Real Estate Credit Surges

According to the State Bank of Vietnam’s report, the institution has finalized regulations on capital safety ratios, assigning risk coefficients to real estate loans based on purpose and type. Commercial real estate lending carries the highest risk coefficient at 200%, while social housing loans have lower coefficients ranging from 20% to 50%.

The State Bank is gradually reducing the proportion of short-term capital used for medium and long-term loans, enhancing monitoring, supervision, inspection, and oversight of real estate credit activities. It is also implementing social housing loan programs and affordable housing initiatives as directed by the Government and the Prime Minister.

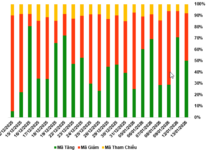

Real estate credit growth outpaces overall credit expansion.

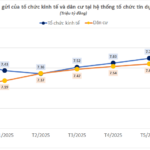

As of July 31, real estate credit outstanding balances reached VND 4,080 trillion, a 16.95% increase from the end of 2024, surpassing overall credit growth. Real estate credit accounts for 23.68% of the total outstanding debt in the economy, with a non-performing loan ratio of 2.43%. Commercial real estate loans totaled VND 1,790 trillion, up 23.87%, representing 43.98% of real estate debt. Consumer and self-use real estate loans reached VND 2,280 trillion, a 12.04% increase, making up 56.02%.

Social housing loan programs have an outstanding balance of nearly VND 30 trillion. The VND 30 trillion program under Resolution 02 has disbursed VND 29.679 trillion, with VND 2.315 trillion remaining. The social housing loan program under Decree 100 has an outstanding balance of approximately VND 19.226 trillion.

The VND 145 trillion social housing, worker housing, and apartment renovation program under Resolution 33, running until 2030, is underway. To date, 26 out of 34 provincial People’s Committees have announced approximately 103 participating projects. As of July 31, 2025, commercial banks have committed nearly VND 8.6 trillion in credit, with VND 4.578 trillion disbursed, a 60.93% increase. This includes VND 3.853 trillion for developers and VND 725 billion for homebuyers.

Loan interest rates for these programs have been reduced multiple times, currently at 6.4% per annum for developers and 5.9% for homebuyers. The Vietnam Bank for Social Policies has an outstanding balance of approximately VND 4.6 trillion for housing credit programs.

Challenges Ahead

Real estate credit outstanding balances are rising, with an increasing share of total economic debt. Growth is concentrated in commercial real estate, while consumer and self-use credit is slowing. This aligns with positive market shifts as the National Assembly, Government, and local authorities implement solutions to address challenges.

However, significant obstacles remain. The market lacks affordable housing supply, and social housing development is slow. High property prices result in a price-to-income ratio of 23.7 times average household income in Vietnam, compared to the global average of 14.6. As of July 2025, social housing construction progress stands at 59.6% of the 2025 target.

Additionally, some developers face financial constraints. Long-term capital mobilization channels like securities and corporate bonds are underdeveloped, leaving real estate heavily reliant on bank credit. Mismatched maturities between long-term real estate investments and short-term bank funding create liquidity risks.

The State Bank recommends the Ministry of Construction accelerate social housing development, establish a Housing Development Fund, and ensure market data transparency. The Ministry of Finance should enhance the capital market legal framework and review real estate-related tax policies. The Ministry of Agriculture and Rural Development must prevent and penalize land auction abuses.

Local authorities should expedite administrative procedures for real estate projects, ensure timely implementation, and strictly manage land auctions with transparency and accountability. Prioritizing land allocation for social housing is essential to meet Government targets.

Real Estate Credit Outstanding Debt Surpasses 4.1 Million Billion Dong

According to the State Bank of Vietnam, as of July 31, 2025, the outstanding real estate credit balance has surpassed 4.1 quadrillion VND.

Revitalized Real Estate Credit Paves the Way for a Surge in Affordable Housing

Real estate credit has rebounded with outstanding loans surpassing VND 4.1 quadrillion, while bad debt ratios remain under control. Multiple preferential credit packages for social housing are entering a robust disbursement phase. Renewed confidence is spreading across banks, businesses, and citizens, fostering expectations of a stable, sustainable market that expands homeownership opportunities for middle and low-income groups.

Peer-to-Peer Lending Pilot by the State Bank: Who Qualifies and What Are the Interest Rates?

Interest rates are mutually agreed upon by both the lender and borrower, ensuring they remain within the maximum limits set forth by the Civil Code.