PC1 Group Joint Stock Company (Stock Code: PC1, HoSE) has announced a report on the stock transactions of insiders and related parties. Notably, Mr. Phan Ngoc Hieu, Vice Chairman of the Board of Directors, successfully acquired 8 million PC1 shares. The transaction was executed through negotiated agreements on September 16, 2025, and September 18, 2025.

Following this acquisition, Mr. Hieu’s ownership stake increased from 0% to 2.24%, officially making him a shareholder of PC1 Group.

Illustrative image

Conversely, VIX Securities Joint Stock Company (Stock Code: VIX, HoSE) recently reported the successful sale of 3 million PC1 shares. This transaction reduced VIX’s holdings from 20.7 million shares to 17.7 million shares, lowering its ownership stake from 5.79% to 4.95%. As a result, VIX is no longer a major shareholder of PC1. The transaction date affecting ownership was September 18, 2025.

Based on the closing price of PC1 shares on September 18, 2025, at VND 26,300 per share, VIX Securities is estimated to have generated VND 78.9 billion from this sale.

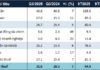

Regarding business performance, PC1’s audited consolidated financial report for the first half of 2025 shows net revenue of nearly VND 4,795.3 billion, a 9.6% decrease compared to the same period in 2024. After-tax profit reached over VND 309.7 billion, down 2.9% year-on-year.

For 2025, PC1 targets a consolidated after-tax profit of VND 836 billion. By the end of the first two quarters, PC1 has achieved 37% of its annual profit goal.

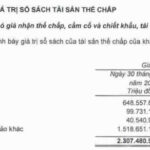

As of June 30, 2025, PC1’s total assets increased by 6.3% since the beginning of the year, reaching over VND 22,315 billion. Fixed assets account for 43.9% of total assets, valued at more than VND 9,805.3 billion, while inventory stands at over VND 2,248.1 billion.

On the liabilities side, total payables amount to over VND 14,415.8 billion, an 8.6% increase year-to-date. Short-term loans total nearly VND 3,644.9 billion, representing 25.2% of total liabilities, while long-term loans and issued bonds total nearly VND 7,465.4 billion, or 51.8% of total liabilities.

Insider Trading Scandal: Affiliates of Corporate Leaders Fined for Illicit Stock Sales

The State Securities Commission has recently imposed penalties on several violations in the stock market. Individuals were caught selling shares illegally, while numerous companies were found to have disclosed inaccurate information.