“How can people afford homes priced at 100 million VND per square meter?” – Prime Minister Pham Minh Chinh’s question at the Central Steering Committee meeting on housing policies and the real estate market on September 22 was not just a reminder but also resonated deeply with millions of Vietnamese citizens.

This question reflects a harsh reality, evidenced by telling statistics. Housing prices have far outpaced income levels, pushing the dream of homeownership further out of reach for many. When a young person needs to save for over 20-25 years to afford a home, and when housing prices are 20 times higher than income, the burden of securing a home is no longer a private family matter but a pressing social welfare issue.

The Burden of Housing Prices

The story of Mr. and Mrs. Hoang Duc (Ho Chi Minh City) is a typical example of the struggle young urban couples face in finding a home. With a combined monthly income of nearly 35 million VND, both being experienced office workers, this figure seems decent. However, in the context of the high living costs in Vietnam’s largest city, it becomes extremely tight.

After deducting 7 million VND for renting a mini apartment, food, transportation, remittances to support both sets of parents, and other unnamed expenses, the couple manages to save about 10-12 million VND monthly.

Their goal is a two-bedroom apartment in the city’s outskirts, where prices are most affordable, costing around 3 billion VND. A simple calculation reveals their challenge: To secure a 30% down payment, or 900 million VND, the couple must save relentlessly for 6-7 years, assuming their income grows steadily and no major setbacks occur.

The dream of homeownership for many young families in major cities is increasingly difficult due to high housing prices. Photo: QH

|

“Six years just to save for a down payment, and the remaining 2.1 billion VND loan, if paid over 20 years with a floating interest rate, would cost about 20 million VND monthly for both principal and interest. This exceeds our family’s affordability,” Mr. Duc said sadly.

If Mr. and Mrs. Duc’s story is a marathon to reach the starting line, Mr. Quoc Tuan’s (43) family represents exhaustion and near surrender after a long journey. After 15 years in Ho Chi Minh City, with two children in secondary school, the family of four still lives in a cramped rented house.

“In 2018, we considered taking a loan to buy a house, but the interest rates were too high, and the financial pressure was overwhelming, so we put it off. Now, looking back, housing prices in our area have doubled or tripled, while our income has only slightly increased,” Mr. Tuan shared.

According to Mr. Tuan, buying a commercial home is now unthinkable. He can only hope for social housing policies, aiming to purchase with low-interest loans or rent affordable social housing with enough space for his children’s education and living. Seeing land and housing prices rise annually, the couple grows increasingly anxious.

This anxiety is not unique. Currently, even social housing prices have seen fluctuations compared to 2024, though still much lower than commercial housing, ranging from 15 to 25 million VND per square meter. However, the biggest issue with this housing type is the extremely limited supply compared to the massive demand.

Similarly, Mr. Nguyen Thanh Tam (34, residing in Binh Duong District, Ho Chi Minh City) shared that with a stable job in Cau Kieu Ward, located over 30km from his home, he rents a place to work. After ten years of saving, he still doesn’t feel confident about buying a home.

“With my current monthly income of nearly 20 million VND, renting is already challenging, let alone buying,” Mr. Tam confessed.

Red Alert

From a professional standpoint, experts agree that the gap between housing prices and income in Vietnam has reached a red alert level, far exceeding reasonable thresholds and international norms.

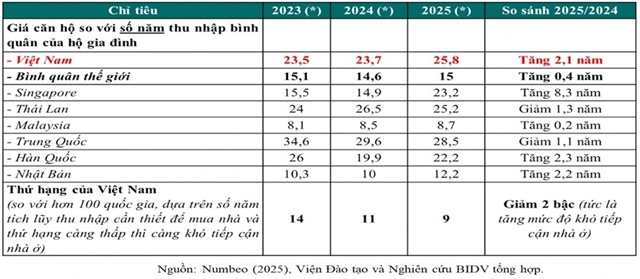

Mr. Ha Quang Hung, Deputy Director of the Department of Housing and Real Estate Market Management (Ministry of Construction), stated that to buy an average home (70 square meters, priced at 3-4 billion VND) in major cities, young people need 20-25 years of income. He affirmed that this ratio of housing price to income in Vietnam is among the highest (very difficult to access), while the suitable ratio is around 6-8 years.

In major cities, young people need 20-25 years of income to buy a 3-4 billion VND apartment. Photo: QH |

Dr. Nguyen Tri Hieu, an economist, provided a detailed calculation: With the average apartment price in Hanoi reaching 70-80 million VND per square meter in 2025, a 70-square-meter apartment costs around 4.9-5.6 billion VND. Meanwhile, the average monthly income of a two-worker household in Hanoi is only about 21.4 million VND.

Thus, the housing price-to-income ratio is 20 times. According to the Ministry of Construction, this ratio is now even higher, reaching nearly 24 times, compared to the global average of 14.6 times, far exceeding the ideal ratio of 5-7 times.

Mr. Nguyen Quoc Anh, Deputy General Director of Batdongsan.com.vn, noted that historical data from the company shows this is a cross-generational challenge. If a young person from the 7X generation in 2004 needed 31.3 years to save for a home, the figure for the 8X generation in 2014 was 22.7 years, and for the 9X generation in 2024, it increased to 25.8 years.

