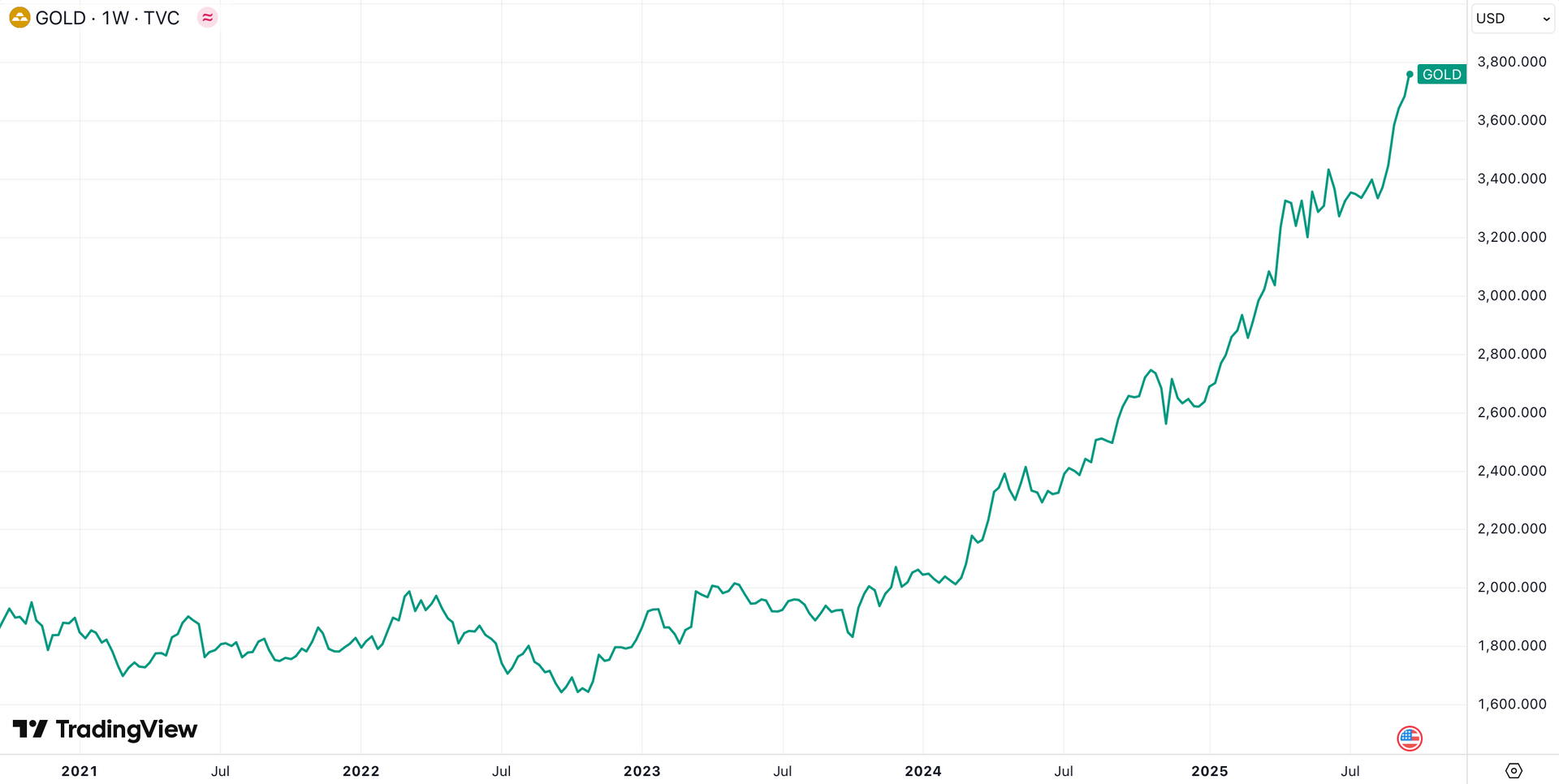

Gold is sparking a global frenzy as investors scramble for safe-haven assets amidst worldwide turmoil. Global gold prices have surged to a new peak of nearly $3,800 per ounce, marking a 40% increase since the year’s start. Central banks’ growing reserves and massive inflows from gold ETFs are fueling this rally.

