Deputy Governor of the State Bank of Vietnam, Nguyen Ngoc Canh

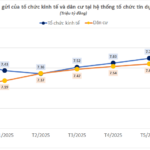

At the first meeting of the Central Steering Committee on Housing Policy and Real Estate Market, the State Bank of Vietnam reported that as of July 31, 2025, outstanding real estate credit reached over 4.1 million billion VND, a 17% increase compared to the end of 2024, accounting for 23.68% of the total outstanding debt in the economy. Of this, credit for real estate business reached 1.79 million billion VND (up 23.87%), and credit for real estate-related consumption reached 2.28 million billion VND (up 12.4%).

The non-performing loan ratio stood at 2.43%, remaining within controllable limits. Deputy Governor Nguyen Ngoc Canh stated that this growth reflects the market’s actual demand and demonstrates banks’ disciplined lending practices, balancing credit expansion with systemic safety, thereby contributing to macroeconomic stability.

By the end of July 2025, outstanding loans for government-directed housing programs reached approximately 30 trillion VND. Specifically, the housing support loan program under Resolution 02 disbursed 29.679 trillion VND, and the social housing loan program under Resolution 100 disbursed 19.226 trillion VND.

The State Bank of Vietnam is currently implementing a social housing loan package under Resolution 33/NQ-CP, totaling 145 trillion VND by 2030. Notably, under the new mechanism, these loans are not included in the annual credit growth targets and prioritize individuals under 35 years old. Interest rates have also been significantly reduced: from 8.7%/year for developers and 8.2%/year for homebuyers to 6.4% and 5.9%/year, respectively, making access easier.

Initial results show that 26 out of 34 provinces and cities have announced approximately 108 participating projects. Banks have committed 8.6 trillion VND in credit, with disbursements reaching 4.578 trillion VND (3.858 trillion VND for developers and 720 billion VND for homebuyers).

At the same conference, Mr. Le Hoang Chau, Chairman of the Ho Chi Minh City Real Estate Association, emphasized that the real estate market has entered a recovery and growth phase since Q1/2024.

Citing a report from the Ministry of Construction, Mr. Chau noted that there are currently 692 social housing projects underway nationwide, comprising over 600,000 units. However, to achieve the target of 1 million social housing units, an additional 300,000 units are needed. Mr. Chau believes this will create a “wave” of supply in the coming years, addressing housing needs for middle- and low-income groups.

A key tool is the 145 trillion VND credit package from 9 commercial banks. Mr. Chau stressed that this is a voluntary commercial credit package, not a subsidized one, with Vietcombank contributing 30 trillion VND. However, disbursement has been hindered due to legal issues with the projects. He expressed confidence that with upcoming specific resolutions, pilot resolutions, and legal amendments, “the 145 trillion VND package will soon be disbursed.”

Regarding amendments to Decree 100 on social housing, Mr. Chau stated that HoREA supports the Ministry of Construction’s proposal to adjust income criteria: 20 million VND/month for individuals, 40 million VND for couples, and 30 million VND for individuals raising children under 18.

On lending rates, Mr. Chau recommended reverting to the 4.8%/year rate, previously approved by the Prime Minister from 2021 to 7/2024. Currently, the Vietnam Bank for Social Policies applies a rate of 6.6%, higher than the commercial rates offered by banks like Vietcombank (5.9–6.1%).

VPBank CEO: Real Estate Market Booms, Interest Rates at Historic Lows

According to Mr. Nguyen Duc Vinh, CEO of VPBank, the real estate market has become significantly more vibrant compared to a year ago. This indicates that we have successfully navigated through the most challenging phase.

Revitalized Real Estate Credit Paves the Way for a Surge in Affordable Housing

Real estate credit has rebounded with outstanding loans surpassing VND 4.1 quadrillion, while bad debt ratios remain under control. Multiple preferential credit packages for social housing are entering a robust disbursement phase. Renewed confidence is spreading across banks, businesses, and citizens, fostering expectations of a stable, sustainable market that expands homeownership opportunities for middle and low-income groups.