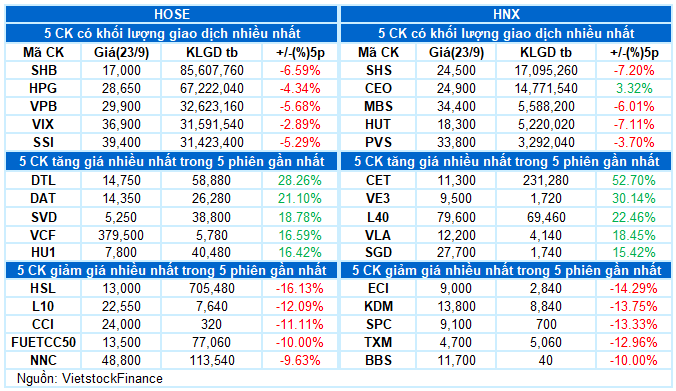

In terms of influence, CTG and VPB were the top contributors, adding 0.88 and 0.75 points, respectively, to the VN-Index. Conversely, VHM and FPT exerted significant downward pressure, dragging the index down by nearly 1.5 points.

Top Stocks Impacting the Index. Unit: Points

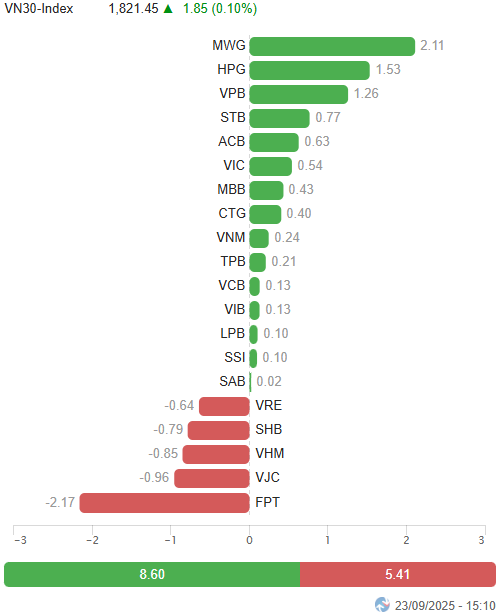

The VN30-Index closed with a slight gain of 0.1%, reaching 1,821.45 points. The basket’s breadth was balanced, with 15 gainers, 11 losers, and 4 unchanged stocks. MWG led the gains with a 1.7% increase. CTG, VPB, STB, and TPB also rose by over 1%. Meanwhile, SHB lagged with a 2.3% decline, followed by VJC, VRE, FPT, BCM, and HDB, all adjusting downward by more than 1%.

Sector performance was mixed. Non-essential consumer goods led the market with a 0.41% gain, primarily driven by MWG (+1.7%), HHS (+0.91%), STK (+2.77%), HTM (+4.76%), and SRC (+6.53%). However, most other stocks in the sector remained flat or underperformed, such as FRT (-1.45%), HUT (-0.54%), TNG (-0.49%), GIL (-0.55%), and CSM (-2.87%).

The financial and real estate sectors traded within narrow ranges, with a mix of green and red. While several stocks maintained strong demand, including CTG (+1.42%), VPB (+1.36%), STB (+1.09%), VIX (+2.07%), TPB (+1.05%), DXG (+1.55%), VPI (+1.33%), SSH (+8.54%), and VCR (+7.07%), others fell by over 1%, such as HDB, SHB, NAB, NVB, KLB, NLG, VRE, KDH, SJS, DIG, CEO, PDR, and HDC.

The information technology sector lagged with a 1.55% decline, primarily due to pressure from leading stocks FPT (-1.71%) and ELC (-0.64%).

