How is the ongoing infrastructure development impacting population migration and real estate capital flow in the Southern region, sir?

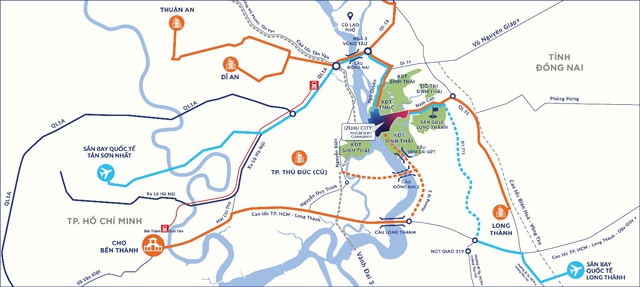

Vietnam’s real estate market often thrives alongside infrastructure development. In Ho Chi Minh City, all major transportation axes, including ring roads, metro lines, and highways connecting the city center to Long Thanh Airport, will become hubs for large-scale projects.

As travel becomes more convenient, natural population shifts occur around infrastructure nodes, driving the growth of satellite urban real estate markets through integrated models. This trend is essential as land in the central core becomes increasingly scarce. Moreover, residents of the newly merged multi-centered Ho Chi Minh City will gravitate toward active and upcoming infrastructure projects like metro lines, Long Thanh Airport, highways, and ring roads.

Dr. Nguyen Tri Hieu – Banking and Finance Expert. Photo: Provided by the individual

Location remains a decisive factor in real estate investment. How do you explain this?

Location is paramount for both investors and homebuyers. A prime location offers easier daily living with proximity to transportation networks, educational institutions, healthcare facilities, and entertainment hubs. Additionally, a clean environment and robust security are critical. Over the years, numerous well-designed but isolated projects with poor connectivity have struggled to attract residents, serving as a cautionary tale.

Beyond basic needs, people aspire to higher standards. They seek not only a home conveniently connected to work and amenities but also a safe, civilized living environment.

What criteria should projects meet to satisfy today’s real estate buyers, in your opinion?

Integrated urban models are ideal for Ho Chi Minh City’s large and growing population. As living standards rise, residents demand not only convenient connections to work and amenities but also higher safety, security, green spaces, and a civilized community. In the East, Izumi City, located along the Dong Nai River, is just a 20-minute drive from Long Thanh Airport and 30 minutes from Ho Chi Minh City’s center. This internationally standardized, meticulously planned project offers a full ecosystem of amenities and emphasizes green spaces, meeting both residential needs and long-term growth potential.

Izumi City is near key transportation routes like National Highway 51 and the Ho Chi Minh City – Long Thanh – Dau Giay Expressway.

Beyond location, how do financial factors influence real estate ownership and investment?

The current low-interest rate environment is advantageous but carries risks if borrowers underestimate repayment capacity. Investors must ensure the asset generates sufficient cash flow to cover interest payments. Homebuyers should adhere to a Debt-to-Income (DTI) ratio of 50-60% and maintain a financial leverage ratio (Total Debt/Equity) of 4-5 times for safety.

What advice do you have for buyers leveraging bank loans and sales policies?

Many developers partner with banks to offer attractive loan packages, especially for young professionals with stable incomes. For instance, Izumi City provides dual financial solutions: the Easy Pay program and the Dragon Priority Account, enabling buyers to enhance their quality of life or investors to choose flexible long-term payment options. However, buyers should carefully review terms, compare costs and benefits, and seek clarity from banks and developers to ensure financial security.

The new Izumi Canaria subdivision of Izumi City. The developer offers flexible payment solutions for this subdivision.

How do you foresee the urban market along the Eastern airport corridor in Ho Chi Minh City evolving?

As ring roads, metro lines, and Long Thanh Airport become operational, satellite cities will emerge along these infrastructure corridors. Projects excelling in location, connectivity, and quality of life will gain a competitive edge. The Southern region’s landscape is shifting toward integrated urban centers, where residents can live, work, study, and enjoy leisure within a compact radius, reducing reliance on the central core.

G6 Group Chairman Proposes Comprehensive Solutions to Reduce Condominium Prices

Nguyễn Anh Quê, Chairman of G6 Group, has proposed several short-term solutions to curb rising housing prices. These include regulating condominium profit margins, resolving legal bottlenecks, and aggressively expanding social housing initiatives.

Strategic Investment Opportunities: Affordable Options Under 1.9 Billion VND in Hai Phong’s Urban Core

In the heart of Hai Phong, where central apartment prices typically range between 2 to 3 billion VND per unit, Rose Residence emerges as a rare opportunity. Starting at just 1.9 billion VND, it offers an affordable yet premium urban living experience, perfectly suited for both homeowners and savvy investors alike.