According to the latest update, HD Securities JSC (HDS) has sought shareholder approval for a rights issue to raise capital. The company plans to issue 365 million shares at a price of VND 20,000 per share, increasing its charter capital from VND 1.46 trillion to over VND 5.1 trillion. The rights ratio is set at 2:5, meaning existing shareholders holding 2 shares will be entitled to purchase 5 additional shares.

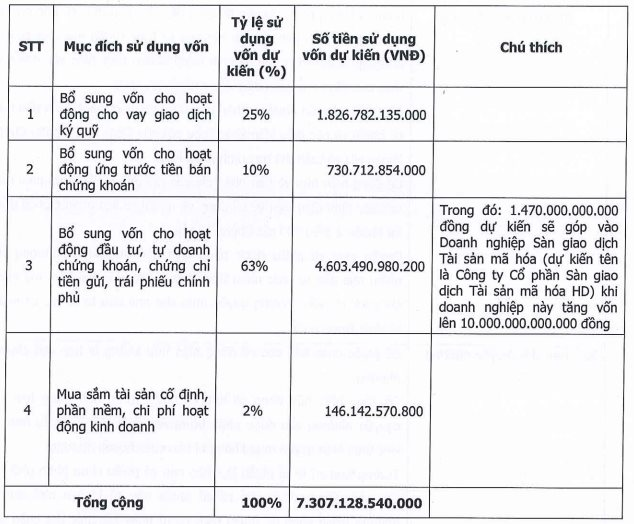

The total proceeds from this offering are expected to exceed VND 7.3 trillion. Approximately 63% of the funds (around VND 4.6 trillion) will be allocated to investment activities, including proprietary trading, purchasing deposit certificates, and government bonds.

Notably, HD Securities intends to invest VND 1.47 trillion in a company operating a digital asset trading platform, as part of the latter’s capital increase to VND 10 trillion. The proposed name for this entity is HD Digital Asset Trading JSC.

The remaining capital will be allocated to other purposes, including: margin lending (25%), advance payment for securities sales (10%), and investment in fixed assets, software, and other operational expenses (2%).

Prior to HDBS’s investment announcement, several major securities firms had already established digital asset trading platforms. Notable examples include VPBankS with Vietnam Prosperity Digital Asset Trading JSC (CAEX), VIX Securities with VIX Digital Asset Trading JSC (VIXEX), and TCBS with Techcom Digital Asset Trading JSC (TCEX).

This surge in market entries follows a significant legal development: the government’s issuance of Resolution No. 05/2025/NQ-CP on the pilot implementation of a digital asset market in Vietnam. Effective from September 9, the pilot program will run for five years.

Under the resolution, licensed entities providing digital asset trading services must be Vietnamese legal entities registered as LLCs or JSCs under the Enterprise Law.

Additionally, these companies must have a minimum charter capital of VND 10 trillion, with at least 65% contributed by institutional shareholders. Over 35% of the capital must come from at least two institutions, including commercial banks, securities firms, fund management companies, insurance companies, or technology enterprises.

Thai Conglomerate Secures $400M from Italian Exit, Eyes Billion-Dollar Expansion in Vietnam

According to Bangkok Post, Central Retail Corporation (CRC) is reportedly selling its high-end Italian department store chain, Rinascente. This move is believed to be part of a strategic portfolio optimization, allowing the Thai retail giant to focus its efforts on core growth markets, namely Thailand and Vietnam.

Lotte Abandons $900 Million Thu Thiem Mega-Project, Yet Retains Billions in Vietnamese Assets

Lotte’s decision to withdraw from the $900 million Lotte Eco Smart City Thu Thiem project has sparked widespread surprise. Despite this move, the conglomerate’s business empire in Vietnam remains robust, boasting multi-billion-dollar assets across the country.

Billionaire Nguyen Thi Phuong Thao Meets with NYSE Chairman as Market Surges 48 Points

As part of the official delegation accompanying President Lương Cường to the United Nations General Assembly, Dr. Nguyễn Thị Phương Thảo, Vietjet’s Chairwoman and Vietnam’s leading female billionaire, visited the New York Stock Exchange (NYSE), the world’s largest and most historic financial hub.