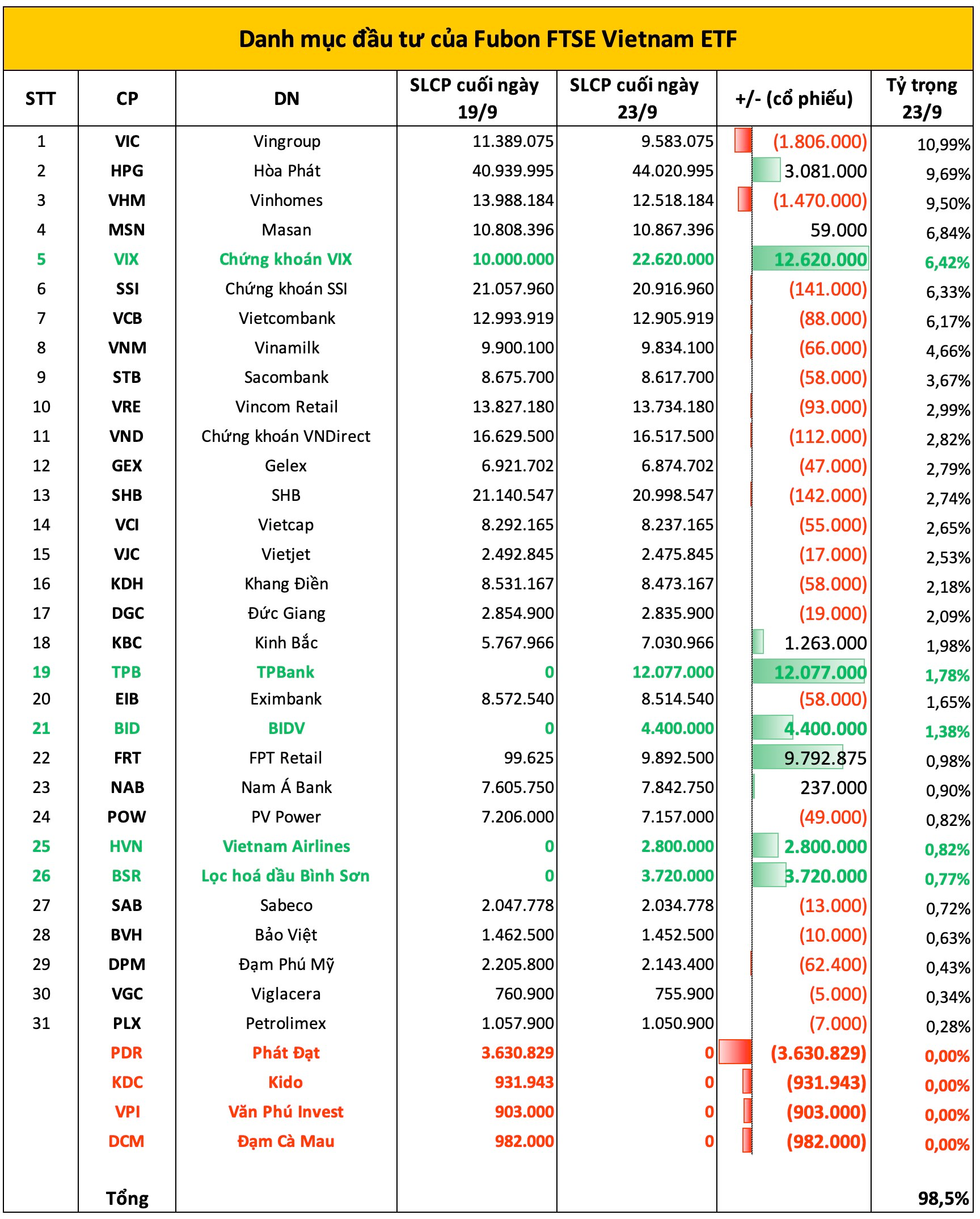

The Q3 2025 rebalancing period includes a review by the Fubon FTSE Vietnam ETF. As of the first two trading sessions of the week (September 22-23), the rebalancing activities are still underway.

Specifically, the fund has acquired over 12 million shares of TPB (TPBank), 4.4 million shares of BID (BIDV), 2.8 million shares of HVN (Vietnam Airlines), and more than 3.7 million shares of BSR (Binh Son Refinery). Additionally, the fund continued to accumulate 12.6 million shares of VIX, following the purchase of 10 million units in the previous week’s final session.

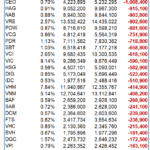

Conversely, Fubon ETF has completely divested from four stocks: PDR (3.6 million shares), KDC (931 thousand shares), VPI (903 thousand shares), and DCM (982 thousand shares), removing them from its portfolio. The fund also continued to sell off other stocks in the first two sessions of the week, including VIC (-1.8 million shares), VHM (-1.5 million shares), and SHB (-142 thousand shares).

As of September 23, 2025, the Fubon ETF portfolio consists of 31 stocks, with a total value of approximately VND 13,300 billion.

The top holdings in the Fubon ETF include VIC (9.6 million shares, 10.99% weighting), HPG (44 million shares, 9.69% weighting), VHM (12.5 million shares, 99.5% weighting), MSN (10.9 million shares, 6.84% weighting), and VIX (22.6 million shares, 6.42% weighting).