A notable paradox is that Vietnam ranks among the countries with the highest homeownership rates globally, at around 90%, higher than Singapore (88%) and the US (66%). However, this rate largely stems from previous generations owning land and building homes when land prices were low.

|

Today’s young people, starting their careers in cities, no longer have that opportunity and must enter the commercial housing market with prices dozens of times higher than their income. Mr. Nguyen Quoc Anh, Deputy General Director of Batdongsan.com.vn |

Dr. Can Van Luc, an economist, noted that according to a survey, a civil servant needs 26 years of saving to buy an apartment. |

The root causes of this situation are a combination of factors. The Ministry of Construction’s report highlights persistent issues such as legal system bottlenecks, particularly in land, bidding, and investment approval; delayed compensation and land clearance, coupled with a fear of making mistakes and accountability among local authorities, leading to slow resolution and buck-passing…

Additionally, hoarding, price manipulation, and speculation persist, driving housing prices beyond the affordability of most citizens.

Surplus of Luxury Homes, Shortage of Affordable Housing

One of the core reasons housing prices remain high, far exceeding buyers’ tolerance, is the severe imbalance in the supply structure. The market faces a supply-demand mismatch, with an oversupply of high-end and luxury products but a severe shortage of affordable and social housing.

Dr. Huynh Phuoc Nghia, Director of the Center for Economics, Law, and Management (University of Economics Ho Chi Minh City), pointed out that the housing supply primarily consists of high-end and mid-range segments, lacking properties priced within the reach of most citizens.

A recent Ministry of Construction report also noted that many localities have not adequately focused on developing affordable commercial housing and social housing suitable for the majority of middle and low-income urban residents.

New real estate supply in Ho Chi Minh City primarily consists of high-end segments for the wealthy. Photo: QH

|

This situation is particularly evident in Ho Chi Minh City. Mr. Le Hoang Chau, Chairman of the Ho Chi Minh City Real Estate Association (HoREA), stated that since 2021, the market has virtually lacked affordable commercial housing projects priced below 30 million VND per square meter.

More alarmingly, in 2024, newly launched projects are exclusively high-end, creating an inverted pyramid market model, lacking balance and sustainability.

|

The shortage of affordable supply has driven overall prices upward. In 2024, high-end apartment prices (primary market) in Ho Chi Minh City reached 90 million VND per square meter, averaging around 9.7 billion VND per unit. |

Meanwhile, social housing development efforts have fallen short of expectations. From 2021 to 2024, Ho Chi Minh City implemented only 10 social housing projects, totaling nearly 6,000 units, a mere 8.6% of the government’s assigned target.

A major cause of the supply shortage is the legal deadlock affecting numerous projects.

Statistics show that 220 real estate projects in Ho Chi Minh City face difficulties, with 143 still awaiting resolution.

The inability to implement hundreds of projects not only wastes land resources and reduces budget revenue but also directly decreases housing supply, putting upward pressure on prices in the short term.

|

According to the Ministry of Construction’s official report for the first nine months of 2025, new primary apartment prices in Ho Chi Minh City averaged around 75 million VND per square meter, a 36% increase from the same period last year. In Hanoi, the situation is even more alarming, with average prices reaching 70-80 million VND per square meter, a 33% increase compared to 2024. |

QUANG HUY – NGUYỄN CHÂU

– 06:03 25/09/2025

Launching and Commencing 10 Key Projects and Initiatives for APEC 2027

Deputy Prime Minister Nguyen Chi Dung emphasized that the projects serving APEC 2027 demonstrate the seamless coordination between the central government and local authorities, as well as between the state and businesses. With the upcoming synchronized infrastructure system, Phu Quoc will not only be the destination for APEC 2027 but also a symbol of an innovative and creative Vietnam, striving towards the goal of becoming a developing country with a modern industrial base by 2030.

Vietnam Overtakes China as Global Footwear Manufacturing Hub: Boston’s 90-Year-Old Firm Relocates to Dong Nai, with 40-50% of Nike and Adidas Shoes Now Made in Vietnam

Once an unshakeable titan, China’s decades-long reign as the world’s “sneaker factory” is facing unprecedented upheaval. A seismic shift in global supply chains is underway, with Vietnam emerging as the brightest new destination, magnetizing billion-dollar orders from industry giants like Nike and Adidas.

Unleashing Economic Potential: VCCI Advocates for Transformative Reforms in Vietnam’s Investment and Business Laws

This legislative draft embodies a bold spirit of reform, poised to establish a robust legal framework that will catalyze economic breakthroughs during this pivotal transition phase.

Vietnam’s $100 Billion Market Roars to Life: Two Korean Giants Race to Secure Early Dominance

Following Dunamu’s strategic partnership with MB Bank—the parent company of Upbit—Bithumb, South Korea’s second-largest cryptocurrency exchange, has unveiled its own plans to enter Vietnam’s market. The rivalry between these two giants is intensifying, signaling a fierce competitive phase in Vietnam’s nascent digital asset landscape.