HD Securities is seeking shareholder approval for a rights issue to raise its charter capital to over VND 5.1 trillion. The move aims to enhance the company’s market presence and financial capacity, supporting its business expansion.

Under the proposed plan, HD Securities will offer shares at a ratio of 2:5, allowing shareholders holding 2 shares to purchase an additional 5. The proposed offering price is VND 20,000 per share, equivalent to the book value reported in the company’s 2025 semi-annual financial statements (VND 20,531 per share).

The planned issuance totals over 365 million shares. If fully subscribed, HD Securities’ charter capital will surpass VND 5.1 trillion.

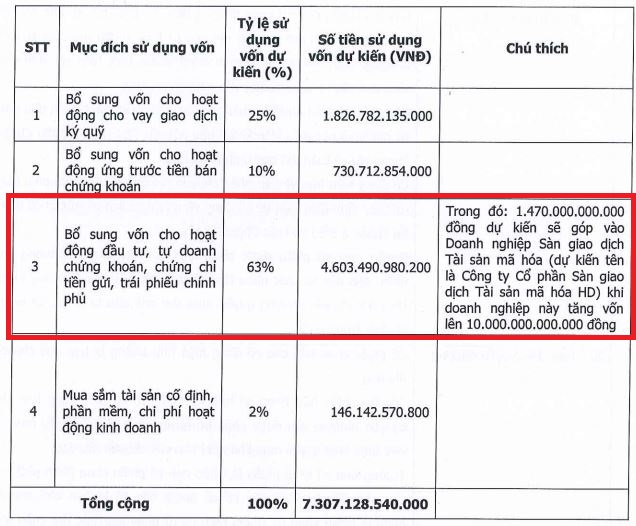

The proceeds, exceeding VND 7.3 trillion, will primarily fund proprietary trading in securities, deposit certificates, and government bonds, with VND 4.6 trillion allocated (63% of the total).

Notably, HD Securities will invest VND 1.47 trillion in a cryptocurrency exchange platform, as part of its capital increase to VND 10 trillion. The platform will operate under the name HD Cryptocurrency Exchange JSC.

The remaining funds will support margin lending (25%), advance payments for securities sales (10%), and the acquisition of fixed assets, software, and operational expenses (2%).

|

Allocation of Funds from HD Securities’ Rights Issue

Source: HDS

|

This initiative aligns with Vietnam’s growing recognition of the cryptocurrency market. Deputy Prime Minister Hồ Đức Phớc recently approved Resolution 05, enabling a 5-year pilot program for cryptocurrency exchanges in Vietnam, effective from September 9, 2025.

Resolution 05 mandates that exchange operators maintain a minimum capital of VND 10 trillion, with at least 35% held by two or more entities from the banking, securities, fund management, insurance, or technology sectors. Foreign ownership in cryptocurrency service providers is capped at 49%.

Reports suggest Vietnam may license up to five cryptocurrency exchanges. Several firms, including SSI Securities, TCBS Securities, VIX Securities, and VPBank Securities, have expressed interest. Additionally, Military Bank (MB) has partnered with Dunamu Group to launch Vietnam’s first domestic cryptocurrency exchange.

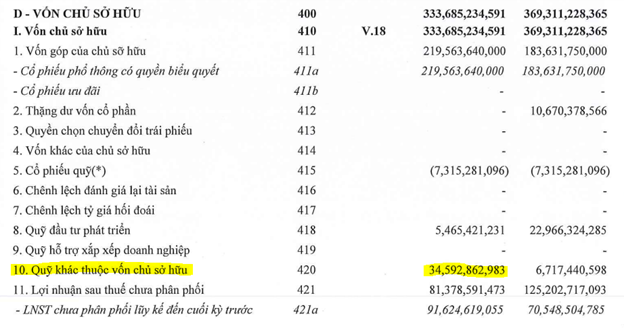

Currently, HD Securities holds a charter capital of VND 1.46 trillion and total assets exceeding VND 6.7 trillion. Its portfolio primarily consists of financial assets measured at fair value through profit or loss (FVTPL, VND 2.5 trillion) and loans (VND 1.5 trillion).

In the first half of 2025, the company reported a net profit of nearly VND 290 billion. Proprietary trading, lending, securities underwriting, and financial advisory services were the primary revenue drivers.

| HD Securities’ Financial Performance |

– 10:08 24/09/2025

Mapletree’s Next Move: Unveiling the 13,600m² West Tay Ho Land (Part 1)

In late 2024, Mapletree Investments Pte Ltd (Mapletree) finalized the acquisition of a 13,600m² land plot in the Tay Ho Tay urban area from Taseco Land, paving the way for the development of a Grade A office tower combined with retail space, boasting a total floor area of nearly 92,000m². This marks a rare move by the Singaporean real estate giant in Hanoi, following over a decade of primary focus on Ho Chi Minh City.

Official Groundbreaking: Launching 10 Key Projects and Infrastructure Initiatives for APEC 2027

Deputy Prime Minister Nguyen Chi Dung emphasized that the projects serving APEC 2027 demonstrate the seamless collaboration between the central government and local authorities, as well as between the state and businesses. With the upcoming synchronized infrastructure system, Phu Quoc will not only be the destination for APEC 2027 but also a symbol of an innovative and creative Vietnam, striving towards the goal of becoming a developing country with a modern industrial base by 2030.