On September 9, 2025, the Vietnamese government issued Resolution 05, officially launching a five-year pilot phase for the cryptocurrency market in Vietnam. According to a recent report by Michael Kokalari, CFA, Director of Macroeconomic Analysis and Market Research at VinaCapital, this move signifies the government’s acceptance of digital assets.

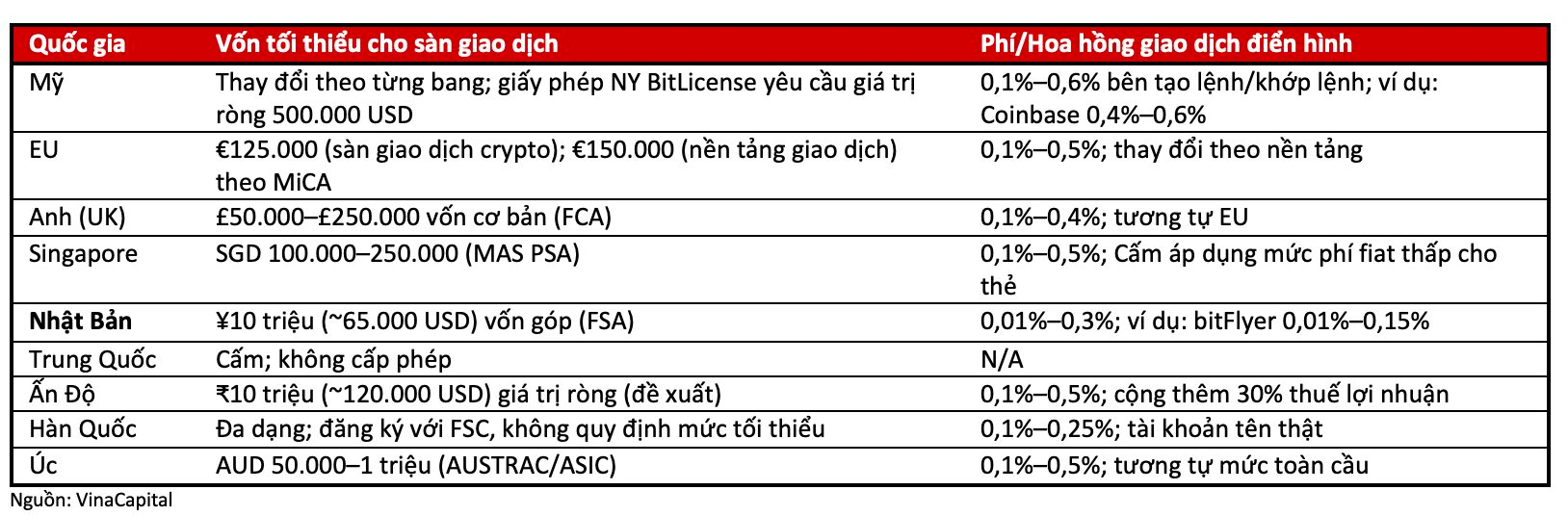

VinaCapital estimates that up to 17 million Vietnamese individuals have engaged in cryptocurrency transactions, with an annual trading volume exceeding $100 billion. The majority of these activities occur on foreign exchanges such as Binance, Bybit, and platforms based in Singapore, South Korea, and Hong Kong.