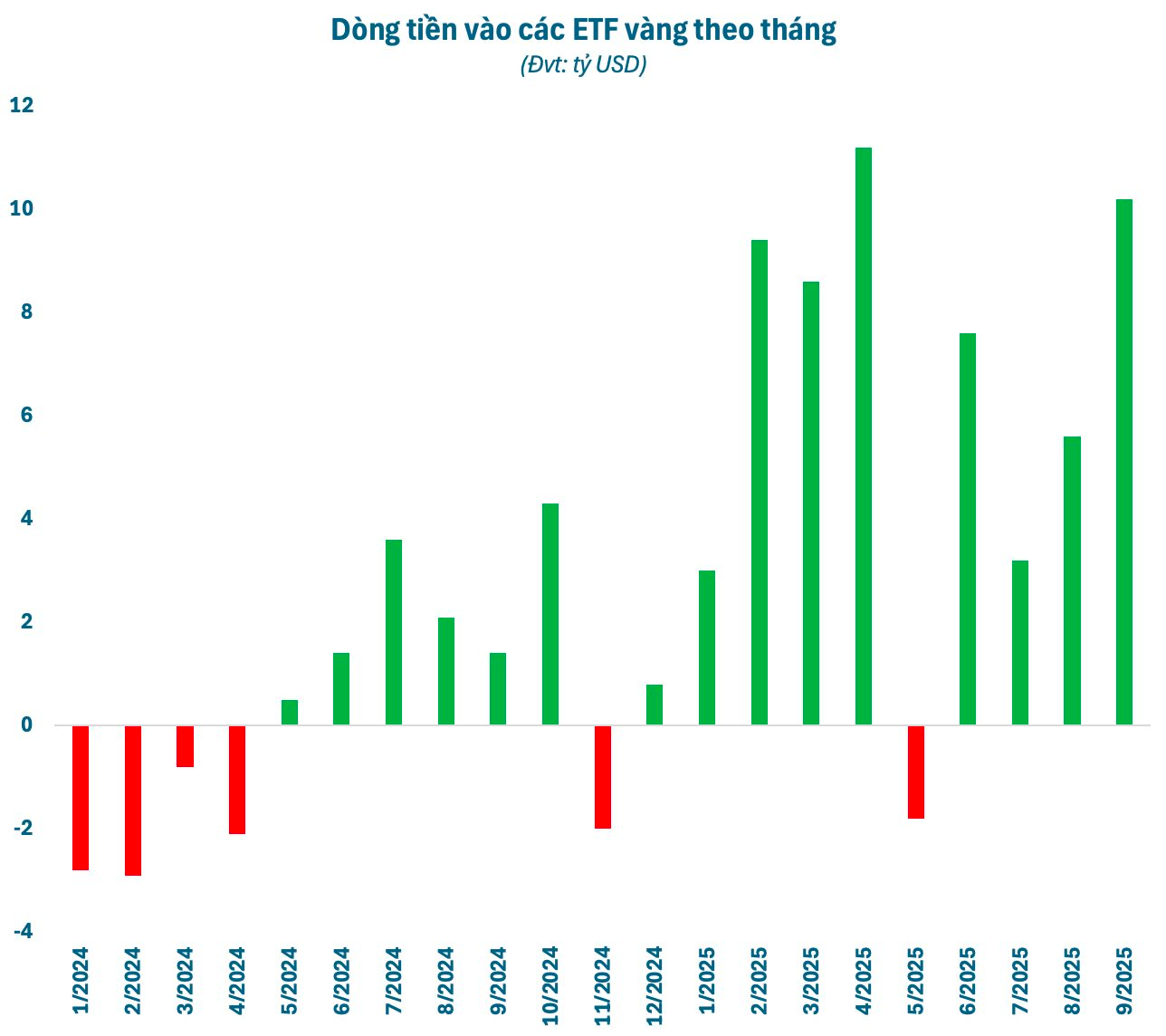

Since January, global gold ETFs—from the U.S., Europe to Asia—have attracted a net inflow of $57 billion (as of September 19), dwarfing the $3.5 billion recorded in 2024. September alone saw over $10 billion inflows, the second-highest monthly total in years, trailing only April 2025.

