The Vietnam Real Estate Market Research Institute (VARS IRE) highlights that cheap capital is fueling a resurgence in the real estate market. Amid volatile gold prices and unpredictable stock markets, real estate remains a top investment channel due to its long-term asset storage value and sensitivity to currency cycles.

In the first seven months of 2025, approximately VND 1,560 trillion was injected into the economy, a 10% increase from the end of 2024. Notably, credit in real estate and securities grew faster than the general market, while production and business expansions remained cautious. Additionally, extended “interest-free – principal grace” periods of up to 5 years and down payment requirements as low as 10-30% have made it easier for investors to enter the market, even with limited capital.

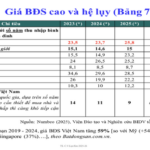

A survey by Batdongsan.com.vn reveals that since the beginning of 2025, Vietnam’s banking system has maintained low deposit and lending interest rates. According to the State Bank of Vietnam, 6-12 month deposit rates range from 4.5% to 5.2% annually, significantly lower than the 7% peak in 2022-2023. Many commercial banks offer home loans at 6-7% annually for the first 12 months, with some as low as 5-6% for individual borrowers. This “cheap money” is a significant boost for the real estate market.

VARS IRE notes that these favorable policies enable investors to own multiple properties simultaneously. For a VND 3 billion apartment, an initial investment of VND 600-900 million can yield 50-70% returns if prices rise 15-20% within 1-2 years. In some cases, investors double their capital during the grace period, even before taking possession of the property.

The allure of high profits is drawing more capital into real estate, reinforcing the cycle of “hoarding – scarcity – price increases.” However, this trend poses significant risks, as profits are concentrated among a few, while genuine buyers and small investors may bear the brunt if the market reverses.

Nguyen Van Dinh, Chairman of the Vietnam Real Estate Brokerage Association, warns: “While cheap capital brings positive signals, it also carries the risk of a bubble. First, low capital costs can fuel speculation, driving up land prices in suburban areas despite incomplete infrastructure. Second, reliance on bank credit is a double-edged sword—global economic volatility could reverse interest rates, trapping highly leveraged investors in a sell-off spiral.”

Dinh emphasizes that lessons from the 2010-2011 period remain relevant, when a booming real estate market quickly froze due to tightened credit. Therefore, cheap capital is meaningful only when directed toward segments with real demand, urbanization, and infrastructure.

In reality, demand in major cities has rebounded. Savills reports an 18% increase in Hanoi apartment transactions in Q2/2025 compared to the same period last year, while CBRE notes that Ho Chi Minh City sold over 13,000 units in the first six months, up 25%. Additionally, land prices in suburban areas and infrastructure-benefiting regions have risen 20-100% over the past two years.

However, relying solely on price expectations and financial leverage could reignite a real estate bubble. “Investors must choose products that match their financial capacity, with clear infrastructure and legal status. Businesses need sustainable development strategies, avoiding excessive debt. Otherwise, cheap capital could become a major threat to the market and the entire economy,” Dinh advises.

Palm Manor Emerges as a Real Estate Magnet Following Legal Transparency Breakthrough

Palm Manor has emerged as a focal point with its accelerated progress in Phase 1, gearing up for the valuation of Segment 3 land plots. Since April 6, 2024, the project has witnessed a remarkable price surge of 30–70%. Even after the distribution of land titles, Palm Manor continues to captivate interest, particularly during the seventh lunar month, offering both a prime residential opportunity and immediate value appreciation upon investment.

Dr. Can Van Luc: Vietnamese Public Servants Need Nearly 26 Years of Work to Afford an Apartment, Compared to Global Average of 15 Years

Dr. Can Van Luc asserts that the real estate market is grappling with significant volatility, as housing prices are rising faster than incomes, making it increasingly difficult for people to afford homes. He urges businesses to restructure, manage risks, and accelerate digital and green transformations. Additionally, he calls on the government to implement measures aimed at reducing overall price levels.

Is the Real Estate Market in Binh Duong (Former) Experiencing a Ripple Effect of Rising Prices?

Following the administrative boundary merger, the real estate market has witnessed a significant population shift from the former Ho Chi Minh City to the emerging “new central hub” of Binh Duong. This region stands out as one of the most prominent areas in the eastern part of Ho Chi Minh City, boasting a robust economy, advanced infrastructure, and exceptional investment appeal.

Hano-vid Records Significant Positive Momentum in First Half of 2025

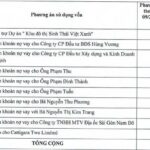

The 2025 semi-annual financial report of Hano-vid Real Estate Joint Stock Company reveals a strengthening financial foundation and underscores the company’s commitment to sustainable growth in the coming years.