Rinascente Store in Italy

According to the Bangkok Post, Central Retail’s Board of Directors has approved the sale of the Rinascente chain, which operates nine high-end shopping centers in Italy, to Harng Central Department Store (HCDS), an unlisted affiliate of Central Group.

The total transaction value is estimated at 14.7 billion baht (over $400 million). Upon completion, CRC is expected to record a significant after-tax profit of approximately 6 billion baht ($163 million).

The proceeds from the divestment will be used to strengthen the financial foundation, repay debt, and support future investment plans. Notably, the company plans to allocate 7.7 billion baht from the transaction to pay a special dividend to shareholders, equivalent to 1.28 baht per share.

Panet Mahankanurak, CFO of CRC, stated that this decision reflects the group’s commitment to focusing on markets where they have deep expertise and see strong growth potential. “Thailand and Vietnam remain our key markets, and we will continue to invest and expand in these countries,” he emphasized.

The CFO added that divesting from Europe will allow CRC greater flexibility to pursue mergers and acquisitions (M&A) opportunities across Southeast Asia, where investment costs are more reasonable.

Vietnam: A Strategic “Gold Mine” with Challenges

Central Retail’s restructuring and focus on Southeast Asia, particularly Vietnam, are well-founded. Vietnam has long been identified as a “promised land” and the group’s second most important strategic market, after its home base in Thailand.

Tops Market (formerly Big C) under Thailand’s Central Retail. Photo: Central Retail

Central Retail’s presence in Vietnam is marked by high-profile M&A deals. Most notably, the acquisition of the entire Big C Vietnam supermarket system from France’s Casino Group in 2016 for over $1 billion. After the takeover, Central Retail rebranded the chain as GO! Hypermarket and Tops Market, and acquired the Nguyen Kim electronics chain and Lan Chi Mart to build a diverse retail ecosystem.

Infographic Source: Central Retail Vietnam

The group’s commitment to investment is increasingly evident through its figures. Recently, Central Retail announced plans to invest an additional $1.45 billion in Vietnam over the next five years (2023-2027) to accelerate expansion. To date, Central Retail’s network in Vietnam includes over 340 stores and shopping centers, spanning 42 provinces and cities, with more than 500,000 daily visitors.

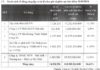

Central Retail’s semi-annual financial report reveals a challenging yet resilient business landscape in Vietnam. In the first half of 2025, revenue in Vietnam reached 24.6 billion baht (approximately 19.9 trillion VND), accounting for 20% of global revenue.

Notably, exchange rate fluctuations played a significant role. In Vietnamese dong, revenue grew by 2% year-on-year, but when converted to Thai baht, it recorded a 7% decline.

Breaking down by segment, the home appliances sector (Nguyen Kim) saw the sharpest decline (21%) due to intense competition. The food segment, a key pillar, also dropped by 4% (to over 21 billion baht), primarily due to two major shopping centers undergoing renovations. Other segments, such as fashion and real estate leasing, experienced slight decreases.

Grand Opening of GO! Hung Yen Shopping Center

Despite short-term challenges, Central Retail remains steadfast in its expansion strategy. In 2025, the group opened two new shopping centers in Hung Yen and Yen Bai and expanded its portfolio of international brands, including HOKA, Crocs, and Dyson, to enhance competitiveness.

These moves underscore the strategic decision to shift resources from Europe to Vietnam, reflecting confidence in the market’s long-term growth potential.

iPhone 17 Sample Shockingly Discounted: Act Fast to Secure Yours Now!

Just days after its official release, several authorized Apple retailers have already begun offering discounts on the iPhone 17.