Localized Price Pressure Expected from 2026

According to Ms. Do Thu Hang, Senior Director of Research and Consulting at Savills Hanoi, the capital’s housing market is currently undergoing a transformative phase. However, it will take additional time for new policies and laws to fully take effect in practice.

Key legislations such as the Land Law, Housing Law, and Real Estate Business Law officially came into force last August. Yet, their synchronized and effective implementation relies on the timely issuance of detailed guidelines and local execution processes.

Meanwhile, numerous residential projects in Hanoi are navigating legal completion, design approvals, and financial obligations. Despite accelerated procedures, these processes still require a certain lag before units officially hit the market.

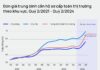

Between 2026 and 2027, Hanoi’s market is projected to welcome approximately 46,600 units from 43 projects, predominantly located outside the city center.

Savills forecasts that around 11,500 units, primarily mid- to high-end, will be launched in the second half of 2025. However, limited product diversification continues to hinder a balanced supply-demand dynamic.

From 2026 onward, as projects finalize legal procedures, new supply is anticipated to surge. Specifically, between 2026 and 2027, Hanoi’s market is projected to welcome approximately 46,600 units from 43 projects, predominantly located outside the city center.

Strategies to Lower Housing Prices

This increased supply is expected to exert localized price adjustment pressure. Ms. Hang notes that price reductions are more likely in areas with abundant land but underdeveloped infrastructure. Conversely, projects in strategic locations like Ring Road 2, Ring Road 3, or those developed by reputable firms are expected to maintain or slightly increase prices due to strong real demand and scarcity.

“Rather than a uniform price drop, the market will witness significant segmentation based on location, quality, and legal progress,” Ms. Hang emphasized.

A critical factor is land use costs, which currently constitute a substantial portion of total housing expenses. Rationalizing these costs to balance state and business interests could make housing more affordable for residents. Additionally, tax incentives, credit schemes, and land policies for affordable housing are essential to promote this segment’s development.

Currently, the market is closely monitoring the impact of infrastructure and transportation changes. Savills assesses that in areas like the Old Quarter, effective utilization for tourism and commerce could sustain or even enhance property values.

“Housing demand in major cities like Hanoi remains robust. Despite transportation shifts, the real estate market will self-adjust to meet this demand. However, given the complexity and numerous variables involved, we recommend continued observation rather than premature conclusions about direct impacts on property values,” Ms. Hang stated.

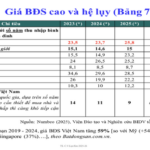

Commenting on current condominium prices, Mr. Can Van Luc, Chief Economist at BIDV, cited BIDV Training and Research Institute data showing that housing prices in major cities exceed young workers’ average incomes.

Globally, families typically save for 15 years to purchase a home, whereas in Vietnam, this period extends to nearly 26 years—10 years longer than the global average. Compared to last year, this savings duration has increased by over two years.

Recently, Prime Minister Pham Minh Chinh, Head of the Central Steering Committee for Housing and Real Estate Market Policies, chaired a meeting announcing the committee’s consolidation and its first session. He stated, “Citizens lack housing but cannot afford available options. With prices at 100 million VND per square meter, how can people buy homes? Many need housing, but high prices make it unattainable. Banks must help control this. If property prices keep soaring, citizens will be perpetually priced out.”

The Prime Minister stressed the need to increase supply to reduce market prices, balance supply and demand through market mechanisms, and identify bottlenecks in housing and real estate development, including institutional, legal, and land-related challenges.

He emphasized a resolute spirit: “All for the people and the nation, with high determination, significant effort, decisive action, and clear task allocation—clear responsibilities, timelines, authority, and deliverables—to drive breakthroughs in housing and real estate development.”

Dr. Can Van Luc: Vietnamese Public Servants Need Nearly 26 Years of Work to Afford an Apartment, Compared to Global Average of 15 Years

Dr. Can Van Luc asserts that the real estate market is grappling with significant volatility, as housing prices are rising faster than incomes, making it increasingly difficult for people to afford homes. He urges businesses to restructure, manage risks, and accelerate digital and green transformations. Additionally, he calls on the government to implement measures aimed at reducing overall price levels.

The Golden Revival: Hanoi’s Luxurious Gold-Plated Apartment Project Suddenly Halts Sales, Developer Recalls Offerings

“Our sources have informed us that the QMS Tower project has been halted, with the developer recalling the inventory. A broker has confirmed that the current asking price is too high and has suggested redirecting buyers towards more reasonably priced ventures.”

The Risk of a Generation with Multiple ‘Nones’: No Homes, No Marriages, and No Competitiveness due to Land Auction Scandals like “Thu Thiem”, Driving Real Estate Prices to Abnormal Heights

The recent land auctions in Hanoi have sparked concerns among experts about the negative impact on the real estate market and social welfare. The soaring land prices have resulted in housing costs that far outstrip the affordability of average citizens, threatening the stability of the property market and the well-being of the community.

Affordable Housing: A Growing Concern for Asian Nations

The affordable housing crisis is a global challenge, affecting both developed and developing nations alike. It is a complex issue that demands attention and innovative solutions. With rising populations and changing economic landscapes, the need for accessible and affordable housing has never been more critical. This crisis presents a unique set of obstacles and opportunities that require a fresh perspective and a creative approach to address them effectively.