ASEAN: A Strategic Direction for Vietnamese Businesses

According to Suan Teck Kin, amidst complex global tariff policies and exchange rate fluctuations, ASEAN stands as a strategic market that Vietnamese businesses should prioritize. Despite recent global economic uncertainties, ASEAN has demonstrated its resilience as a sustainable economic region, driven by effective cross-border policy coordination, deep intra-bloc integration, and political stability. Notably, FDI inflows into the region reached $225 billion in 2024, marking a nearly 10% increase from the previous year, surpassing the global average growth rate of 3.7% (UNCTAD 2025).

Within ASEAN, Vietnam’s economy continues to show positive signals. In the first six months, GDP grew by 7.52%, with exports remaining a key driver. July’s export turnover reached $42.3 billion, bringing the cumulative increase to nearly 16%. The trade surplus remains stable, the PMI index recovered to 52.4, industrial output rose by 9%, and FDI disbursement reached $13.6 billion after seven months.

However, the U.S. remains Vietnam’s largest export market, and over-reliance on a single market poses risks, particularly for key sectors like electronics, machinery, and furniture, which account for over 40% of total export turnover. Diversifying export markets, especially expanding into neighboring regions like ASEAN, is a strategic move to mitigate risks associated with U.S. tariff policies. This approach also leverages lower logistics costs, growing consumer demand, and the region’s dynamic young population. Engaging in regional supply chains further provides a platform for sustainable global market expansion.

VND Exchange Rate Volatility and Its Impact on Exports

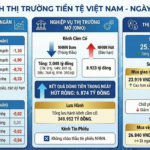

Alongside market diversification, businesses must closely monitor VND exchange rate fluctuations to optimize exports. The Vietnamese Dong (VND) continues to face depreciation pressure against the USD, reaching 26,436 VND/USD in August 2025, a 3.4% decline since the beginning of the year, marking the fourth consecutive year of weakening. Contrary to the recovery trend of other Asian currencies, the VND underperforms due to strong foreign currency demand, trade uncertainties, and expectations of stable domestic monetary policy.

Suan Teck Kin notes that while the U.S. has reduced its “countervailing” tariff from 46% to 20%, risks such as the 40% tax on transshipment goods remain unclear, prompting businesses to reassess their supply chain strategies. Experts also highlight that the U.S. Federal Reserve’s (Fed) rate-cutting cycle will lead to moderate USD weakness, causing the USD to depreciate against Asian currencies in the coming quarters. However, the pace of decline may be limited due to regional growth challenges and Asia’s central banks’ accommodative monetary policies.

Exchange rate volatility presents both opportunities and risks. A weaker VND enhances price competitiveness in international markets but increases import costs for raw materials and equipment. Businesses must adopt flexible risk management strategies, capitalize on deeper ASEAN cooperation, and diversify markets to reduce reliance on the U.S., stabilize revenue, and improve operational efficiency amidst prolonged currency fluctuations.

Opportunities for Vietnamese B2B Enterprises in the Global Market

By effectively managing exchange rate risks and leveraging ASEAN’s advantages, Vietnamese B2B enterprises can tap into global export-import potential, particularly through e-commerce. Digital platforms enable businesses to reach international customers without geographical or cost constraints, offering data analytics, smart marketing tools, cross-border services, and strategic consulting to optimize operations, enhance efficiency, and expand markets flexibly.

Suan Teck Kin emphasizes three critical factors for businesses expanding internationally: monitoring tax policy developments and trade regulations in target markets; understanding market-specific opportunities and challenges, including cultural, linguistic, and legal aspects; and navigating exchange rate volatility in emerging markets, which directly impacts output, pricing, and profit margins. Partnering with reliable local entities is key to mitigating legal, cultural, and business environment risks.

To effectively seize opportunities and manage risks, UOB offers comprehensive solutions, including regional supply chain financing covering the entire supply chain cycle—from procurement to payment, production to sales, and sales to debt recovery; trade financing, cross-border cash management, and liquidity solutions; and industry-specific expert support. With a strong presence in key markets such as Singapore, Malaysia, Thailand, Indonesia, and Vietnam, B2B enterprises can shape internationalization strategies, expand global sales channels, and achieve sustainable growth amidst economic and currency volatility.

Additionally, in Vietnam, UOB operates a dedicated Foreign Direct Investment (FDI) Advisory team to support domestic and international businesses in expanding their regional operations. This is particularly crucial for companies seeking to diversify internationally and leverage Vietnam’s growing role in global supply chains.

The Weakening US Dollar: Opportunities and Challenges for Emerging Economies?

Standard Chartered forecasts a weaker USD over the next 6–12 months, predicting the DXY index to drop to around 96 as the Federal Reserve initiates rate cuts. This scenario presents opportunities for exchange rate stability, easing import inflation pressures, and attracting capital inflows into Asia. However, it also poses challenges for export competitiveness and capital flow risks should market expectations reverse.

The 2025 Top Tax-Contributing Enterprises Awards: Recognizing Businesses Contributing Hundreds of Thousands of Billions

The 2025 Top Tax-Contributing Enterprises Recognition Ceremony was a resounding success, celebrating the immense contributions of leading businesses to the nation’s economic growth. The event not only honored these economic powerhouses but also served as a platform for discussing opportunities and challenges amidst the powerful digital transformation wave.

“Digital Integration Will Reposition Vietnam’s Strength: CEO Truong Ly Hoang Phi”

“Trương Lý Hoàng Phi, the esteemed Chairwoman and CEO of IBP, and Vice Chairwoman of the Ho Chi Minh City Young Entrepreneurs Association, envisions digital integration in 2025 as a pivotal moment akin to ASEAN in 1995. This marks the beginning of a new chapter for the Vietnamese economy.”