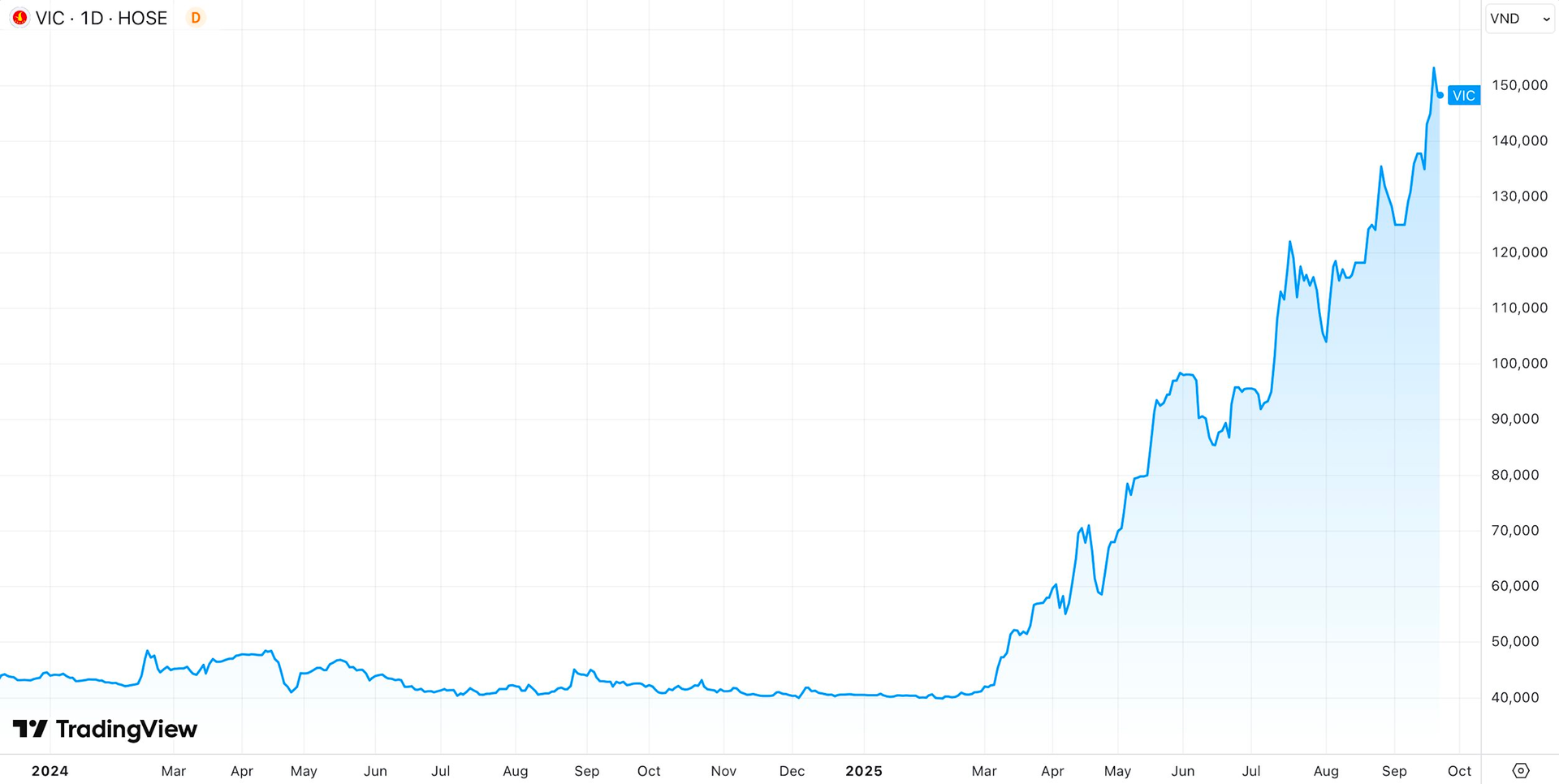

Over the past two weeks, the stock market witnessed one of its most notable events of 2025: Vingroup’s VIC shares consistently reached new highs, pushing the company’s market capitalization to over 590 trillion VND (approximately $22 billion).

This milestone solidified Vingroup’s position as the leading company on the stock exchange and brought it closer to becoming the first Vietnamese enterprise to achieve a 600 trillion VND market cap. It’s worth recalling that earlier, numerous baseless rumors had cast a shadow over Vingroup’s reputation, unsettling investor confidence.

