Taseco Land Investment Corporation (Taseco Land, Stock Code: TAL) has successfully distributed all 48.15 million shares in its private placement to 15 professional investors. Priced at VND 31,000 per share, the company raised a total of VND 1,493 billion. The proceeds, after deducting expenses, will be used to restructure loans, with disbursement expected from Q4/2025 to Q1/2026. Following this issuance, Taseco Land’s chartered capital will increase to VND 3,600 billion.

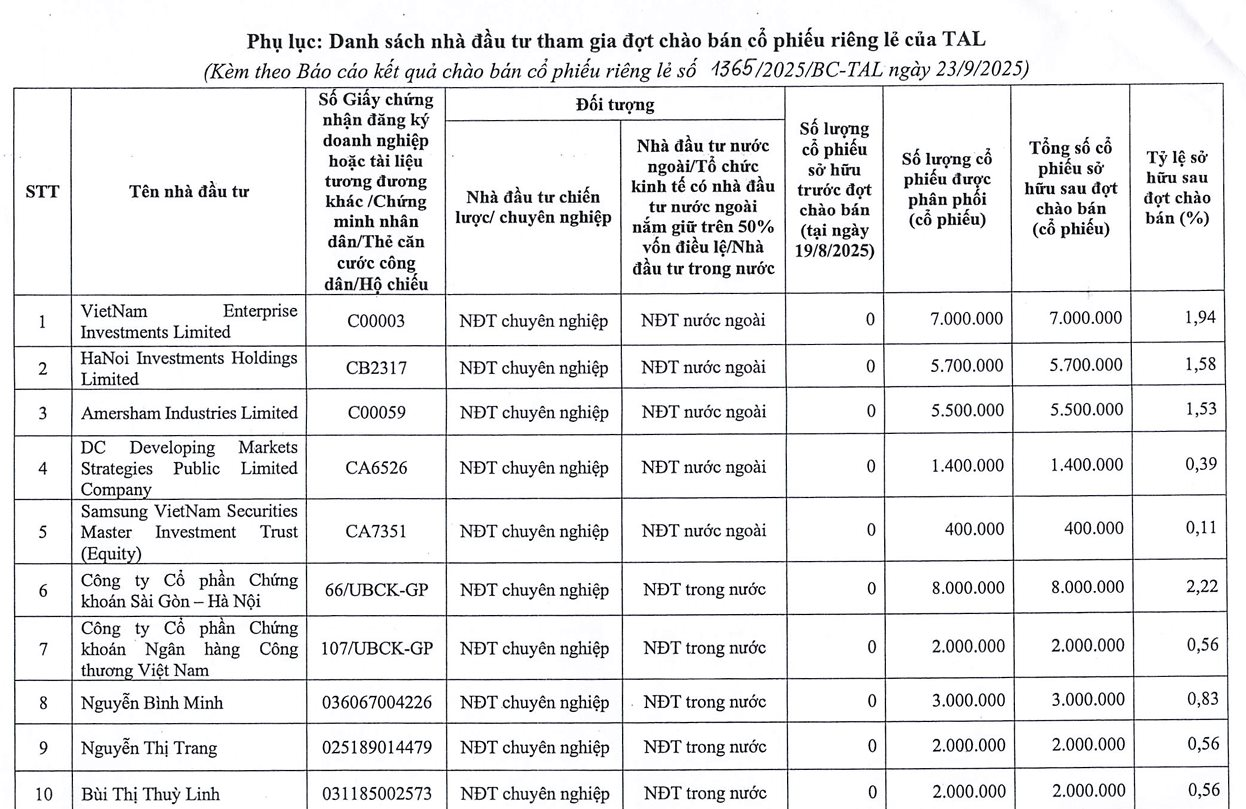

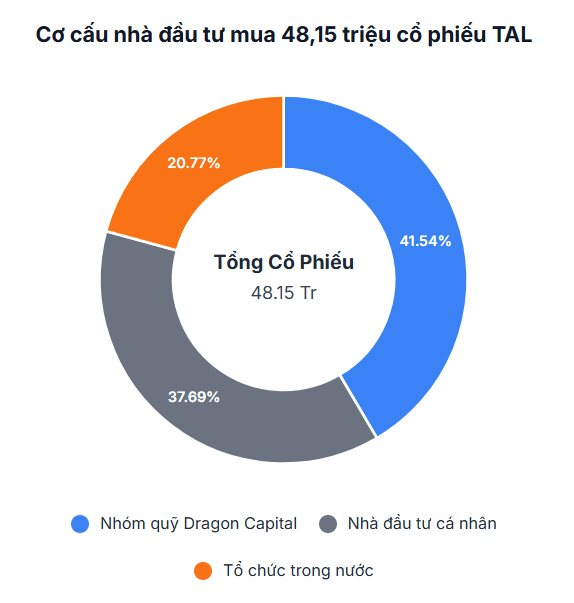

The highlight of this offering was the participation of Dragon Capital’s funds. Specifically, five member funds—Vietnam Enterprise Investments Limited, Hanoi Investments Holdings Limited, Amersham Industries Limited, DC Developing Markets Strategies Public Limited Company, and Samsung Vietnam Securities Master Investment Trust—acquired a total of 20 million TAL shares. This transaction officially makes the group a major shareholder, holding 5.55% of Taseco Land’s chartered capital.

In addition to Dragon Capital, domestic institutions such as Saigon-Hanoi Securities JSC (SHS) and Vietinbank Securities JSC (VietinbankSC – CTS) participated, purchasing 8 million and 2 million shares, respectively.

Among individual investors, 8 professionals acquired a total of 18.15 million shares. Ms. Pham Minh Trang led with 4 million shares, increasing her total holdings to 8.77 million units (2.44%). Other significant buyers included Mr. Nguyen Binh Minh and Mr. Ho The Anh (3 million shares each), Ms. Nguyen Thi Trang, Mr. Nguyen Dinh Bach, and Ms. Bui Thi Thuy Linh (2 million shares each).

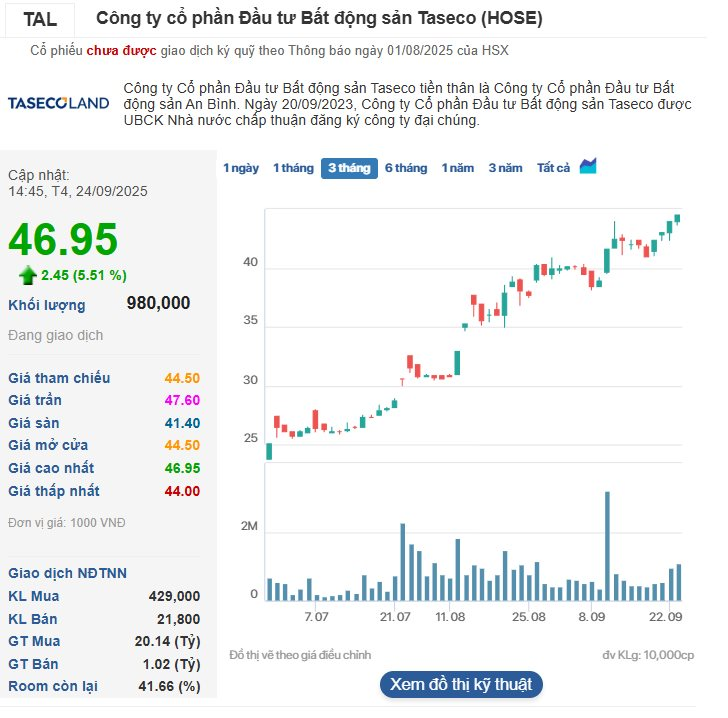

