Market liquidity increased compared to the previous session, with the order-matching trading volume of the VN-Index reaching over 942 million shares, equivalent to a value of more than 25 trillion VND; the HNX-Index reached over 91 million shares, equivalent to a value of more than 2.1 trillion VND.

The VN-Index opened the afternoon session on a less favorable note as selling pressure continued to dominate, keeping the index below the reference level. However, buyers quickly regained control, helping the VN-Index surge and close in optimistic green territory. In terms of influence, VPB, TCB, HDB, and VCB were the most positively impactful stocks on the VN-Index, contributing over 8.1 points of growth. Conversely, VHM, VIC, BMP, and SJS faced selling pressure, subtracting more than 1 point from the overall index.

| Stocks with the strongest influence on the VN-Index |

Similarly, the HNX-Index showed a positive trend, influenced by stocks such as SHS (+5.71%), CEO (+8.43%), MBS (+5.48%), and NVB (+2.04%).

| Stocks with strong influence on the HNX-Index |

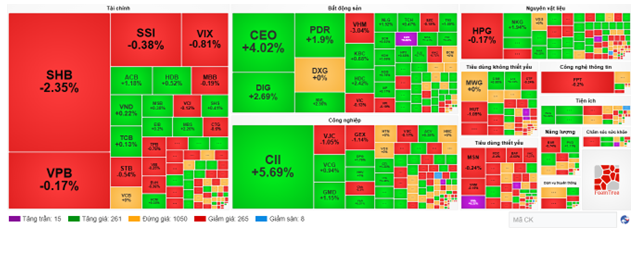

At the close, the market rose by 1.25%, with green across all sectors. The financial sector led the gains with a 2.22% increase, primarily driven by HDB (+6.97%), TCB (+3.47%), VPB (+5.69%), and ACB (+2.56%). The information technology and materials sectors followed with gains of 1.47% and 1.2%, respectively.

Foreign investors continued to net sell, with a total of over 1.524 trillion VND on the HOSE market, concentrated in stocks like VHM (245.47 billion), SSI (198.34 billion), VPB (123.54 billion), and VCI (104.74 billion). On the HNX, foreign investors net sold over 42 billion VND, focusing on IDC (49.3 billion), PVS (20.19 billion), HUT (9.23 billion), and NTP (9.22 billion).

| Foreign investors continue net selling (all three exchanges) |

11:30 AM: Continued decline

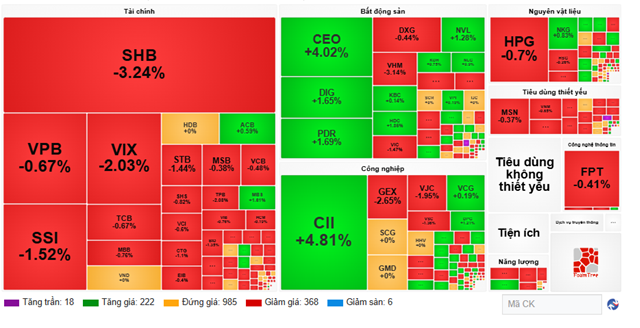

Major indices weakened further towards the end of the morning session. At the midday break, the VN-Index fell by 0.86% to 1,621.16 points, while the HNX-Index dropped by 0.14% to 272.63 points. The number of declining stocks outnumbered advancing ones, with 374 stocks falling and 240 rising.

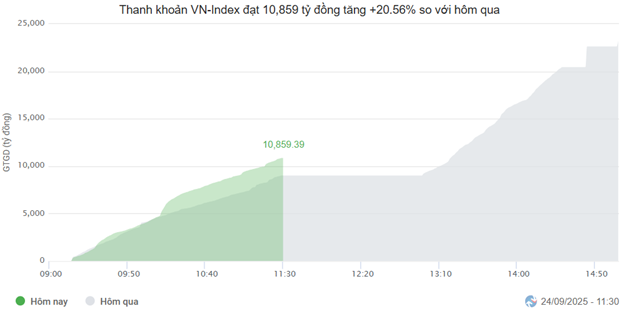

Market liquidity showed signs of improvement compared to the previous session’s low levels. The trading value on the HOSE reached nearly 11 trillion VND, up 20.56%, though still below the one-month average. The HNX recorded a volume of nearly 42 million units, equivalent to over 1 trillion VND.

Source: VietstockFinance

|

In terms of influence, the Vin Group duo, VHM and VIC, had the most negative impact, subtracting 2.88 points and 1.96 points from the VN-Index, respectively. Meanwhile, the top 10 positively influential stocks collectively contributed just over 1 point to the overall index.

Divergence continued to dominate, with all sectors fluctuating within narrow ranges. The financial sector exerted significant pressure on the market, as numerous stocks traded in the red, including SHB (-3.24%), SSI (-1.52%), VIX (-2.03%), STB (-1.44%), MBB (-0.76%), CTG (-1.1%), and TPB (-2.08%).

