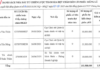

According to the latest announcement, October 8th marks the record date for shareholders, with each share entitled to receive VND 1,300, equivalent to a 13% dividend payout ratio based on the charter capital. With a capital scale exceeding VND 3.76 trillion, Sonadezi will allocate approximately VND 490 billion from undistributed profits for this payment, scheduled for October 23rd.

Since its listing, Sonadezi has consistently paid cash dividends, maintaining a regular payout in October each year. The dividend rate has gradually increased: VND 1,000 per share in 2020 and 2021, VND 1,100 in 2022, and VND 1,200 in 2023.

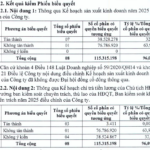

For the 2025 dividend plan, shareholders have approved a 12.8% payout ratio, amounting to around VND 482 billion. The management has indicated that if annual profits exceed expectations, they may propose a higher dividend distribution.

Sonadezi has consistently paid cash dividends since 2017. Source: VietstockFinance

|

| The 2024 dividend payment is the highest since SNZ listed |

In the first half of 2025, Sonadezi recorded revenue of over VND 3.7 trillion, a nearly 30% increase year-on-year. The industrial park infrastructure segment saw a significant 73% growth, reaching nearly VND 1.6 trillion. Slower cost increases contributed to a gross profit of VND 1.8 trillion, up 44%. Including other income and profits from associates, Sonadezi’s net profit reached nearly VND 782 billion, a 43% increase, achieving 92% of the annual target halfway through the year.

Established in 1990 in Dong Nai, Sonadezi began with the Bien Hoa 2 Industrial Park and expanded to major projects like Go Dau, Chau Duc, and Giang Dien. In 2005, the company transitioned to a parent-subsidiary model and was equitized in 2016 with a charter capital of VND 3,765 billion. Currently, Sonadezi has 16 subsidiaries operating in four sectors, recognized as one of the nation’s leading industrial park infrastructure developers.

Sonadezi’s record profit in Q2

– 10:18 23/09/2025

ASM Unveils 37 Million Share Dividend Payout, Boosting Chartered Capital Beyond 4,000 Billion

Alongside plans to issue over 37 million shares for a 10% dividend payout, Sao Mai Group Corporation (HOSE: ASM) has reported its 2025 half-year financial results, revealing a 79% decline in profits compared to the same period last year, with only 4% of the annual target achieved so far.