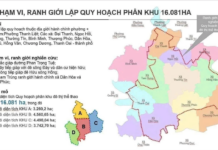

Causes of Land Price Inflation

On September 24th, during a meeting regarding the draft Government Resolution on addressing challenges in asset auction activities, the Legal Aid Department (Ministry of Justice) reported that unusually high bidding followed by deposit forfeiture, collusion, price suppression, and manipulation in land auctions across several localities have adversely affected the healthy development of the real estate market. These practices pose significant risks to security, public order, and socioeconomic development.

These issues stem from several factors, including low starting prices compared to market rates, resulting in low deposit requirements (up to 20%) and extended payment deadlines for winning bids. This has encouraged speculative participation from individuals and investors without genuine land use needs, artificially inflating prices for profit. Additionally, the scarcity of land plots in Hanoi has caused sudden price spikes.

Following directives from the General Secretary and the Government Party Committee Office, the Ministry of Justice is tasked with refining policies in key areas: amending regulations to increase individual auction deposits from 20% to 50%; criminalizing deposit forfeiture by winning bidders; and imposing stricter administrative penalties or criminal charges for auction-related violations.

Prime land in Thu Thiem (HCMC) previously saw Tan Hoang Minh Group bid excessively before forfeiting the deposit.

The Legal Aid Department emphasized the urgency of a Government Resolution to address challenges in land use rights auctions, ensuring transparency and minimizing exploitation under the Land Law framework.

Increasing Auction Deposits to 50%

According to the Legal Aid Department, the draft Resolution proposes deposit requirements for residential land auctions ranging from 10% to 50% of the starting price for individuals and investment projects.

The draft also stipulates that individuals failing to fulfill payment obligations for residential land auctions will face bidding bans ranging from 6 months to 5 years. They must also cover all auction-related expenses as notified by competent authorities.

Overview of the Ministry of Justice’s Resolution meeting.

Deputy Minister of Justice Nguyen Thanh Tu suggested reconsidering the 6-month to 5-year bidding ban, as Article 70 of the Asset Auction Law currently restricts such measures to investment and mineral exploitation projects.

He noted that raising deposit requirements to 50% serves as a strong deterrent, discouraging deposit forfeiture due to significant financial loss. Thus, additional bidding bans may be unnecessary.

Regarding fees and deposits, Deputy Minister Tu stressed that high deposits with forfeiture penalties render additional fees redundant and overly complex. He endorsed increasing maximum deposits from 20% to 50% as a sufficient deterrent.

Minister of Justice Nguyen Hai Ninh supported focusing the draft Resolution on resolving land auction challenges to ensure transparency and curb exploitation. He directed thorough reviews of practical issues and legal provisions to propose solutions aligned with higher-level directives, ensuring legal and technical accountability.

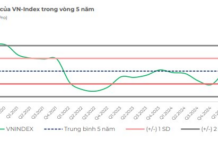

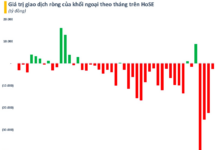

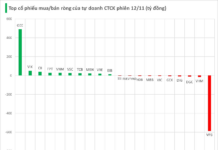

Surprising Forecast for the Real Estate Market in the Final Quarter

Real estate is no longer a “buy and forget” investment that guarantees automatic price appreciation as it once did. Experts caution investors to proceed with care, while also revealing the opportune moments when the market is poised to accelerate and rebound.

Unveiling the Secrets Behind $100 Million per Square Meter Condo Prices

The current prices of condominiums have skyrocketed beyond the reach of not only low-income earners but also those in the upper-middle-income bracket. This staggering reality stems from developers grappling with exorbitant costs: soaring interest payments on loans, escalating soft costs, prolonged legal procedures for project approvals, hefty land-use fees, surging construction material prices, and debt moratorium policies.