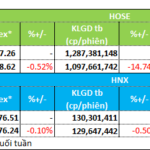

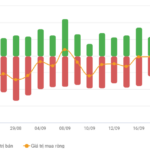

Following a volatile session, cautious market sentiment led to a tug-of-war for the VN-Index. The index closed the September 23rd session with a modest gain of 0.81 points, settling at 1,635. Trading volume remained subdued, with HOSE transactions totaling over 22.6 trillion VND.

After several sessions of heavy selling, foreign investor activity balanced out, with net selling across the market amounting to a mere 7 billion VND.

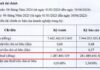

On HOSE, foreign investors were net sellers to the tune of 14 billion VND.

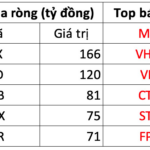

On the buying side, VIX emerged as the most sought-after stock by foreign investors on HOSE, attracting over 249 billion VND. MWG followed closely, with 149 billion VND in purchases. SHB and VPB also saw significant buying interest, with 135 billion VND and 77 billion VND respectively.

Conversely, FPT witnessed the heaviest selling pressure from foreign investors, with 562 billion VND exiting the stock. MSN and KDH also faced selling pressure, with outflows of 82 billion VND and 46 billion VND respectively.

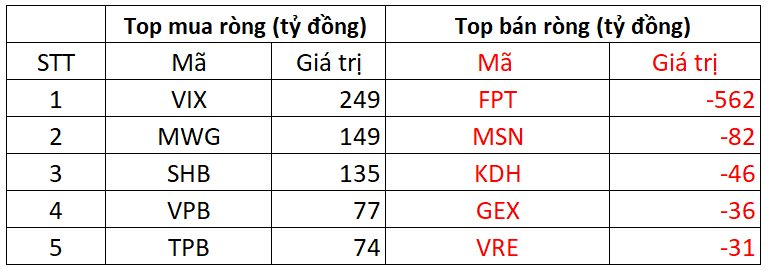

On HNX, foreign investors were net sellers for 8 billion VND.

On the buying front, CEO led the charge with 27 billion VND in net purchases. SHS followed suit with 14 billion VND in net buying. EVS, TIG, and C69 also saw modest buying interest from foreign investors.

On the selling side, MBS faced the brunt of foreign selling pressure, with nearly 22 billion VND exiting the stock. NTP, IDC, and TVC also experienced selling pressure, with outflows in the billions of VND.

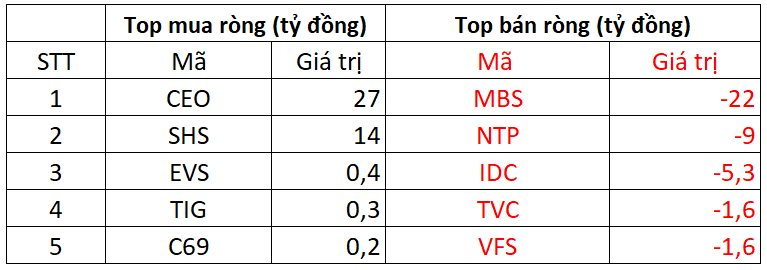

On UPCOM, foreign investors were net buyers for 15 billion VND.

MCH was the top pick for foreign investors on UPCOM, attracting 11 billion VND in purchases. VEA and KLB also saw buying interest, with net purchases in the billions of VND for each.

Conversely, HNG saw 2.4 billion VND in net selling by foreign investors. SAS and other stocks also experienced selling pressure.

Market Liquidity Weakens as Capital Flows Out of Equity Securities

In recent weeks, cash flow has shown signs of weakening. Despite this trend, certain sectors continue to attract investment. Conversely, the financial sector, particularly stocks, has experienced significant outflows.

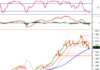

Vietstock Daily 24/09/2025: Liquidity Hits Record Low

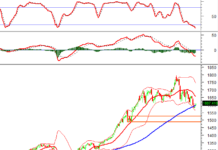

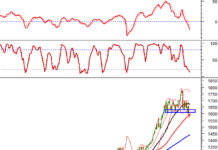

The VN-Index formed a Doji candlestick pattern, accompanied by a sharp decline in trading volume below the 20-session average, indicating persistent market caution. With both the Stochastic Oscillator and MACD continuing to weaken following sell signals, the August 2025 low (around 1,600-1,630 points) is expected to serve as short-term support for the index.

Proprietary Trading Firms Inject Nearly VND 400 Billion into Vietnamese Stocks Amid Sharp Market Decline: What Are the Key Targets for Accumulation?

Proprietary trading desks at securities companies recorded a net buy of VND 375 billion on the Ho Chi Minh City Stock Exchange (HOSE).