False and misleading information about Vingroup spread widely across social media platforms like TikTok, Facebook, and YouTube, focusing on four main themes: the group’s financial health, product quality and origin, legal issues surrounding its products, and personal information about its leadership. These narratives painted a distorted image of Vingroup for investors.

At one point, the rumor “Vingroup is on the brink of bankruptcy with a debt of 800 trillion VND” went viral, despite the fact that the group’s actual financial debt as of June 30, 2025, was only around 283 trillion VND, with a debt-to-equity ratio of nearly 1.8—well within safe limits according to international and Vietnamese standards.

Mr. Hoàng Minh, a seasoned individual investor in Hanoi, shared: “The stock market is highly sensitive to rumors. Without official information, many panic-sell their shares, triggering a domino effect. Especially in a market dominated by individual investors, fake news finds fertile ground to spread.”

Many experts agree that with the current market structure, rumors significantly impact stock prices, and only transparent, timely information can restore investor confidence. “Fake news is a grave issue for the economy and society, not just individuals or businesses. A single fabricated story can crash stock prices, disrupt markets, and affect millions of workers,” stated Lawyer Trương Thanh Đức, Director of ANVI Law Firm.

In response, Vingroup chose transparency and legal action. On September 8, 2025, the group filed civil lawsuits, reported the matter to authorities, and sent notices to embassies regarding 68 domestic and international individuals and organizations spreading false information about the company online. “Vingroup’s decisive fight against misinformation aims not only to protect its legal rights but also to uphold societal interests and the integrity of the law,” the company stated.

In its official announcement, Vingroup clarified details about its actual debt, product origins, and VinFast’s localization rate. The results were immediate: VIC shares surged nearly 3.4% on September 9, reaching 129,200 VND per share. In the following days, VIC continued its remarkable rally, hitting new highs four times in two weeks, peaking at 153,200 VND per share on September 19, 2025.

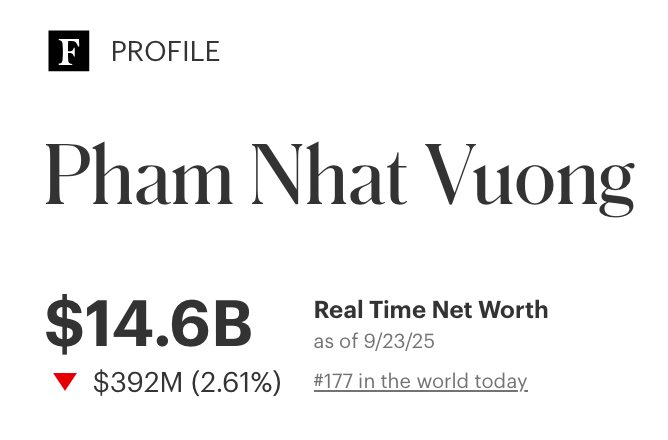

The surge in stock prices also boosted the personal wealth of Phạm Nhật Vượng, Vingroup’s Chairman. According to Forbes, his net worth peaked at $15 billion, placing him among the world’s top 200 richest individuals. Vingroup’s legal actions thus served not only to protect its reputation but also to demonstrate its financial strength and influence.

Vingroup’s story highlights the impact of rumors on capital markets. When misinformation spreads, investor sentiment can be disrupted, leading to stock price volatility. Conversely, transparency and decisive action can swiftly restore market confidence. In Vingroup’s case, disclosing financial data, clarifying debt issues, and suing those spreading false information triggered a rebound in its stock price.

Lawyer Trương Thanh Đức emphasized that in the face of rampant online misinformation, businesses remaining silent out of fear of complications only distort societal perceptions. Vingroup’s bold stance against this issue is a civilized approach that deserves support, as it not only protects the company’s rights but also serves as a societal wake-up call, preventing the public from being manipulated by chaotic information.

Vietstock Daily 24/09/2025: Liquidity Hits Record Low

The VN-Index formed a Doji candlestick pattern, accompanied by a sharp decline in trading volume below the 20-session average, indicating persistent market caution. With both the Stochastic Oscillator and MACD continuing to weaken following sell signals, the August 2025 low (around 1,600-1,630 points) is expected to serve as short-term support for the index.

Proprietary Trading Firms Inject Nearly VND 400 Billion into Vietnamese Stocks Amid Sharp Market Decline: What Are the Key Targets for Accumulation?

Proprietary trading desks at securities companies recorded a net buy of VND 375 billion on the Ho Chi Minh City Stock Exchange (HOSE).