The land plot, designated as B3-CC2-A, is approved for the development of a 37-story tower within the Landmark 55 complex, planned for hotel, commercial, and office use, with a total investment of nearly 6 trillion VND. Initially, this asset was acquired by Taseco Land Joint Stock Company (Taseco Land, HOSE: TAL) from THT Development LLC, the developer of Tay Ho Tay Urban Area. However, by the end of 2024, it was transferred to Mapletree. As of the end of Q3/2024, the original land value was recorded at 781 billion VND. Additionally, TAL completed the divestment of its entire 99.8% stake in Tay Ho Tay Vision JSC (equivalent to nearly 1.32 trillion VND) in mid-December 2024.

Rendering of Mapletree’s office building within the Landmark 55 complex. Source: Compiled from Mapletree

|

This marks Mapletree’s second project in Hanoi, following Pacific Place—a mixed-use complex with nearly 40,000m² of Grade A office space acquired by the group in 2010. In the report to shareholders for the fiscal year 2024/2025, Hiew Yoon Khong, CEO of Mapletree, affirmed that Vietnam remains a strategic market for the group.

“Vietnam’s office market remains highly promising. Therefore, we decided to acquire land in Hanoi to develop a nearly 92,000m² project combining retail and commercial spaces,” he stated.

|

In mid-August 2025, Central announced its successful bid for Mapletree’s project named TAHOE Tay Ho, valued at 3.5 trillion VND. |

Unlike Pacific Place, which was acquired after completion, the Hanoi Mixed-use Development (Mapletree’s new project in Hanoi) is being developed from the ground up. Construction of the basement has begun, and the project is expected to deliver approximately 69,400m² of leasable space to the market.

The choice of Tay Ho Tay—one of Hanoi’s well-planned new urban areas—signals Mapletree’s intention to align with the shift of the administrative and financial center toward the northwest of the capital.

Construction of the basement underway in early September 2025. Photo: Kinh tế & Đô thị Newspaper

|

What’s the fate of the twin office towers in Saigon South Place?

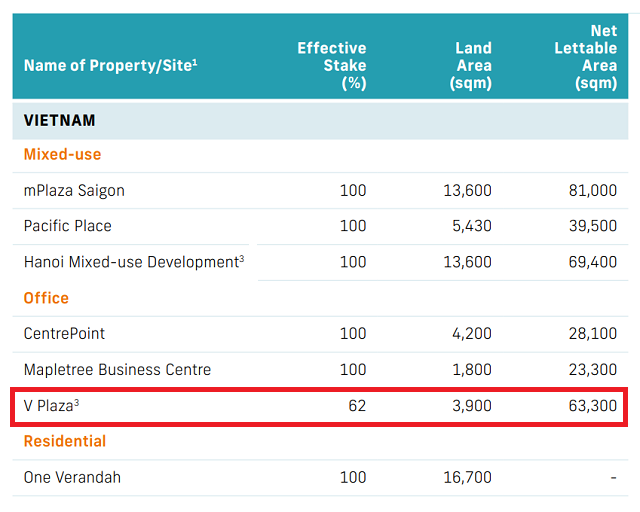

Alongside its Hanoi plans, Mapletree’s 2024/2025 annual report unexpectedly highlighted the V Plaza project—a Grade A twin-tower development with 63,300m² of leasable space in southern Ho Chi Minh City—after years of inactivity. Located within the Saigon South Place complex in District 7, the project was first unveiled in 2019 with an expected completion date of 2023, but construction has yet to commence.

Saigon South Place is Mapletree’s first mixed-use project in Vietnam, launched in 2009 in partnership with Saigon Co.op Investment and Development JSC (SCID, UPCoM: SID). To execute the project, the parties established Vietsin Commercial Complex Development JSC with a charter capital of 117.8 million USD, in which Mapletree Tan Phong Ltd holds 48.5%, Ever Fortune Commercial Center JSC (a Mapletree subsidiary) holds 13.5%, SCID holds 36%, and Saigon Co.op International Investment LLC holds 2%.

After over a decade, the complex has completed several components, including SC VivoCity shopping center, Mapletree Business Centre office tower, and residential and serviced apartment buildings. The reappearance of V Plaza in the report indicates Mapletree’s continued commitment to the project and hints at its plans to expand further in the Grade A office segment in Ho Chi Minh City.

Source: Compiled by the author

|

V Plaza project reappears in Mapletree’s 2024/2025 annual report. Source: Mapletree

|

Prior to reaffirming its plans for V Plaza and Hanoi Mixed-use Development, Mapletree had expanded its portfolio in Vietnam by acquiring completed properties. Notably, in 2016, the group spent over 215 million USD to acquire the Kumho Asiana Plaza complex in the former District 1 of Ho Chi Minh City.

At that time, Asiana Airlines Inc. and Kumho Industrial Co., Ltd. jointly transferred their entire 50% stake each (equivalent to nearly 507 billion VND) in Kumho Asiana Plaza Saigon LLC to Mapletree. Following the transaction, the company was renamed Saigon Boulevard Complex LLC.