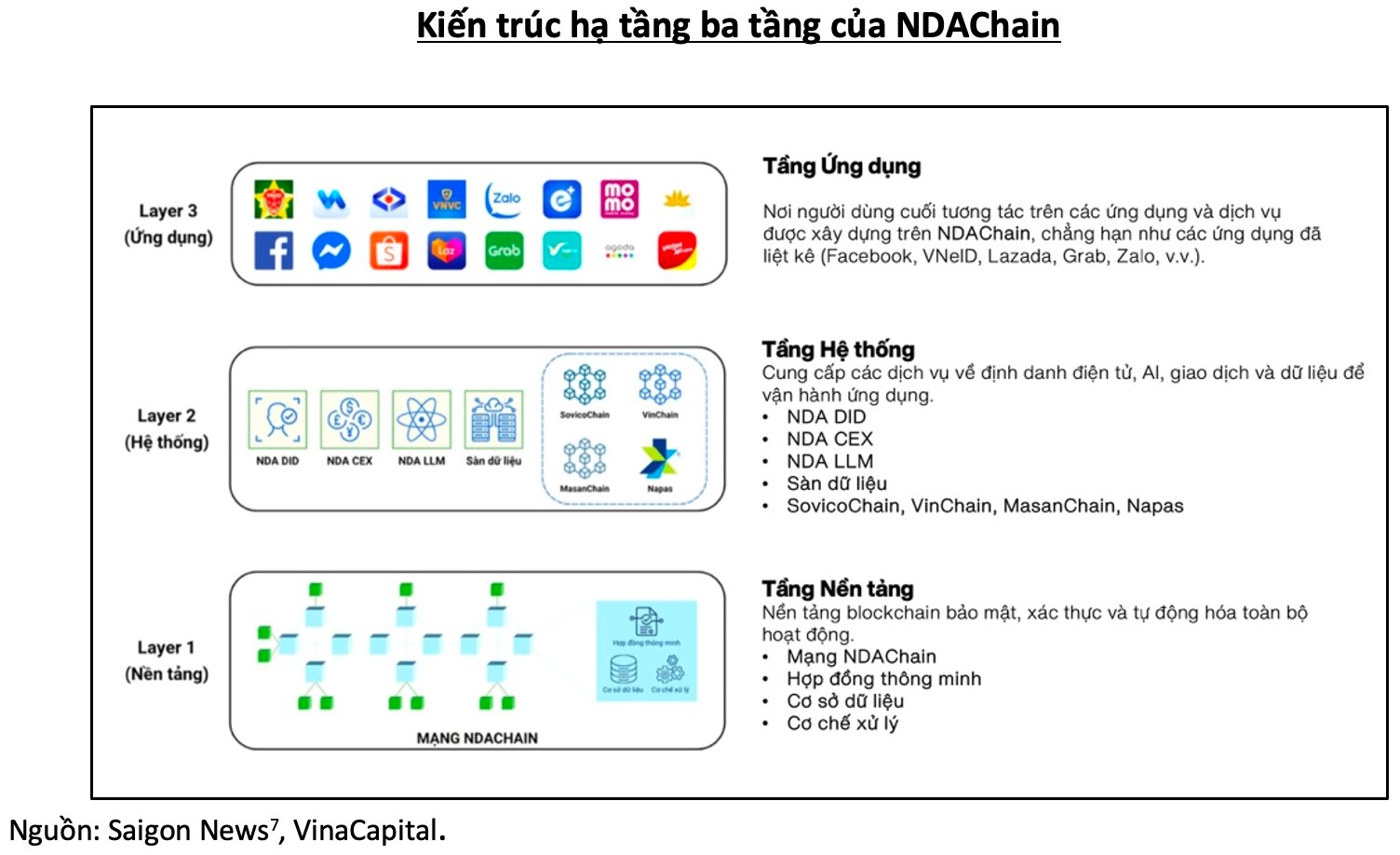

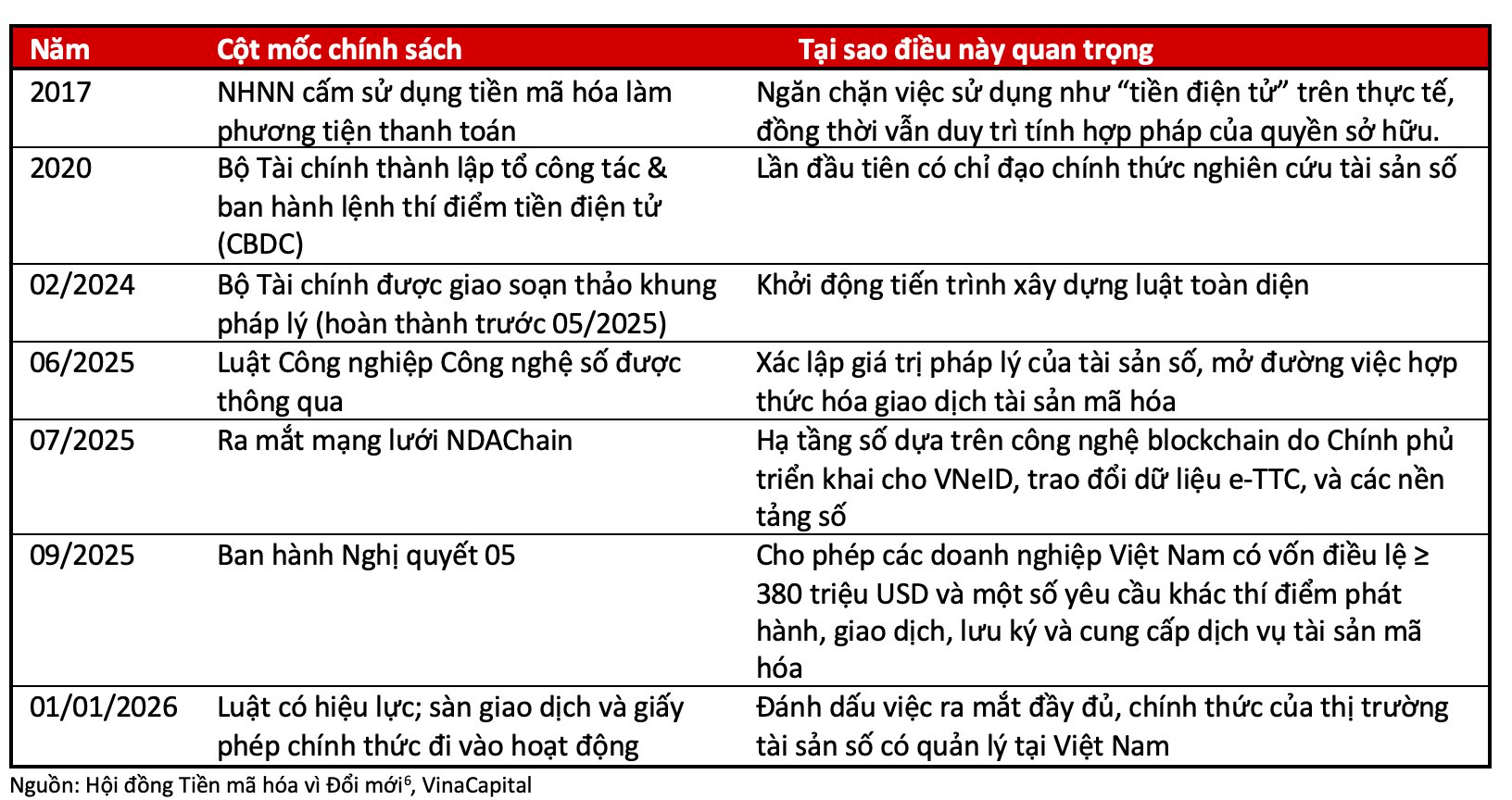

The government aims to transition cryptocurrency activities from a large-scale, informal market dependent on foreign channels to a formal, regulated market. This shift will enable tax management and integration into the domestic financial system. In July, the National Assembly passed the Digital Technology Industry Law, officially recognizing digital assets and requiring cryptocurrency platforms to obtain domestic licenses. These platforms must also provide direct Vietnamese Dong (VND) trading gateways by January 1, 2026. Additionally, in July, the government launched NDAChain, Vietnam’s national blockchain platform, facilitating secure financial transactions and online shopping.

VinaCapital highlights three key objectives of the government:

First, to legitimize and tax cryptocurrency transactions, shifting billions of dollars in trading volume from foreign exchanges to domestic platforms, thereby generating tax revenue.

Second, to integrate digital assets into the domestic financial system, fostering closer connections and enabling new capital-raising channels to support the digital economy while reducing cash dependency.

Third, to enhance investor protection and market oversight by establishing custody and reporting standards, and incorporating digital assets into existing anti-money laundering (AML) and counter-terrorism financing (CFT) regulations.

While Vietnam has taken cautious steps in the digital asset space over the years, VinaCapital observes a distinct shift in momentum. There is a noticeable acceleration in activities, marked by frequent discussions among regulators, industry events, and the launch of NDAChain. These developments reflect a move toward recognizing digital assets as a legitimate part of the financial system.

Three Key Factors Supporting Vietnam’s Digital Asset Prospects

VinaCapital identifies three critical factors supporting the prospects of digital assets in Vietnam: a vibrant market with active retail investor participation, one of Asia’s fastest-growing economies, and a government committed to regulating cryptocurrency activities.

These factors create opportunities for various stakeholders. First, early-licensed exchanges and brokers can attract trading volumes, fees, and valuable market data from foreign platforms to regulated domestic channels. Second, new regulations pave the way for Bitcoin funds and diversified digital asset funds, catering to domestic institutions like insurers and pension funds. Third, leveraging the state-backed NDAChain and the upcoming pilot exchange will enable the tokenization of trade invoices, carbon credits, and other real-world assets.

