In a recent report, MBS Research highlights the modern retail sector as a prime beneficiary of the government’s tightened market regulations. The Vietnamese government is actively streamlining the retail market by addressing critical violations, such as a $21.7 million counterfeit milk scandal, enforcing stricter advertising compliance, and mandating e-invoicing for businesses with annual revenues exceeding $43,000. These measures not only enhance transparency but also curb counterfeit and substandard goods.

Notably, Hanoi aims to eliminate all informal markets by 2025, a goal previously unattainable due to consumer preferences for convenience, affordability, and speed. However, the rise of modern retail systems offering clean food, reasonable prices, transparent sourcing, and integrated online channels now provides a viable alternative. This policy shift creates a level playing field for supermarkets, convenience stores, and e-commerce platforms.

Domestic retail and consumer goods companies are poised to gain significantly. Leading firms such as The Gioi Di Dong (MWG), Vinamilk (VNM), Sabeco (SAB), and particularly Masan Group (MSN) are highly regarded by analysts for their robust growth and attractive valuations.

Catalyzed by Modern Retail and Consumer Goods

With a population of 100 million and a rapidly expanding middle class, Masan Group (HoSE: MSN) is recognized by international financial institutions and securities firms as Vietnam’s top consumer and retail entity. Its growth is fueled by the synergy of WinCommerce, operator of the nation’s largest supermarket and convenience store network (WinMart/WinMart+), Masan Consumer (UPCoM: MCH), a leading consumer goods company, and Masan MEATLife (UPCoM: MML), a pioneer in branded meat products.

In the first eight months of the year, WinCommerce opened 415 new stores, all of which turned a profit, underscoring the effectiveness and appeal of modern retail, especially in rural areas. Approximately 300 new stores, or nearly 75% of the total, cater to rural consumers. The Central region saw 194 new stores, contributing nearly 50% of the total.

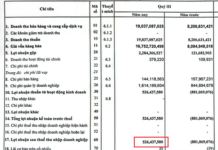

In August 2025, Masan MEATLife’s branded meat division reported strong performance, with sales volume reaching 14,007 tons, up 12.9% year-on-year. Net revenue climbed 11.1% to $42.5 million, reflecting steady demand and growing contributions from modern retail channels. Operational efficiency improved significantly, with EBIT rising 42.9% to $1.8 million and net profit surging 60.5% to $1.3 million. EBITDA also increased 18% to $3.2 million, indicating strengthened profit margins. These results affirm MML’s sustainable recovery post-restructuring, with enhancements in both operational scale and financial health.

MEATDeli’s European-standard chilled meat products are favored by consumers for their superior quality. Produced from healthy pigs meeting “3 No” standards—no diseases, no growth promoters, and no antibiotic residues—and undergoing a 3-tier quarantine process, MEATDeli products also feature QR codes for traceability. This trend reflects consumers’ growing preference for high-quality, safe, and transparently sourced products.

Meanwhile, Masan Consumer is navigating a short-term adjustment phase due to distribution channel restructuring and new invoicing requirements. The company projects 2025 revenue of $1.3 billion, up 5% year-on-year, with a strong rebound expected from 2026 as distribution stabilizes and new products gain market penetration.

According to MBS, Masan’s net profit is forecast to grow 44% in 2025 and 40% in 2026, driven by its retail and consumer goods segments. Additionally, loan restructuring and reduced interest expenses have significantly improved the net debt-to-EBITDA ratio, strengthening the company’s financial foundation.

Foreign Capital Seeks Sustainable Growth Opportunities

As foreign capital seeks out Vietnam’s growth story, Masan stands out as a leading consumer enterprise. Its integrated retail-consumer ecosystem positions it to benefit directly from the shift to modern retail and the rising demand for quality products among higher-income consumers.

WinCommerce serves as a key touchpoint for millions of households and a vital distribution channel for MCH and MML products. This creates a closed-loop growth cycle—production, distribution, consumption—establishing a unique competitive advantage for Masan in the market.

Challenges remain, including intense competition between domestic and foreign chains, rising operational costs, new regulatory compliance requirements, and evolving consumer habits. To lead the market, companies must expand while optimizing operations and managing risks.

Given recent positive developments, experts suggest that as Vietnam reaches a $5,000 GDP per capita, Masan could emerge as a leading consumer stock and a strategic investment destination for international investors focused on Vietnam’s 100 million population and sustainable consumption growth.

– 14:46 24/09/2025

Unraveling the Allure of Masan Stocks: Why Are Foreign “Sharks” Circling?

This focus is driven by two key factors: first, the operational efficiency and growth potential of the conglomerate’s core business segments; second, the positive catalysts emanating from Vietnam’s stock market.

August 2025: Consumer Spending Rebounds, Leading VN30 Company Accelerates Rural Expansion

In 2025, domestic consumption remains a pivotal driver of Vietnam’s economic growth. According to the General Statistics Office, the total retail sales of goods and consumer service revenue in August reached 588.2 trillion VND, marking a 10.6% increase compared to the same period last year.