On the stock market, TAL shares have shown positive momentum, reflecting investor optimism. As of September 24, 2025, TAL closed at VND 46,950 per share, a 51.5% premium over the private placement price (VND 31,000). Notably, TAL has maintained a strong uptrend over the past three months, leading up to the capital raise announcement.

The successful capital raise comes amid Taseco Land’s robust financial performance. In the first half of 2025, the company reported net revenue of VND 933 billion, a slight decrease of VND 6 billion compared to the same period in 2024. However, with a gross profit margin up 24.3% to 33.7%, net profit reached VND 60 billion, 3.51 times higher year-on-year.

Rendering of the Long Biên Central project (Hanoi)

IPA Shareholders Approve Plan to Issue 50 Million Shares

Through a written consent process, IPA shareholders have approved a private placement of 50 million shares. The proceeds from this offering will be utilized to repurchase outstanding bonds issued in 2024 ahead of their maturity date.

Investment Fund Transactions: Selling Pressure Dominates

By mid-September (15-19/09/2025), newly announced investment funds revealed their trading activities from the beginning of the month. The data indicates a closely contested balance between buying and selling pressures, with a slight tilt towards selling. This dynamic unfolds as the VN-Index fluctuates near its historical peak.

Dragon Capital Group Trims Stake as MWG Shares Hit Record High

Dragon Capital’s September 16th report reveals a significant shift in its investment strategy. The group’s funds have collectively divested from Mobile World Investment Corporation (HOSE: MWG), resulting in the group no longer holding a substantial stake in the company.