At the Annual General Meeting (AGM) four months ago, VIX shareholders approved the 2025 business plan with pre-tax profits of VND 1,500 billion and post-tax profits of VND 1,200 billion, marking an 84% and 81% increase, respectively, compared to the 2024 results.

VIX has already surpassed this plan in the first half of 2025. Specifically, the company achieved nearly VND 2,068 billion in pre-tax profits and approximately VND 1,674 billion in post-tax profits, exceeding the annual plan by nearly 40%. These figures are also almost six times higher than the profits recorded in the first half of 2024.

According to the company, the first half of 2025 saw a positive performance in the Vietnamese stock market, with the VN-Index closing at 1,376 points on June 30th, the highest since 2022. In line with market trends, profits from financial assets recorded through profit/loss (FVTPL) grew impressively by nearly 482%, equivalent to an increase of VND 2,056 billion compared to the same period last year.

Additionally, the company’s lending and receivables activities reached a new milestone, surpassing VND 9,000 billion for the first time, a 161% increase from the beginning of the year. Profits from this segment also rose by 61% year-on-year.

| VIX Reports Strong First-Half 2025 Results |

VIX’s decision to raise its profit targets comes amid a highly bullish phase in the Vietnamese stock market, characterized by record-breaking indices and significantly improved liquidity. This environment has heightened expectations for key business segments of securities companies, including lending, proprietary trading, and brokerage.

The favorable market conditions have also driven VIX‘s stock price to new heights. The stock reached an all-time high of VND 39,950 per share on September 16th, more than tripling its value since the beginning of the rally in July.

| VIX Stock Surges Since Early July |

Shortly before VIX, another securities company, VPBankS, also revised its 2025 business targets, setting new total revenue and profit goals of VND 7,177 billion and VND 4,450 billion, respectively, representing a 58% and 122% increase compared to the original plan approved at the 2025 AGM.

Securing a VND 4,000 Billion Credit Line from Techcombank

On September 19th, the VIX Board of Directors passed a resolution approving a VND 4,000 billion credit line from Techcombank. The funds will be used for investing in government bonds or government-guaranteed bonds, as well as bonds issued by the “Big4” banks: Vietcombank, Agribank, Vietinbank, and BIDV. Additionally, the credit will supplement capital for margin lending.

The resolution also approved the use of the company’s assets or third-party assets as collateral to secure all obligations with Techcombank.

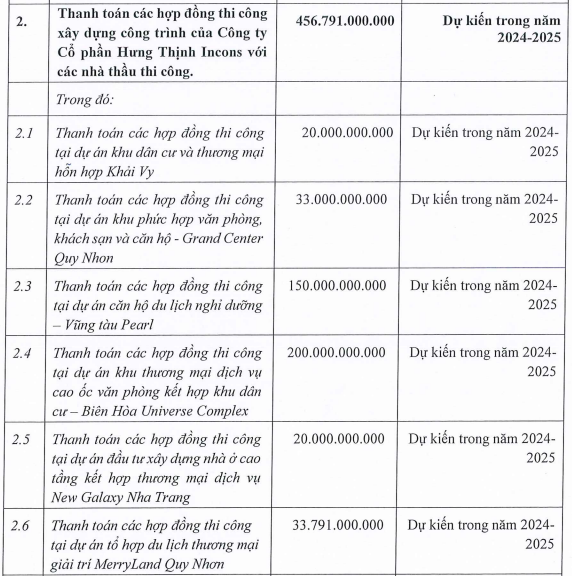

As of June 30, 2025, VIX reported outstanding loans of VND 6,207 billion, 2.2 times higher than at the beginning of the year. All loans are short-term with interest rates below 7.5% per annum. Major lenders include Eximbank (VND 2,881 billion), Techcombank (VND 1,500 billion), BIDV (VND 441 billion), and Vietinbank (VND 396 billion).

Source: VIX‘s 2025 Semi-Annual Financial Report

|

– 14:58 22/09/2025

Stock Market Week 15-19/09/2025: Cautious Tug-of-War

The VN-Index closed the week in the red, marking four consecutive sessions of decline. Cautious sentiment persists as trading volumes remain below the 20-day average. Amid weak liquidity and persistent net selling pressure from foreign investors, the market awaits a stronger catalyst to break free from its current stalemate.

Since Billionaire Pham Nhat Vuong Advised “Choose VIC Over Gold”: VIC Stock Has Surged Nearly 3x, While Gold Remains Virtually Stagnant

Just five months after billionaire Pham Nhat Vuong’s advice, VIC shares surged 2.5 times, propelling Vingroup back to the top as Vietnam’s most valuable publicly traded company. Meanwhile, gold prices climbed a modest 7%, reaching 129 million VND per tael.

Prime Minister Criticizes 29 Ministries, Agencies, and 12 Localities for Below-Average Disbursement Rates

According to reports, 18 ministries, central agencies, and 30 localities have yet to fully allocate the capital plans assigned by the Prime Minister, totaling nearly VND 38,400 billion. By the end of August 2025, 29 ministries, agencies, and 12 localities recorded disbursement rates below the national average.