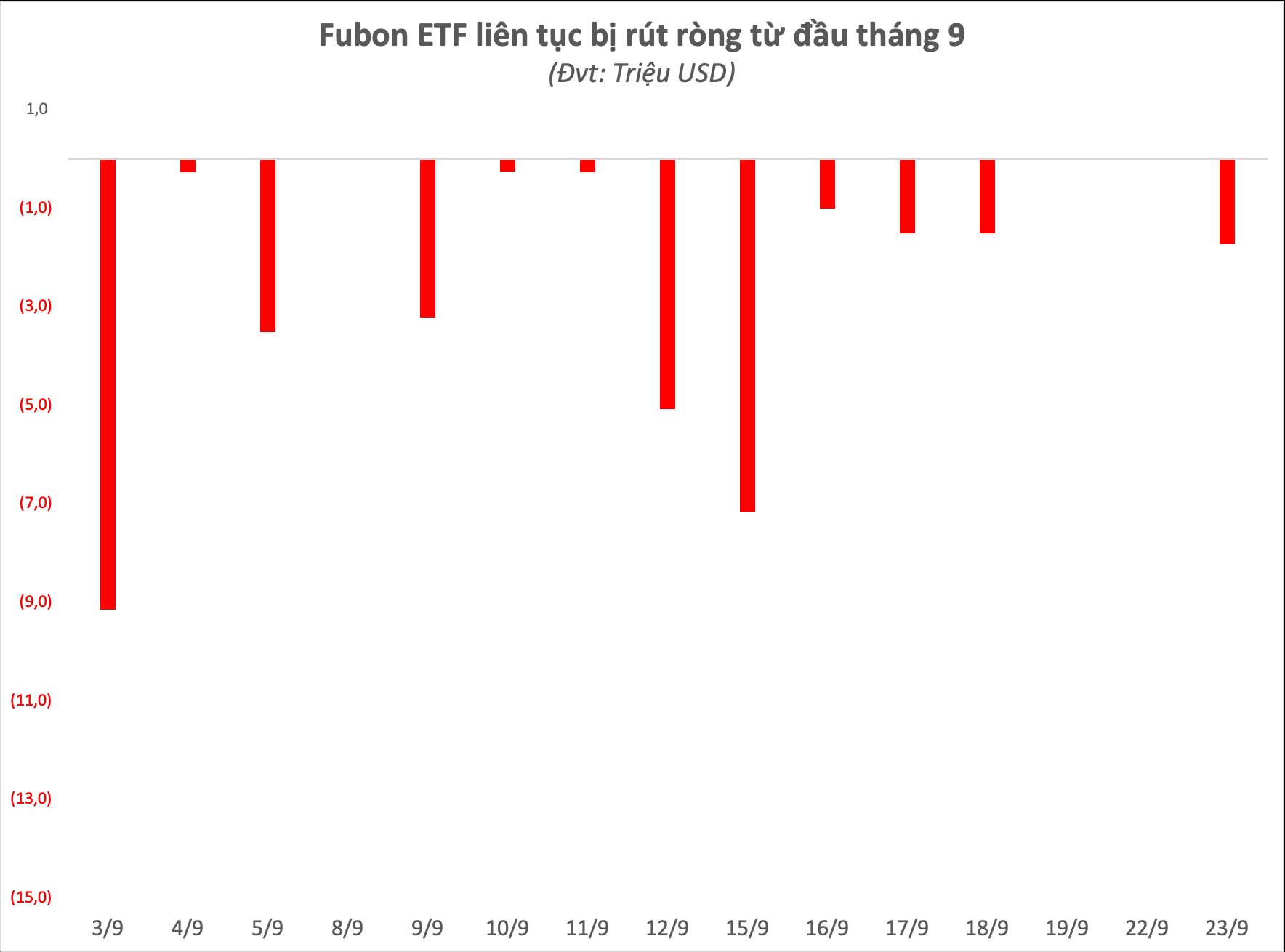

Since the beginning of September, Fubon ETF has maintained a net outflow trend, with a value of nearly USD 35 million, equivalent to approximately VND 900 billion in Vietnamese stocks being sold.

Half-Billion Dollar ETF Fund Executes Major Portfolio Restructuring Trades This Week

During the period from September 15 to 22, the VanEck Vectors Vietnam ETF (VNM ETF) exhibited significant trading activity in the stocks within its portfolio. This coincided with the official implementation of the MarketVector Vietnam Local Index review results, which took effect on September 19, serving as the benchmark index for the fund.

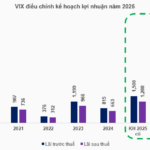

VIX Finalizes Shareholder Approval for New Plan, Projected Profits Surge 3.3x Over Previous Version

On September 23rd, the Board of Directors of VIX Securities JSC (HOSE: VIX) passed a resolution approving an adjusted plan to increase the company’s profit target for 2025, which will be presented to an extraordinary shareholders’ meeting.

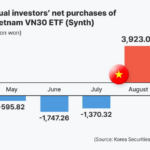

Korean Investors Flock to Vietnamese Stock Market

Amidst the sluggish growth of South Korea’s domestic stock market, retail investors are increasingly channeling capital into Vietnam’s equity market, drawn by the country’s promising economic indicators and robust growth prospects. This influx of Korean retail investment underscores Vietnam’s emerging appeal as a lucrative destination for international capital.