Vietnam Exhibition Fair Center JSC (VEFAC) emerges as a vital cash flow source for Vingroup, following substantial dividend payouts.

Vietnam Exhibition Fair Center JSC (VEFAC) is rapidly becoming a critical cash provider for its parent company, Vingroup, following significant dividend distributions. In the first half of 2025, VEFAC’s cash contributions stood out prominently compared to other revenue streams.

In July 2025, VEFAC completed a dividend payout totaling 435%, equivalent to over VND 7.2 trillion. Holding 83.32% of VEFAC’s shares, Vingroup received approximately VND 6.038 trillion.

Building on this momentum, VEFAC is seeking shareholder approval for a second interim dividend of 330%. If approved, Vingroup is expected to receive an additional VND 4.6 trillion, bringing the total cash inflow from its subsidiary—the developer of Vinhomes Global Gate—to over VND 10.5 trillion in 2025.

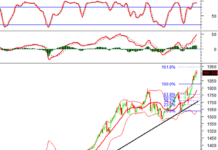

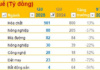

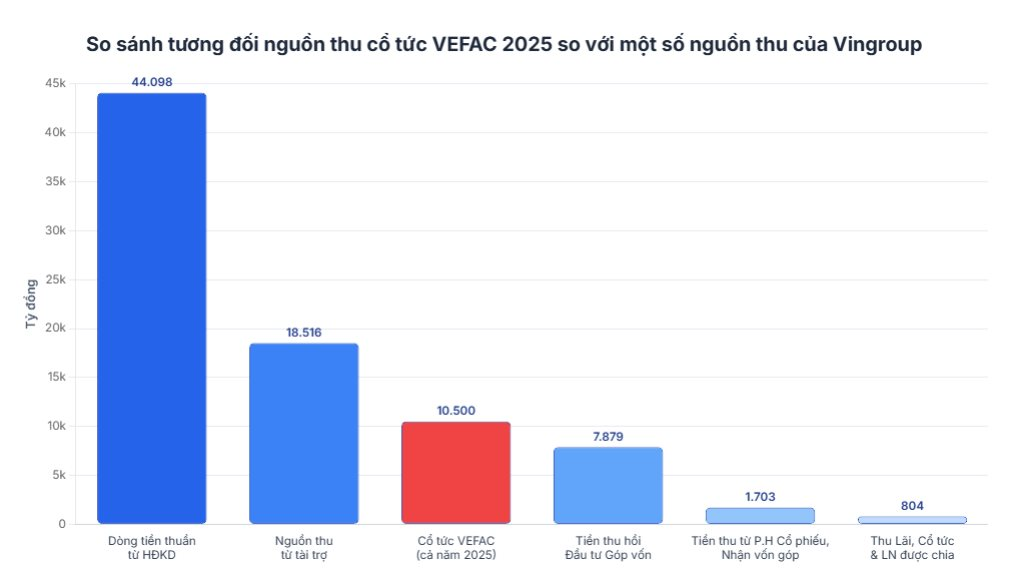

Comparative analysis of Vingroup’s cash inflows in H1 2025 highlights VEFAC’s significant contribution.

To contextualize, the projected VND 10.5 trillion from VEFAC in 2025 surpasses the VND 7.879 trillion generated from “capital recovery from investments in other entities” in the first half of the year, as per Vingroup’s Q2 2025 Consolidated Financial Report.

This amount also represents 24% of the group’s net cash flow from operations, which totaled VND 44.098 trillion in the first half of 2025.

Additionally, in Q2, Vingroup recorded an extraordinary “Other Income” of VND 18.516 trillion, primarily attributed to a sponsorship from Chairman Pham Nhat Vuong, as disclosed in the financial statements.

Other cash inflows during the period included VND 1.703 trillion from equity issuances and capital contributions, and VND 804 billion from interest, dividends, and profit-sharing.

Vingroup’s financial landscape in the first half of 2025 also featured substantial inflows from borrowing activities, totaling VND 129.757 trillion. These funds were allocated to support large-scale investments, with cash outflows for investment activities reaching VND 65.815 trillion.

Robust capital raising and revenue streams bolstered Vingroup’s financial health, with cash and cash equivalents peaking at VND 74.760 trillion as of June 30, 2025—the highest in the company’s history.

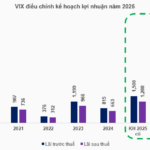

VEFAC leads profit growth on the Vietnamese stock market in H1 2025, driven by the partial transfer of Vinhomes Global Gate.

In the first half of 2025, VEFAC topped the list of profit growth on the Vietnamese stock market, with pre-tax profits reaching VND 19.081 trillion—an 8,341% increase year-on-year. This remarkable growth was fueled by VND 44.560 trillion in revenue from the partial transfer of the Vinhomes Global Gate project.

As a result, VEFAC has become a pivotal cash provider for Vingroup, supporting its expanded investments in technology and industrial sectors.

Vietnamese Billionaire Receives Additional Trillions in Dividends

Vietnam Exhibition Fair Center JSC played a pivotal role in securing approximately VND 6,000 billion in dividends for Vingroup, the conglomerate led by billionaire Pham Nhat Vuong. Similarly, Nguyen Dang Quang and Masan Group reaped substantial dividends totaling thousands of billions of Vietnamese dong from Techcombank, Vinacafé Bien Hoa, and Net Detergent.