Mapletree also acquired CentrePoint in the former Phu Nhuan District. This project belonged to Nguyen Vu Investment JSC, directed by Ms. Chu Thi Minh Ngoc. In 2015, Mapletree took over the entire charter capital of 132 billion VND.

Kumho Asiana Plaza, now mPlaza Saigon, is strategically located in central Ho Chi Minh City, featuring a Grade A office tower, serviced apartments, and a 5-star hotel. Formerly managed by InterContinental Hotels, the hotel and serviced apartments are now operated by JW Marriott

|

Unlike its Singaporean counterparts, CapitaLand and Keppel Land, Mapletree maintains a more focused portfolio but holds prime properties, with a strong emphasis on Grade A offices. By 2018, the group ventured into residential real estate with One Verandah—a luxury riverside apartment project spanning over 1.6 hectares in the former District 2 of Ho Chi Minh City.

This project, with a total investment of over 2.9 trillion VND and comprising 779 apartments, is developed by Truoc Song TML (Vietnam) LLC. The company, originally under Lancer (Cayman Islands) with a charter capital of 14.1 million USD, was acquired by Mapletree in 2018. Subsequently, its capital was increased to over 30.2 million USD.

Notably, many entities associated with Mapletree’s projects in Vietnam bear the imprint of Lim Teng-Kiat. He currently serves as the General Director and legal representative of Ever-Fortune Commercial Center JSC—the developer of Pacific Place in Hanoi—and holds similar positions at Tay Ho Tay Vision JSC, an indirect subsidiary of Taseco Land that owns the recently transferred land plot. Additionally, Lim leads several other companies within Mapletree’s ecosystem, including Nguyen Vu Investment JSC (owner of CentrePoint) and Truoc Song TML LLC (developer of One Verandah).

One Verandah—Mapletree’s first residential project in Vietnam

|

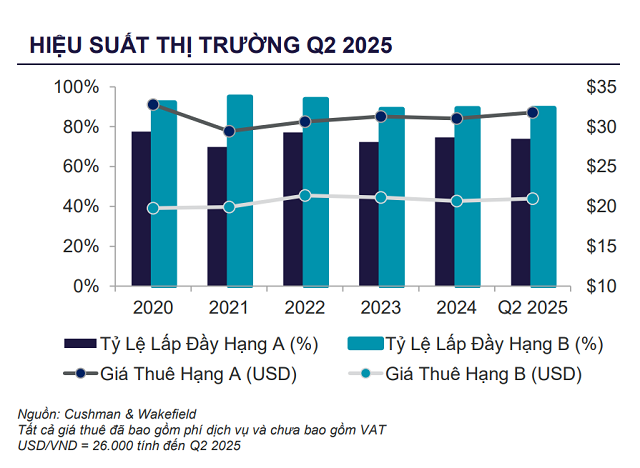

Hanoi’s office market faces oversupply pressure

Mapletree’s investment decision in Hanoi comes amid forecasts of significant supply pressure in the office market over the next three years. According to Cushman & Wakefield (C&W), in Q2/2025, the average rent for Grade A offices reached 31.79 USD/m²/month—largely stable quarter-on-quarter but up 2.3% year-on-year, primarily due to adjustments in central projects. The occupancy rate for Grade A offices exceeded 76%, increasing nearly 2 percentage points quarter-on-quarter.

C&W predicts that between 2025 and 2027, Hanoi will add over 418,000m² of office space, with the western area accounting for approximately 74%. CBRE also anticipates that as projects are completed by the end of 2025, vacancy rates will rise, aligning with Mapletree’s assessment that Hanoi will face pressure from approximately 170,000m² of new supply in the next 2-3 years. In contrast, Ho Chi Minh City benefits from limited land availability.

Office occupancy rates in Hanoi. Source: C&W

|

Originating from the industrial real estate sector, Mapletree has rapidly elevated offices to one of its four core business segments, alongside logistics, data centers, and student housing. As of March 2025, offices accounted for 25% of Mapletree’s total assets under management (AUM) of over 80 billion SGD (approximately 62 billion USD), second only to logistics (42%).

India is currently the most dynamic market, with a total office area of 1.6 million m² in the 2024/2025 fiscal year, far surpassing other markets like the US and China.

“In gateway markets such as India, Vietnam, and certain European countries, demand for Grade A offices continues to rise as workers return to the office. Conversely, in the US and Australia, this segment remains sluggish due to remote work trends. Despite short-term caution, we are increasing investments in India and Vietnam—markets with high potential,” noted CEO Hiew Yoon Khong.

– 10:00 24/09/2025

Official Groundbreaking: Launching 10 Key Projects and Infrastructure Initiatives for APEC 2027

Deputy Prime Minister Nguyen Chi Dung emphasized that the projects serving APEC 2027 demonstrate the seamless collaboration between the central government and local authorities, as well as between the state and businesses. With the upcoming synchronized infrastructure system, Phu Quoc will not only be the destination for APEC 2027 but also a symbol of an innovative and creative Vietnam, striving towards the goal of becoming a developing country with a modern industrial base by 2030.