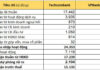

Specifically, the credit program for agricultural, forestry, and fishery sectors, as outlined in Official Dispatch No. 5631/NHNN-TD dated July 14, 2023, and Official Dispatch No. 2756/NHNN-TD dated April 15, 2025, will continue until the loan disbursement reaches 185,000 billion VND (as registered by commercial banks). Other related details are to be implemented according to the instructions in Official Dispatch No. 5631/NHNN-TD.

The following banks are responsible for monitoring and reporting the implementation results of the program, while ensuring compliance with the program’s commitments (regarding eligible borrowers and interest rates): Bank for Agriculture and Rural Development of Vietnam, Vietnam Bank for Investment and Development, Joint Stock Commercial Bank for Industry and Trade of Vietnam, Joint Stock Commercial Bank for Foreign Trade of Vietnam, Loc Phat Joint Stock Commercial Bank, Saigon Commercial Credit Joint Stock Bank, Military Commercial Joint Stock Bank, Asia Commercial Joint Stock Bank, Nam A Commercial Joint Stock Bank, Orient Commercial Joint Stock Bank, Vietnam Export-Import Commercial Joint Stock Bank, Ban Viet Commercial Joint Stock Bank, Saigon-Hanoi Commercial Joint Stock Bank, Vietnam Thuong Tin Commercial Joint Stock Bank, Ho Chi Minh City Development Commercial Joint Stock Bank, Tien Phong Commercial Joint Stock Bank, Kien Long Commercial Joint Stock Bank, and Bac A Commercial Joint Stock Bank.

Additionally, the State Bank of Vietnam encourages other commercial banks interested in participating in the program to follow the provided guidelines.

|

Eligible Borrowers and Applicable Interest Rates: The scope of eligible borrowers has been expanded as per Official Dispatch No. 5631/NHNN-TD dated July 14, 2023, issued by the State Bank of Vietnam, under the credit program for agricultural, forestry, and fishery sectors. Eligible borrowers are customers with projects or plans serving production and business activities in these sectors. Interest rates for loans in Vietnamese Dong are set at least 1-2% per annum lower than the average lending rates for the same term (short-term, medium to long-term) applied by the lending bank during the respective period. |

– 10:08 25/09/2025

What Are Deposit Certificates and Why Do They Offer Higher Interest Rates Than Savings Accounts?

Revised Introduction:

A certificate of deposit (CD) is a specialized variant of traditional savings accounts, offering a secure, long-term investment avenue for discerning investors.

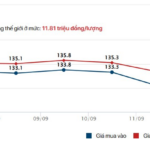

Today, September 13th: Ring Gold and Gold Bar Prices Continue Their Sharp Decline

Domestic gold prices continued their steep decline at the opening of today’s trading session. Ring and bullion gold prices at several enterprises plummeted by nearly 2 million VND per tael compared to the same time yesterday.