Amid escalating global standards, stakeholder expectations, and Vietnam’s national climate commitments, Environmental, Social, and Governance (ESG) is increasingly viewed as a strategic priority rather than mere compliance. On September 23, PwC Vietnam unveiled the 2025 ESG Practice Progress Report, highlighting Vietnamese businesses’ shift from awareness to action in Environment, Social, and Governance (ESG). The report, based on a survey of 174 Vietnamese enterprises, builds on the 2022 ESG Readiness Report.

The findings were presented at the “Building Sustainable Advantage” launch event and panel discussion, gathering business leaders and policymakers to explore how ESG can drive measurable impact, unlock long-term value, and position Vietnamese firms for global success. According to PwC’s latest global study, “Value in Motion,” trillions are shifting toward sustainable sectors, driven by climate action, technological breakthroughs, and societal demands.

Ms. Đinh Thị Quỳnh Vân, PwC Vietnam Chair, opens the event.

“This global shift aligns perfectly with Vietnam’s green growth vision, offering unprecedented opportunities and an urgent call to action for businesses,” stated Ms. Đinh Thị Quỳnh Vân, PwC Vietnam Chair.

Global ESG regulations are tightening, with the EU leading through directives like CSRD and CSDDD. In Asia-Pacific, policy implementation is accelerating. ESG is now mandatory, data-driven, and independently verified. For export-oriented Vietnam, meeting global ESG standards is critical for competitiveness. Despite strong policy momentum, challenges remain, including high emissions, financial barriers, and institutional gaps.

“Vietnamese firms are entering a new ESG maturity phase. While the shift from planning to action is evident, deeper integration, smart data, and collaboration are essential. ESG is about future-proofing businesses, not just compliance,” noted Mr. Nguyễn Hoàng Nam, ESG Consulting Lead, PwC Vietnam Deputy Director.

From Vision to ESG Strategy

The 2025 report reveals 89% of surveyed firms have or plan ESG commitments within 2–4 years, up from 80% in 2022. Non-committed firms halved to 11%. Over half (54%) have implemented ESG initiatives, though adoption varies:

Foreign-invested enterprises (FDI) lead with 71% implementation, driven by global standards. Listed companies follow at 57%, spurred by investors and regulations. Private/unlisted firms lag at 27%, with 23% still uncommitted, reflecting greater barriers or lower prioritization.

Mr. Nguyễn Hoàng Nam presents the report.

Legal compliance (70%), stakeholder pressure (40%), and leadership directives (39%) are key drivers. Only 16% cite cost reduction, and 25% highlight green finance access, indicating underutilized financial incentives. Governance leads ESG maturity, with 41% formal structures and 68% board involvement. Data collection is widespread (82%), but only 10% use BI tools for insights.

Panelists discuss ESG advancements.

Reporting maturity is rising: 57% issue ESG reports, and 43% adopt standards like GRI or ISSB (up from 30% in 2022). Challenges persist in translating data into actionable metrics.

Accelerating ESG Maturity in Vietnam

As firms move from commitment to action, challenges evolve. Developing firms face internal hurdles: unclear strategies (70%), skill gaps (60%), and incomplete metrics (54%). Mature firms confront external issues like policy gaps (45%) and economic instability (38%).

Businesses seek government support: green financing (59%), standards/certifications (56%), and sustainability-linked incentives (55%). Market solutions include foundational training and advanced tools like emissions tracking for mature firms. This dual approach is key to ESG progress and long-term value creation.

From Compliance to Sustainable Transformation

ESG is now a strategic imperative. With 45% of Asia-Pacific CEOs fearing obsolescence without transformation, Vietnamese firms must decarbonize, digitize, and pursue sustainable growth. Integrating ESG into core functions, leveraging data, and aligning with financial strategies will unlock value and resilience in a volatile global landscape.

Lightning-Fast Delivery: Giao Hàng Nhanh Invests $14.5M in 309 New Trucks

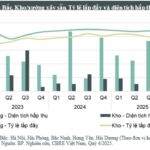

On September 19th, Giao Hàng Nhanh finalized the delivery of the last trucks in its new batch of 309 vehicles, representing a significant investment of 330 billion VND. With this addition, Giao Hàng Nhanh now boasts an impressive fleet of nearly 1,500 trucks, offering a wide range of load capacities.

Mazda6 Discontinued in Vietnam: Dealerships Stop Taking Deposits as Sales Plummet to Under 100 Units in 8 Months

The Mazda6, while still listed on the official website, is rumored to be discontinued in Vietnam, as sales have reportedly hit zero over the past four months.

Leading Securities Firm to Invest Nearly $60 Million in Establishing a Crypto Asset Trading Platform

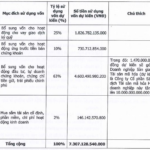

This leading securities firm is set to offer 365 million shares at an initial price of VND 20,000 per share, significantly boosting its chartered capital from VND 1,460 billion to over VND 5,100 billion. A key allocation of the raised capital will be directed toward establishing a cryptocurrency asset trading platform.

Thai Conglomerate Secures $400M from Italian Exit, Eyes Billion-Dollar Expansion in Vietnam

According to Bangkok Post, Central Retail Corporation (CRC) is reportedly selling its high-end Italian department store chain, Rinascente. This move is believed to be part of a strategic portfolio optimization, allowing the Thai retail giant to focus its efforts on core growth markets, namely Thailand and Vietnam.