The new bond issuance, coded HDC12502, comprises 3,000 units with a face value of 100 million VND per unit, a 3-year term, and maturity in September 2028. The initial interest rate is set at 10.5% per annum, slightly lower than the previous batch’s 11%. Both issuances are non-convertible bonds, unsecured, and backed by assets.

According to Hodeco’s leadership, the proceeds from this private bond issuance will be allocated for two purposes: 200 billion VND to repay bank loans and 300 billion VND to acquire land use rights for the Phuoc Thang Urban Area project (Phuoc Thang Project).

Spanning approximately 54 hectares, the project is strategically located along the Dinh River and 3/2 Street, a gateway to the former Vung Tau City. Upon completion, it will relocate industrial facilities from the city center, increase housing supply, and enhance urban architecture. Hodeco anticipates acquiring an additional 15 hectares of land in 2025.

The Phuoc Thang Urban Area received its investment certificate from Ba Ria – Vung Tau Province in 2012, with a total capital of nearly 1.5 trillion VND. Initially planned for 593 villas, 612 townhouses, high-rise apartments (18-36 floors) with office spaces, and a 5-9 floor resettlement area, the project covered 75 hectares. However, 24 hectares designated for resettlement were later separated. To date, Hodeco has acquired and transferred ownership of over 2.5 hectares.

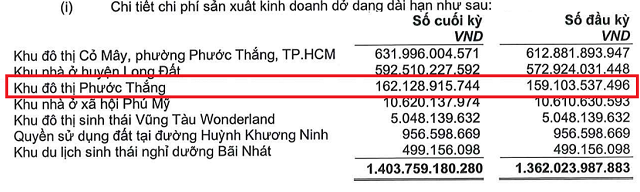

By the end of June 2025, the investment cost for the Phuoc Thang Project reached over 162 billion VND, a modest increase of 3 billion VND since the beginning of the year.

Rendering of the Phuoc Thang Industrial and Urban Complex. Source: Hodeco

|

Source: Hodeco’s 2025 Semi-Annual Reviewed Financial Report

|

In addition to the private issuance, HDC is also launching a public offering of 500 billion VND in convertible bonds. These unsecured bonds have a 2-year term and a fixed interest rate of 10% per annum. Existing shareholders are entitled to purchase bonds at a ratio of 35,671 shares per 1,000 bonds, with transfer rights limited to one transaction.

The bonds will mandatorily convert into common shares in two phases: 40% of the total issuance after one year and the remainder at maturity. The fixed conversion price is 10,000 VND per share, with each bond convertible into 10 common shares. The primary goal of this issuance is to restructure bank debt.

Hodeco plans to offer convertible bonds to existing shareholders

– 07:10 24/09/2025

Deputy Prime Minister: Tighten Control Over Private Corporate Bond Issuances

The Deputy Prime Minister has instructed the Ministry of Finance to prioritize the regulation and oversight of margin lending activities, ensuring stringent control over the issuance of private corporate bonds. Additionally, the Ministry is tasked with urging businesses to promptly settle bond payments as they mature.

Hodeco, CEO Group, and Leading Housing Developers Venture into Industrial Park Sector

Amidst a housing market that has yet to show clear signs of recovery, numerous real estate companies are pivoting toward new avenues of growth by developing industrial zones.

A Rewarding Quarter for CII Shareholders: Over VND 300 Billion in Dividends to be Distributed in Q4

“CII is set to reward its shareholders with a 5% dividend payout, marking a significant shift from the past two quarters, where efforts were focused on diverting resources towards the ambitious $1.7 billion highway project. This move underscores CII’s commitment to balancing growth initiatives with shareholder value.”

“CII Concludes Convertible Bond Offering, Raising $85 Million”

Ending the offering period on August 18, 2025, CII successfully distributed 20 million convertible bonds to 155 individual and institutional investors, raising VND 2,000 billion.