Steel Production Continues to Grow, Prices Recover

In the latest Q3 steel industry update, MB Securities (MBS) forecasts domestic production to grow by 21% year-on-year, reaching 6.3 million tons. This growth is primarily driven by construction steel and HRC (hot-rolled coil), which account for 65% of the total.

Specifically, with real estate supply in Hanoi and Ho Chi Minh City expected to rebound by over 30% and public investment disbursement projected to grow by 18% in 2025, construction steel consumption is forecasted to increase by 10% year-on-year in Q3/2025.

Additionally, thanks to the second phase of the Dung Quat 2 plant coming online in Q3 and domestic enterprises increasing their market share to over 60%, HRC consumption is expected to grow by 48% year-on-year, reaching 1.7 million tons.

For exports, consumption is projected to remain sluggish due to weak demand in regions like the EU and the US. MBS forecasts export volumes to decline by 10% year-on-year.

Furthermore, MBS analysts predict a slight recovery in steel prices, while low input costs for coal and ore will positively impact gross profit margins.

In Q3/2025, HRC and construction steel prices saw a modest recovery of 2% and 3%, respectively, compared to the previous quarter, and remained stable. Price increases by companies indicate strong domestic demand, potentially competing with Chinese steel supported by anti-dumping tariffs. MBS expects domestic steel prices to continue rising in Q4, driven by peak consumption season and accelerated deployment of real estate and public investment projects.

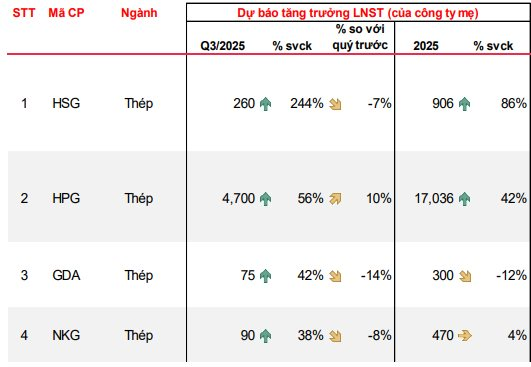

Projected After-Tax Profits for Steel Companies

Based on tracked companies, MBS projects Hoa Sen Group (HSG) to achieve a profit of VND 260 billion in Q3, a 244% year-on-year increase. For the 2025 fiscal year, MBS forecasts an 86% growth for Hoa Sen, reaching VND 906 billion.

According to MBS, the significant profit growth from the low base in 2024 is attributed to improved gross margins due to steel price recovery since August 2025 and stable HRC input costs, along with a 7% increase in production volume driven by domestic market demand.

Additionally, MBS analysts project Hoa Phat Group (HPG) to achieve an after-tax profit of VND 4.7 trillion in Q3, a 56% year-on-year increase. In Q3/2025, with contributions from the second phase of the Dung Quat 2 plant, HRC production is expected to grow by 60% year-on-year, supported by favorable consumption demand. This will positively impact overall production growth, with 9M/2025 profit expected to rise by 34%, completing 82% of the annual plan.

Meanwhile, Ton Dong A (GDA) and Nam Kim Steel (NKG) are forecasted to achieve profit growth of 42% and 38% year-on-year, respectively, reaching VND 75 billion and VND 90 billion. MBS notes that the profit growth for these two companies is driven by slightly improved gross margins and reduced selling expenses.

The Rising Cost of Construction Materials: A Heavy Burden on Ongoing Projects

The construction industry is facing a challenge with rising material costs. According to the Ministry of Construction, steel prices have surged by an average of 12-15% compared to the same period in 2024, while cement and construction sand prices have also seen significant increases of 8-10% and over 20%, respectively.

Steel Prices are Poised for a New Upswing: Securities Firms Forecast a Potential 47% Profit Growth for the Industry in 2025.

“Steel prices in the 2025-26 period have begun to move past their nadir, heralding the commencement of a new upward cycle amidst robust domestic demand,” asserts the analytical team at MBS.