Following the transaction, HAP will reduce its ownership in Green International Hospital from 84.81% to 49.5%, equivalent to 29.7 million shares, thereby ending the parent-subsidiary relationship. At a minimum price of 20,000 VND per share, HAP is expected to generate at least 423.8 billion VND.

According to HAP, the divestment aims to focus resources on the 50,000-ton/year Tissue Paper project and the Hapaco Social Housing project.

HAP‘s decision has drawn attention, as just over a year ago, in August 2024, the company acquired the same amount of shares in Green International Hospital. HAP contributed 32.33% of the capital (19.4 million shares), while the remaining 2.98% (1.79 million shares) was contributed by its subsidiary, Hai Phong Paper Joint Stock Company.

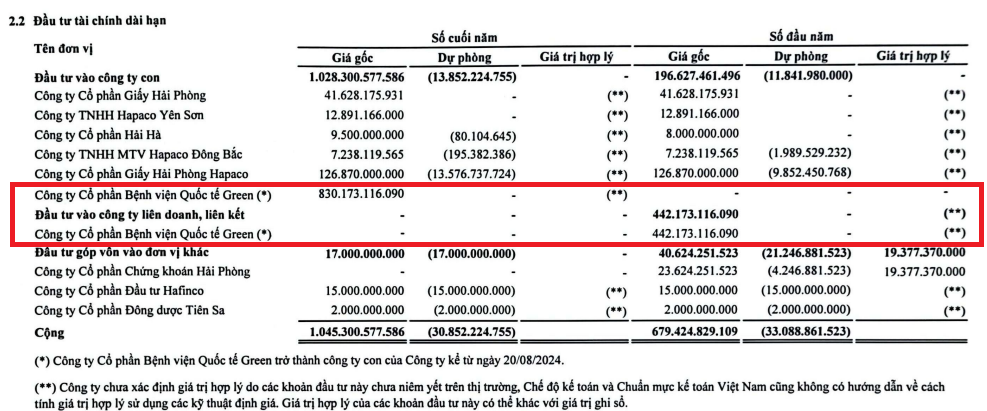

In the 2024 audited financial statements of the parent company, HAP reclassified Green International Hospital from an associate to a subsidiary, increasing the book value from over 442 billion VND at the beginning of the year to more than 830 billion VND by year-end. This resulted in a difference of 388 billion VND for the additional ownership of nearly 19.4 million shares (20,000 VND per share). At that time, HAP announced plans to develop the Green International General Hospital project in Hai Duong Province (now Hai Phong City) while continuing its Hapaco paper mill projects.

Source: 2024 Audited Financial Statements of HAP

|

In reality, HAP has been closely associated with Green International Hospital since its inception in 2014 and has previously adjusted its ownership stake in the hospital.

Specifically, the company launched the hospital on October 10, 2014, with a total investment of 447 billion VND. The project also commemorated the 85th anniversary of the Vietnam Trade Union. By 2016, the hospital received additional licensing for internal medicine and plastic surgery from the Department of Health and signed a health insurance contract with Hai Phong Social Insurance.

On March 23, 2022, the Board of Directors approved a resolution to inject additional capital into the hospital. At that time, the company held 33.65% of the charter capital and decided to contribute an additional 731 billion VND (49.1 million shares), including 480 billion VND (24 million shares) through the transfer of existing shares and 74 billion VND (7.4 million shares) through a new issuance. Following this transaction, HAP owned 81.8% of the hospital’s charter capital.

However, by December 2022, HAP reduced its stake to 49.5%. The proceeds from this divestment were allocated to projects for the 2021-2026 period, as approved by the 2021 Shareholders’ Meeting.

In the latest business registration update on August 6, 2025, Mr. Vu Duong Hien, Chairman of HAP, was appointed as the Chairman of Green International Hospital’s Board of Directors.

Green International Hospital in Hai Phong City

|

In terms of business performance, HAP reported a net loss of over 13.4 billion VND in the first half of 2025, compared to a profit of nearly 5.2 billion VND in the same period last year. According to the company, while the operations of its subsidiaries have improved, the consolidated financial statements had to allocate goodwill from the additional acquisition of Green International Hospital shares for control purposes.

| HAP Reports Net Loss After Completing Control of Green International Hospital |

In recent years, HAP has been promoting another hospital project, specifically investing in the construction of Green International General Hospital in Hai Duong Province (now Hai Phong City). The company announced this project when acquiring a significant stake in Green International Hospital in August 2024.

The new hospital project is described by HAP as having a capacity of 500 beds, with a total investment of 1,000 billion VND. The construction period is expected to be 2 years, with operations commencing by the end of 2026.

In August 2023, Green International Hospital contributed 180 billion VND (60% stake) to establish Green – Haiduong Hospital Joint Stock Company. The new entity has an initial charter capital of 300 billion VND, with other shareholders including Mr. Vu Duong Hien (26.667%) and Mr. Vu Xuan Cuong (General Director, 13.333%). By December 2024, Green – Haiduong Hospital increased its charter capital to 800 billion VND.

However, with HAP‘s intention to divest from Green International Hospital to focus on paper and social housing projects, the progress of the new hospital project has been called into question.

– 11:58 24/09/2025

“Quiet Markets Post-Holiday: Investment Funds See Lull in Trading Action”

The stock market resumed trading after an extended holiday break with three sessions (September 3-5, 2025) in an attempt to conquer the psychological threshold of 1,700 points, yet it fell short. Amid this backdrop, investment funds’ activities were relatively subdued, with no significant new transaction announcements as of yet.

The Four Stocks Delisted by HOSE for Margin Trading

On August 29, the Ho Chi Minh City Stock Exchange (HOSE) announced the addition of four stocks ineligible for margin trading, including C32, HAP, and VPH, due to net losses in their reviewed semi-annual financial statements for 2025, and VTO, whose 2025 semi-annual reviewed financial statements were qualified by the auditor’s opinion.

“Vinahud Fails to Hold Annual Shareholder Meeting”

Unfortunately, the Annual General Meeting of Shareholders for Vinahud in 2025 did not meet the required quorum to proceed, as per legal requirements and the company’s charter. The shareholder attendance rate fell short, reaching only 31.52% of the total voting shares.

![[IR Awards] September 2024 Disclosure Calendar: Mark Your Dates!](https://xe.today/wp-content/uploads/2024/09/LCBTT_Screenshot_1.png)