Illustrative Image

According to preliminary statistics from the General Department of Customs, Vietnam’s soybean imports in August reached over 297,000 tons, valued at more than $141 million, a slight increase of 1.8% in volume and 2.2% in value compared to July. Cumulatively, in the first eight months of the year, the country spent over $837 million to import more than 1.8 million tons of soybeans, a significant increase of 25.3% in volume and 11.1% in value compared to the same period in 2024.

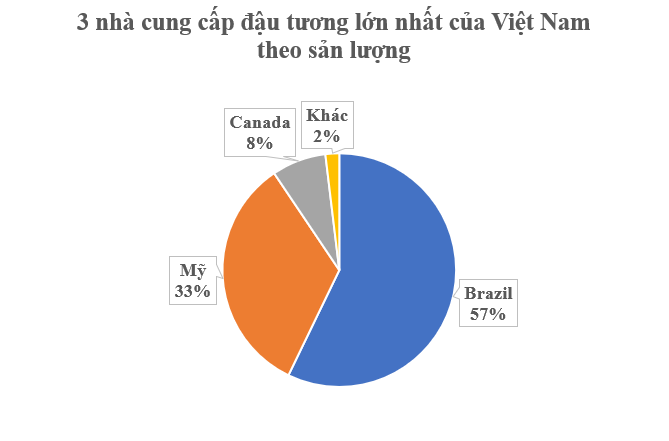

In terms of market share, Brazil is the largest supplier with over 1 million tons, valued at more than $483 million, up 22% in volume and 13% in value compared to the first eight months of 2024. The average price is $467 per ton, a 7% decrease.

The United States ranks second with a volume of over 604,000 tons, corresponding to more than $273 million, up 29% in volume and 8% in value compared to the same period in 2024. Notably, the average price has significantly decreased to $451 per ton, a 16% drop compared to the first eight months of 2024.

Canada is the third-largest supplier with over 136,000 tons, valued at more than $64 million, a strong increase of 63% in volume and 30% in value compared to the first eight months of 2024. The average price also recorded a 20% decrease, reaching $475 per ton.

Globally, China halted purchases of U.S. soybeans in February after the Trump administration imposed new tariffs on Chinese goods. This is the longest disruption ever, increasing financial pressure on American farmers. The U.S. Department of Agriculture recently lowered its soybean export forecast to the lowest level since 2013, at 1.65 billion bushels.

In 2024, the U.S. exported approximately $12.8 billion worth of soybeans to China, accounting for a quarter of total soybean exports. However, China is increasingly diversifying its supply sources, importing $36 billion worth of soybeans from Brazil last year, along with stable supplies from Argentina and Uruguay. “China’s purchase of U.S. soybeans depends on whether the U.S. lifts tariffs,” said Johnny Xiang, founder of Agradar Consulting in Beijing.

Vietnam primarily imports soybeans for use as raw materials in animal feed production, accounting for the majority of the volume, with a smaller portion used for human consumption, edible oil production, and other processed products. The high import demand stems from Vietnam’s rapidly growing livestock and aquaculture sectors, which require large quantities of soybean meal for animal and aquatic feed.

According to Decree 73/2025/NĐ-CP, which amends and supplements the preferential import tax rates for certain goods listed in Appendix II – Preferential Import Tariff Schedule under the List of Taxable Goods specified in Article 3 of Decree 26/2023/NĐ-CP, new preferential import tax rates have been established. These include reducing the preferential import tax rate for corn from 2% to 0% and for soybean meal from 1-2% to 0%.

It is forecasted that Vietnam will continue to increase soybean imports in 2025, primarily due to the strong growth in demand for animal feed and the low tax barriers, especially for U.S. imports.