The real estate and industrial sectors were affected by negative adjustments in large-cap stocks such as VIC (-1.47%), VHM (-3.14%), VRE (-1.06%), KSF (-1.25%), SNZ (-1.11%), HVN (-3.55%), VJC (-1.95%), GEX (-2.65%), and GEE (-3.41%). However, buying interest remained in stocks like CEO (+4.02%), NVL (+1.28%), DIG (+1.65%), PDR (+1.69%), CII (+4.81%), DPG (+1.21%), LCG (+0.82%), and CDC (+5.27%).

Conversely, stocks like DHT (+0.83%), TNH (+1.44%), PMC (+7.69%), DP1 (+1.88%), and JVC (ceiling) helped the healthcare sector maintain a slight green gain of 0.09%.

Source: VietstockFinance

|

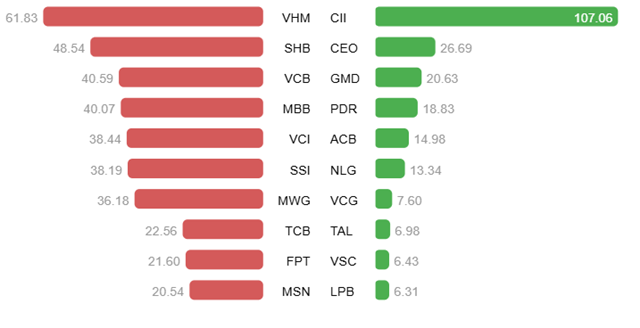

Foreign investors continued net selling, with a total value of nearly 630.89 billion VND across all three exchanges. Selling pressure was concentrated in VHM, with a value of 61.83 billion VND. Meanwhile, CII led the net buying with a value of 107.06 billion VND, far ahead of other stocks.

Source: VietstockFinance

|

10:30 AM: Hesitation at the 1,630-point mark

Investors showed hesitation, causing major indices to move in opposite directions around the reference level. As of 10:30 AM, the VN-Index fell by over 4.3 points, trading around 1,630 points, while the HNX-Index rose by 0.38 points, trading around 273 points.

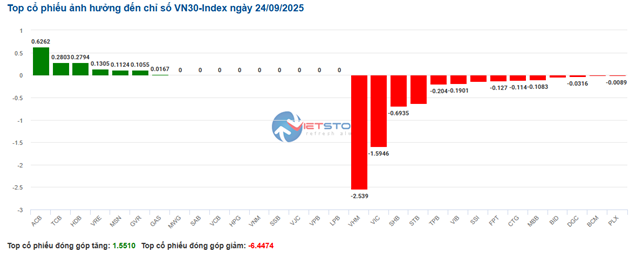

The breadth of the VN30-Index basket was mixed, with red dominating. On the negative side, VHM subtracted 2.53 points, VIC 1.59 points, SHB 0.69 points, and STB 0.62 points from the overall index. Conversely, a few stocks like ACB, TCB, HDB, and VRE contributed over 1.3 points to the index.

Source: VietstockFinance

|

Real estate stocks were mixed, with selling pressure dominating. Specifically, VHM fell by 2.74%, VIC by 1.07%, VRE by 0.35%, and BCM by 0.15%. Meanwhile, stocks like KBC, NVL, DXG, and PDR maintained slight gains.

The financial sector also faced selling pressure, with stocks like VCB (-0.16%), VPB (-0.17%), MBB (-0.38%), and BID (-0.61%) declining.

Conversely, the materials sector rebounded, with green appearing in leading stocks such as GVR (+0.71%), MSR (+2.34%), DCM (+0.54%), and DPM (+0.38%).

Compared to the opening, buyers and sellers were evenly matched, with a strong divergence as over 1,000 stocks remained unchanged. There were 261 advancing stocks (15 at the ceiling) and 265 declining stocks (8 at the floor).

Source: VietstockFinance

|

9:30 AM: Cautious sentiment

The VN-Index and HNX-Index opened the morning session fluctuating around the reference level, indicating lingering cautious sentiment. However, there were positive contributions from the information technology, healthcare, and communication services sectors.

Leading the way was the information technology sector, with slight gains from the opening bell. Green spread across stocks like FPT (+0.31%) and DLG (+0.34%).

The healthcare sector followed, with stocks like DHT (+1.18%), TNH (+0.72%), and AGP (+1.23%). The communication services sector also saw gains in stocks like CTR (+0.11%) and YEG (+1.06%).

In contrast, real estate stocks opened on a less positive note. Industry giants like VIC, VHM, BCM, and VRE all declined, while other stocks in the sector showed insignificant gains.

– 09:32 24/09/2025

Foreign Investors Dump Nearly 600 Billion VND in Blue-Chip Stock on September 23rd

After several robust selling sessions, foreign trading activity has stabilized, with net selling now limited to a modest 7 billion VND across the entire market.