After an initial tug-of-war, Vietnam’s stock market experienced a surprising turnaround post-2 PM, fueled by a surge in bottom-fishing capital. This influx propelled numerous stock groups upward, with 27 out of 30 VN30 constituents closing in the green, including one that hit the ceiling price.

By the September 24th close, the VN-Index climbed 22.2 points to reach 1,657.46. Trading value on HoSE exceeded VND 25,030 billion.

Despite this rebound, foreign investors remained net sellers, offloading a total of VND 1,591 billion throughout the session. Here’s a breakdown:

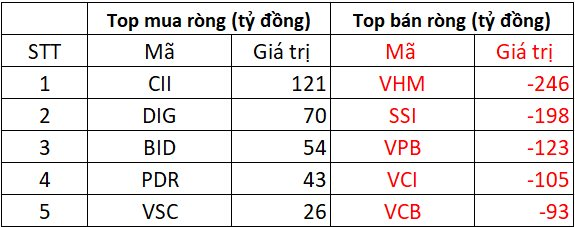

On HoSE, foreign investors net sold approximately VND 1,510 billion

On the buying side, CII led the market with a net buy value of VND 121 billion. DIG, BID, PDR, and VSC followed suit, attracting net buys ranging from VND 26 billion to VND 70 billion.

Conversely, VHM witnessed the heaviest foreign selling pressure, with a net sell value of VND 246 billion. SSI, VPB, and VCI also faced significant net selling, amounting to VND 198 billion, VND 123 billion, and VND 105 billion, respectively. VCB saw net selling of VND 93 billion.

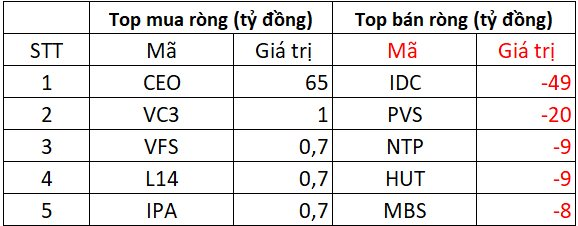

On HNX, foreign investors net sold nearly VND 43 billion

CEO emerged as the top net buy on HNX, attracting VND 65 billion. VC3, VFS, L14, and IPA also saw modest net buying interest, ranging from a few hundred million to VND 1 billion.

IDC and PVS faced the brunt of foreign selling, with net sell values of VND 49 billion and VND 20 billion, respectively. HUT, NTP, and MBS also experienced net selling, each around VND 8-9 billion.

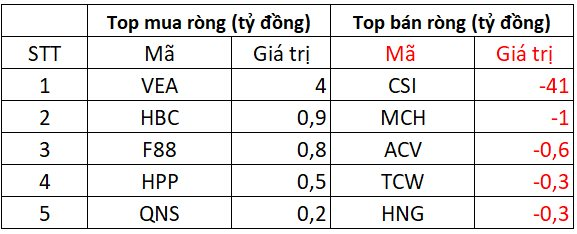

On UPCOM, foreign investors net sold VND 38 billion

VEA led the net buys on UPCOM with VND 4 billion, followed by HBC, F88, HPP, and QNS, each attracting a few hundred million dong in net buying.

CSI bore the brunt of foreign selling, with a net sell value of VND 41 billion. MCH, ACV, TCW, and HNG also faced net selling, ranging from a few hundred million to VND 1 billion.

Streamline Account Opening for Foreign Investors

The State Bank of Vietnam has issued a directive to commercial banks, mandating compliance with regulations regarding the opening of accounts for foreign investors engaging in indirect investment activities within Vietnam.

Technical Analysis for the Afternoon Session of September 23: Anticipating the August 2025 Low Revisited

The VN-Index halted its downward trend as it approached the August 2025 low (around 1,600-1,630 points). Meanwhile, the HNX-Index experienced intense volatility, forming a Long Upper Shadow candlestick pattern.