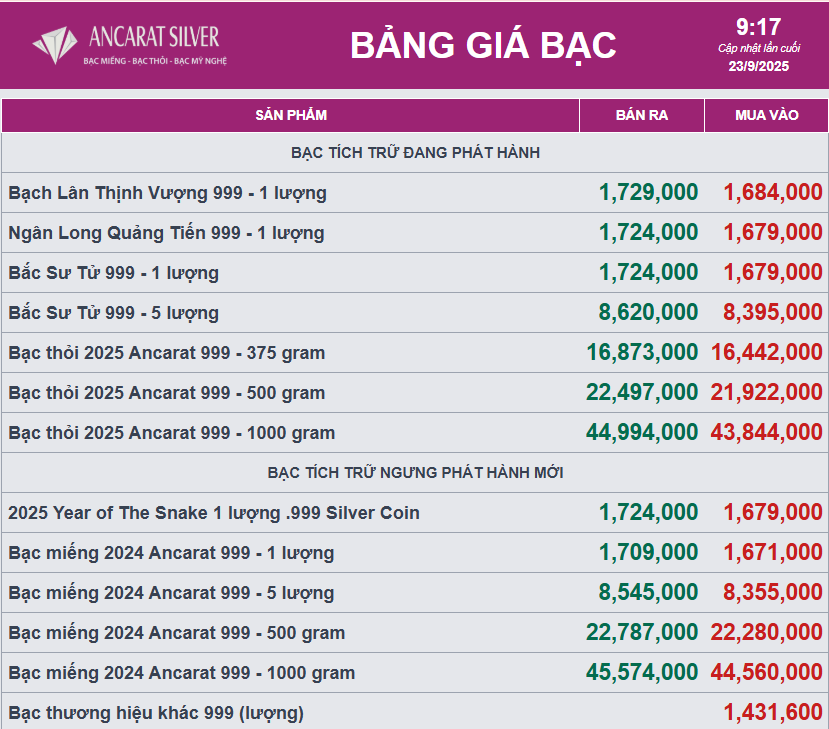

At Ancarat Vietnam Joint Stock Company, silver prices have surged, reaching VND 1,684,000 per tael (buy) and VND 1,729,000 per tael (sell) in Hanoi. Over the past year, silver prices have climbed by 58.6%, outpacing gold’s 50.2% increase.

Meanwhile, 1kg 999 fine silver bars are priced at VND 43,844,000 (buy) and VND 44,994,000 (sell), as of 9:17 AM on September 23.

Globally, silver is trading at USD 43.67 per ounce.

Silver prices have held at their highest levels in 14 years following the U.S. Federal Reserve’s decision to cut interest rates by 0.25 percentage points and signal potential further easing in the coming months.

Analyst James Hyerczyk notes that capital inflows into precious metals remain steady, driven by three key factors: interest rate repricing, sustained physical demand, and robust industrial production. He observes that silver is nearing the critical resistance level of USD 44.22 per ounce, with the market awaiting macroeconomic data to determine its next direction.

The upcoming focus is the final September consumer sentiment survey from the University of Michigan (UofM). Preliminary results show a 4.8% drop in consumer confidence, while long-term inflation expectations rose to 3.9%. “This is a closely watched indicator for the Fed. If the final results are weaker than expected, expectations for further rate cuts will strengthen. Conversely, stronger data could slow the easing process,” Hyerczyk explains.

Gold and Silver Prices Surge: The Rise of Diversified Asset Portfolios

Following the U.S. Federal Reserve’s interest rate cut, gold and silver prices surged. Gold has hovered around $3,700 per ounce over the past week, marking a nearly 40% increase since the start of the year. Silver broke past $43 per ounce, achieving its highest gain on record. Phú Quý-branded 999 fine silver bars soared to 45.4 million VND per kilogram.

What Benefits Does Vietnam Reap When the Fed Cuts Interest Rates?

Should the Fed opt to cut interest rates in the upcoming meeting, Vietnam’s macroeconomic landscape and financial markets will face a rare opportunity, creating a conducive environment for stabilizing exchange rates, easing monetary policy, and fostering synchronized growth.

Silver Prices Plummet on September 18th

Compared to the morning of September 17th, domestic silver prices have dropped by approximately VND 45,000 per tael on the selling side.