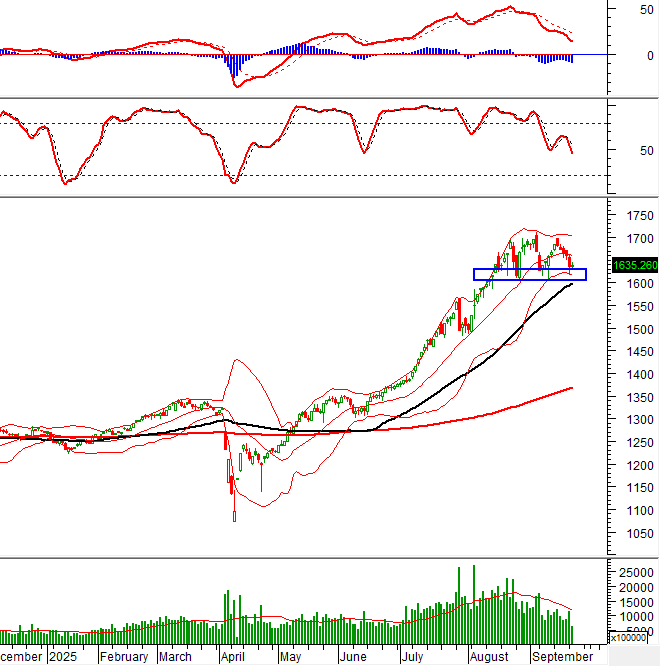

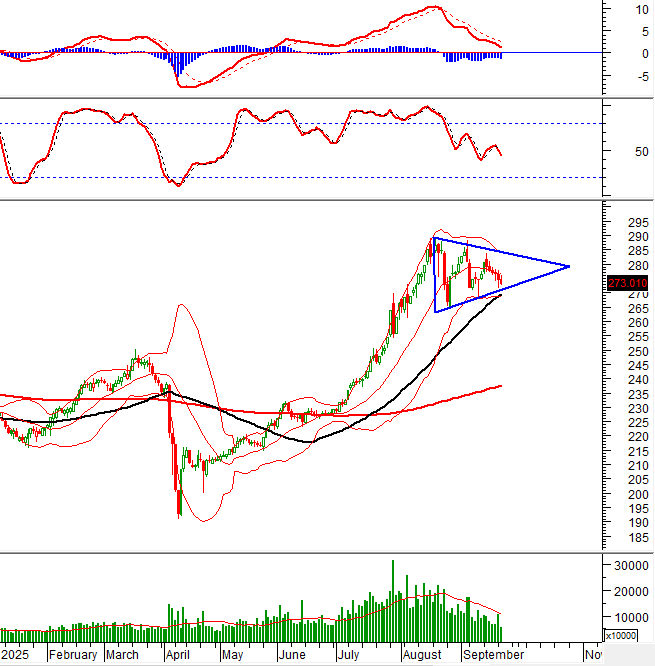

The VN-Index formed a Doji candlestick pattern with trading volume sharply falling below the 20-session average, indicating persistent caution. With the Stochastic Oscillator and MACD continuing to weaken after issuing sell signals, the August 2025 low (equivalent to the 1,600-1,630 range) will serve as short-term support for the index.

II. PRICE TREND AND VOLATILITY ANALYSIS

VN-Index – Doji Candlestick Pattern Emerges

The VN-Index formed a Doji candlestick pattern with trading volume sharply falling below the 20-session average, indicating persistent caution.

With the Stochastic Oscillator and MACD continuing to weaken after issuing sell signals, the August 2025 low (equivalent to the 1,600-1,630 range) will serve as short-term support for the index.

HNX-Index – Sixth Consecutive Declining Session

The HNX-Index continued its decline for the sixth consecutive session, with trading volume remaining below the 20-session average.

As the index fell below the Middle line of the Bollinger Bands, this level will act as resistance in the near term.

This week, the HNX-Index is likely to retest the lower boundary of the Triangle pattern (equivalent to the 269-272 range).

Capital Flow Analysis

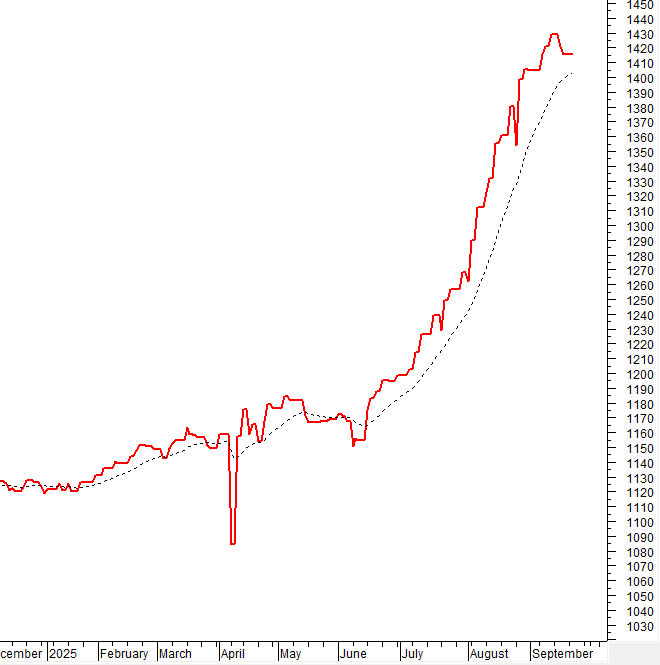

Smart Money Movement: The Negative Volume Index of the VN-Index remains above the 20-day EMA. If this condition persists in the next session, the risk of a sudden downturn (thrust down) will be mitigated.

Foreign Capital Movement: Foreign investors continued their net selling on September 23, 2025. If this trend persists in upcoming sessions, the outlook will become increasingly pessimistic.

III. MARKET STATISTICS FOR SEPTEMBER 23, 2025

Economic & Market Strategy Analysis Department, Vietstock Advisory Division

– 17:15, September 23, 2025

Stock Market Plunges Over 40 Points Before Rebounding: Investors Face Losses Amid Sudden Sell-Off

Technically speaking, experts note that key indicators have collectively breached the support zone of the 20-day moving average, signaling a clear short-term correction.