Fourth, licensed exchanges will integrate with domestic banks and approved e-payment tools for VND deposits and withdrawals, granting pioneers access to payment fees and user data. This could evolve into a “digital asset banking” model, where banks offer custody, payment, and lending services for digital assets. The recent surge in bank stocks expected to benefit most from the new digital asset policy underscores the market’s swift response.

“Vietnam is laying the groundwork for a digital economy that extends beyond cryptocurrency transactions, aiming to integrate digital assets into national markets and services,” states the VinaCapital report.

With a large retail investor base and numerous institutions poised to enter, pilot programs and licensing mechanisms could establish a more transparent, liquid, and reliable market. This shift is likely to attract capital back into the country, generate revenue for banks and securities firms, and create opportunities for specialized service providers in custody, compliance, and analytics.

Beyond finance, the national economy will benefit from tokenization and blockchain applications. Sectors such as supply chain management, renewable energy, and real estate can access new funding models through tokenized assets, while carbon credits, trade invoices, and other instruments will gain enhanced liquidity.

The Great Crypto Con: When Crypto Scams Run Rampant, It’s High Time to Regulate Digital Asset Exchanges

The crypto investment landscape in Vietnam is currently in a legal gray area. While the law prohibits the use of cryptocurrencies as a legitimate means of payment, it falls short of providing clear regulations regarding ownership and trading. With the recent passing of the Digital Technology Industry Law, the country is taking a step towards clarifying the legal status of digital assets, but the law will only come into effect in 2026.

The Great Crypto Con: Why Regulation of Digital Asset Exchanges is Urgent in the Wake of Billion-Dollar Scams

Investing in cryptocurrencies in Vietnam is currently in a legal gray area. While the law prohibits the use of cryptocurrencies as a legitimate means of payment, it falls short of providing clear regulations regarding ownership and trading. The recently passed Digital Technology Industry Law will not come into force until 2026, leaving the current legal framework ambiguous.