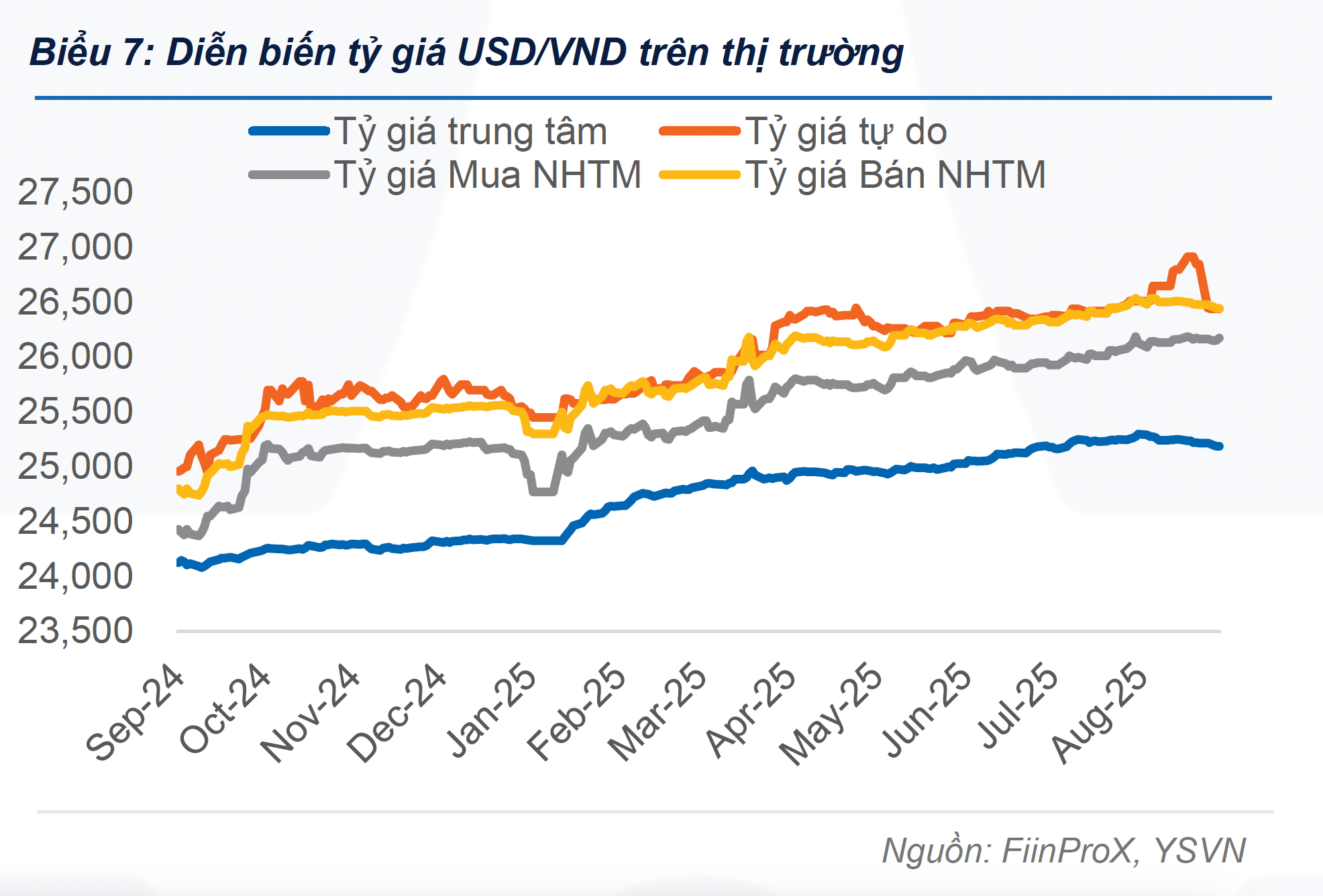

Bank USD Rates Stable, Free Market Sees Sharp Decline

On the morning of September 23, the State Bank of Vietnam set the central exchange rate at 25,189 VND/USD, a 3 VND increase from the previous day. However, over the past month, the rate has consistently cooled down from its peak of 25,300 VND.

At major commercial banks such as Vietcombank, BIDV, Eximbank, and ACB, the USD rate remained steady at around 26,218 VND/USD for buying and 26,448 VND/USD for selling, virtually unchanged from the previous session. Compared to a month ago, the USD rate at banks has decreased by approximately 0.33%.

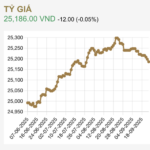

In the free market, activity was more dynamic. Some currency exchange points in Ho Chi Minh City quoted rates at 26,485 VND/USD for buying and 26,585 VND/USD for selling, a 15 VND increase from yesterday. However, compared to the peak of 27,000 VND earlier in September, the free market USD rate has dropped by about 1.5%, a significant cooling in just two weeks. The current gap between free market and bank rates is only around 50 VND.

Free Market USD Rates Cool Down Rapidly

Global Influences and Short-Term Forecasts

Vietnam’s currency movements align with global trends as the greenback weakens. Internationally, the USD index (DXY) traded around 97.29 points this morning, its lowest level in a month. This is primarily due to the U.S. Federal Reserve’s (FED) recent 0.25 percentage point cut in the benchmark interest rate, now at 4–4.25%, as expected by the market.

Analysts predict the FED will continue easing monetary policy in upcoming meetings. Several other central banks have also cut rates to support growth, further pressuring the USD downward.

Mr. Nguyen The Minh, Director of Individual Client Analysis at Yuanta Vietnam Securities, notes that the USD/VND exchange rate continues to cool, with the free market rate dropping sharply by 1.52% in just one week.

He suggests that in the short term, Vietnam’s exchange rate is likely to remain stable due to the narrowing interest rate gap between USD and VND, reducing pressure on the local currency.

USD/VND Exchange Rate Trends Over Time

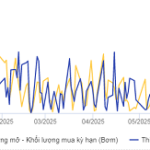

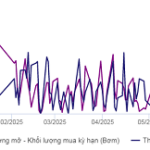

Central Bank Withdraws Over 27 Trillion VND from Open Market Operations

During the week of September 15–22, 2025, the State Bank of Vietnam (SBV) significantly reduced its reliance on the forward purchase channel, despite substantial maturities occurring within this channel.

Year-End Exchange Rates and Solutions for Businesses

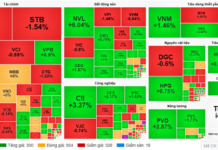

In the final months of 2025, currency exchange rate pressures are emerging as a critical challenge directly impacting the financial health of import-export businesses. As the USD continues to strengthen against the VND, the business landscape is painted with contrasting hues, where one’s opportunity becomes another’s obstacle.

Central Bank Injects Nearly VND 1.5 Trillion into Open Market

After two consecutive weeks of net withdrawals, the State Bank of Vietnam (SBV) resumed net injections into the open market during the week of September 8-15, utilizing the term purchase channel.