Sonadezi Joint Stock Company (Sonadezi, Stock Code: SNZ, UPCoM) has recently announced the Board of Directors’ Resolution regarding the payment of dividends for 2024 to its shareholders.

Accordingly, Sonadezi is set to distribute a cash dividend at a rate of 13%, meaning shareholders holding one share will receive 1,300 VND. The final registration date for shareholders is October 8, 2025, with the expected payment date being October 23, 2025.

With approximately 376.5 million SNZ shares currently in circulation, Sonadezi is estimated to allocate over 489.4 billion VND for this 2024 dividend payment.

Illustrative image

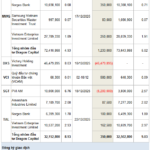

Regarding business performance, according to the audited consolidated financial report for the first half of 2025, Sonadezi achieved a net revenue of over 3,703.5 billion VND, a 29.7% increase compared to the same period in 2024. After deducting the cost of goods sold, gross profit reached nearly 1,817 billion VND, up 44.7%.

During this period, the company also generated approximately 69.4 billion VND in financial revenue, a 33.7% decrease year-over-year. Meanwhile, selling expenses decreased by 2.5% to 61.6 billion VND.

Conversely, financial expenses rose by 56.7% to nearly 91.7 billion VND, and administrative expenses increased from nearly 210.7 billion VND to approximately 256.8 billion VND.

As a result, after accounting for taxes and fees, Sonadezi reported a net profit of nearly 1,295.8 billion VND, a 48.3% increase compared to the first half of 2024.

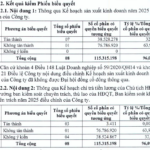

For 2025, Sonadezi has set a business target with a post-tax profit of over 1,403.6 billion VND. Thus, by the end of the first two quarters, the company has achieved 92.3% of its planned profit.

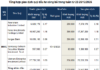

As of June 30, 2025, Sonadezi’s total assets increased by 4% from the beginning of the year to nearly 21,954 billion VND. Of this, inventory amounted to over 2,210.4 billion VND, accounting for 10.1% of total assets, and long-term work in progress recorded over 5,245.7 billion VND, representing 23.9% of total assets.

On the liabilities side, total payables stood at over 10,368.1 billion VND, a slight increase of 166 billion VND from the beginning of the year. This includes short-term and long-term loans totaling nearly 3,855.9 billion VND, making up 37.2% of total liabilities, and long-term unearned revenue of approximately 2,410.2 billion VND, accounting for 23.2% of total liabilities.

Billions in Profits on the Horizon for Leading Businesses

Phuoc An Port Joint Stock Company successfully raised VND 1.325 trillion through a private placement of 125 million shares. Meanwhile, Chuong Duong Joint Stock Company plans to issue up to nearly 53 million shares to double its chartered capital. Miza Joint Stock Company also offered nearly 10.6 million shares to existing shareholders, generating VND 106 billion in proceeds.