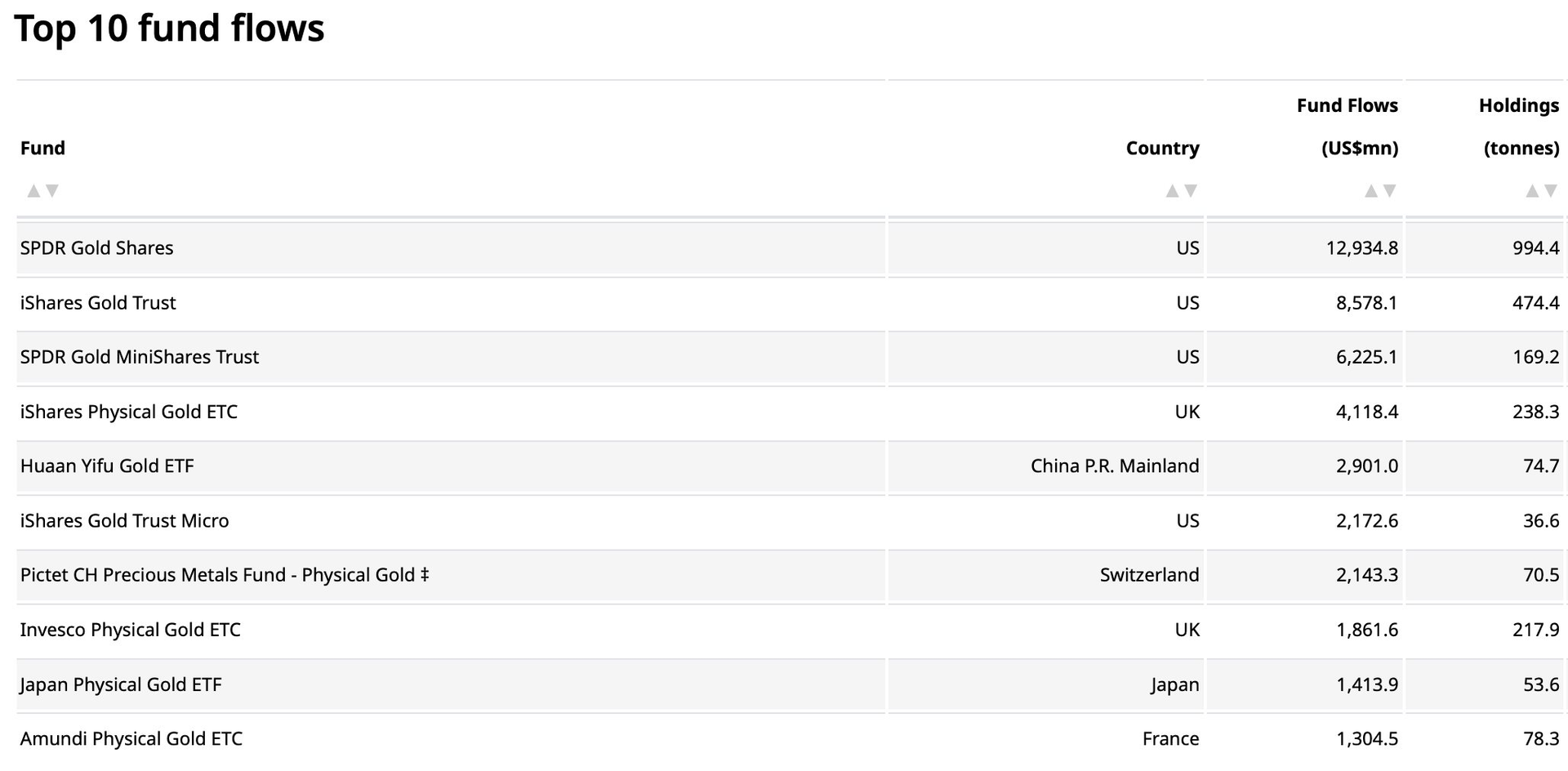

BlackRock and State Street Global Advisors (SSGA) lead the charge. SSGA’s SPDR Gold Trust, the world’s largest gold ETF, has drawn nearly $13 billion year-to-date. Another SSGA fund, SPDR Gold MiniShares Trust, has pulled in over $6 billion.

BlackRock’s trio—iShares Gold Trust ($8.6 billion), iShares Physical Gold ($4.1 billion), and iShares Gold Trust Micro ($2.2 billion)—has collectively amassed nearly $15 billion. China’s Huaan Yifu Gold ETF has also seen robust inflows of $2.9 billion.

Strong inflows and soaring prices have pushed global gold ETFs’ assets under management to $407 billion by August-end. Holdings total nearly 3,692 tons, the highest since July 2022 and just 6% shy of the 2020 record of 3,929 tons. SPDR Gold Trust alone holds over 1,000 tons.

This year’s ETF gold boom stems from multiple factors. The Federal Reserve’s rate cuts have lowered gold’s opportunity cost, with U.S. real yields hitting their lowest since December 2024. A weaker U.S. dollar has also made gold cheaper for international buyers.

Geopolitical tensions further boost demand. The U.S.-China trade war under Trump, Middle East conflicts, and global trade risks have cemented gold’s role as the ultimate safe haven. India’s record-high demand in H1 reflects equity market volatility.

Goldman Sachs predicts gold’s appeal will grow if Fed independence weakens, leading to higher inflation, falling equities, and a weaker dollar. Gold, as a non-institutional store of value, stands to benefit significantly.

Goldman forecasts gold hitting $4,000/ounce by mid-2026 in its base case. Extreme risks could push it to $4,500, while a 1% shift from U.S. Treasury holdings to gold could drive prices near $5,000/ounce.

September 22 Afternoon: Ring Gold and SJC Gold Prices Surge, Global Gold Hits New Peak

The current purchase price for plain gold rings fluctuates between 126.8 and 127.2 million VND per tael, while the selling price ranges from 129.5 to 130.2 million VND per tael.

Today’s Crypto Market, September 17: Latest Bitcoin Forecast

Alongside Bitcoin, major cryptocurrencies such as Ethereum, Solana, and BNB also recorded significant gains on the morning of September 17th.