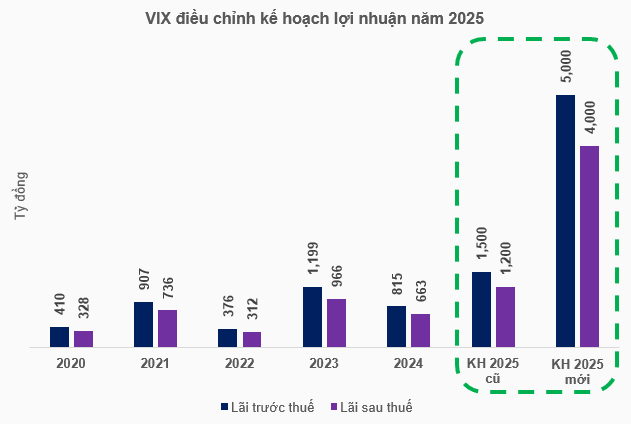

The revised plan outlines a pre-tax profit of VND 5,000 billion and a post-tax profit of VND 4,000 billion, both marking a 3.3-fold increase compared to the plan approved at the 2025 Annual General Meeting (AGM).

Previously, VIX announced the final registration date for the 2025 Extraordinary General Meeting (EGM) as October 8. In addition to the business plan upgrade, the meeting is expected to address other matters within its jurisdiction.

Despite the original plan already projecting an 80% profit growth, VIX‘s decision to adjust its business plan upward in the current context is deemed appropriate. This is because the actual results achieved in the first half of the year have significantly surpassed initial expectations.

In the first half of 2025, the company recorded nearly VND 2,068 billion in pre-tax profit and approximately VND 1,674 billion in post-tax profit, already exceeding the initial plan by nearly 40%. These figures are also nearly six times higher than the profits reported in the first half of 2024.

According to the company, the first half of 2025 saw a robust performance in the Vietnamese stock market, with the VN-Index closing at 1,376 points on June 30—the highest since 2022. Aligning with market trends, profits from financial assets measured at fair value through profit or loss (FVTPL) grew impressively by nearly 482%, or VND 2,056 billion year-on-year.

Additionally, the company’s lending and receivables activities reached a new milestone, surpassing VND 9,000 billion for the first time—a 161% increase from the beginning of the year. Profits from this segment also rose by 61% compared to the same period last year.

If the new plan is approved, VIX will gain further momentum to sustain growth in the latter half of 2025. Comparing the achieved results to the new targets, the securities company has already completed over 40% of its goals.

Source: VietstockFinance

|

VIX‘s move to raise profit targets comes amid an exceptionally bullish phase in the Vietnamese stock market, marked by continuous record-high indices and significantly improved liquidity. This environment has heightened expectations for key business segments of securities firms, including lending, proprietary trading, and brokerage.

The favorable conditions have also driven VIX‘s stock price to surge. The stock reached an all-time high of VND 39,950 per share on September 16—more than triple its value since the rally began in July.

| VIX Stock Accelerates Since Early July |

Shortly before VIX, another securities firm, VPBankS, also decided to raise its 2025 business targets. The new total revenue and profit figures stand at VND 7,177 billion and VND 4,450 billion, respectively—a 58% and 122% increase compared to the original plan approved at the 2025 AGM.

– 19:13 23/09/2025

VIX Securities Aims to Boost 2025 Profit Plan, Secures $170 Million Credit Line

VIX Securities Corporation (HOSE: VIX) announces the final registration date for its 2025 Extraordinary Shareholders’ Meeting, scheduled to review the 2025 profit plan adjustment and other authorized agenda items. The ex-rights trading date is October 8th.

Stock Market Week 15-19/09/2025: Cautious Tug-of-War

The VN-Index closed the week in the red, marking four consecutive sessions of decline. Cautious sentiment persists as trading volumes remain below the 20-day average. Amid weak liquidity and persistent net selling pressure from foreign investors, the market awaits a stronger catalyst to break free from its current stalemate.

September Market: Where Should Investors Focus Their Attention?

The VN-Index is predicted to sustain its upward trajectory, aiming for the 1700 – 1800 point range, presenting an attractive investment prospect for September. With a focus on securities, port, and steel sectors, this presents a fresh opportunity for investors to capitalize on.