After five consecutive sessions of decline and a sudden surge in selling pressure in the previous session, the stock market experienced significant volatility on September 23. The VN-Index closed with a slight gain of 0.81 points (+0.05%), reaching 1,635.26 points, comfortably above the psychological support level of 1,600 points. Following several sessions of heavy selling, foreign trading activity stabilized, with net selling amounting to only 7 billion VND across the market.

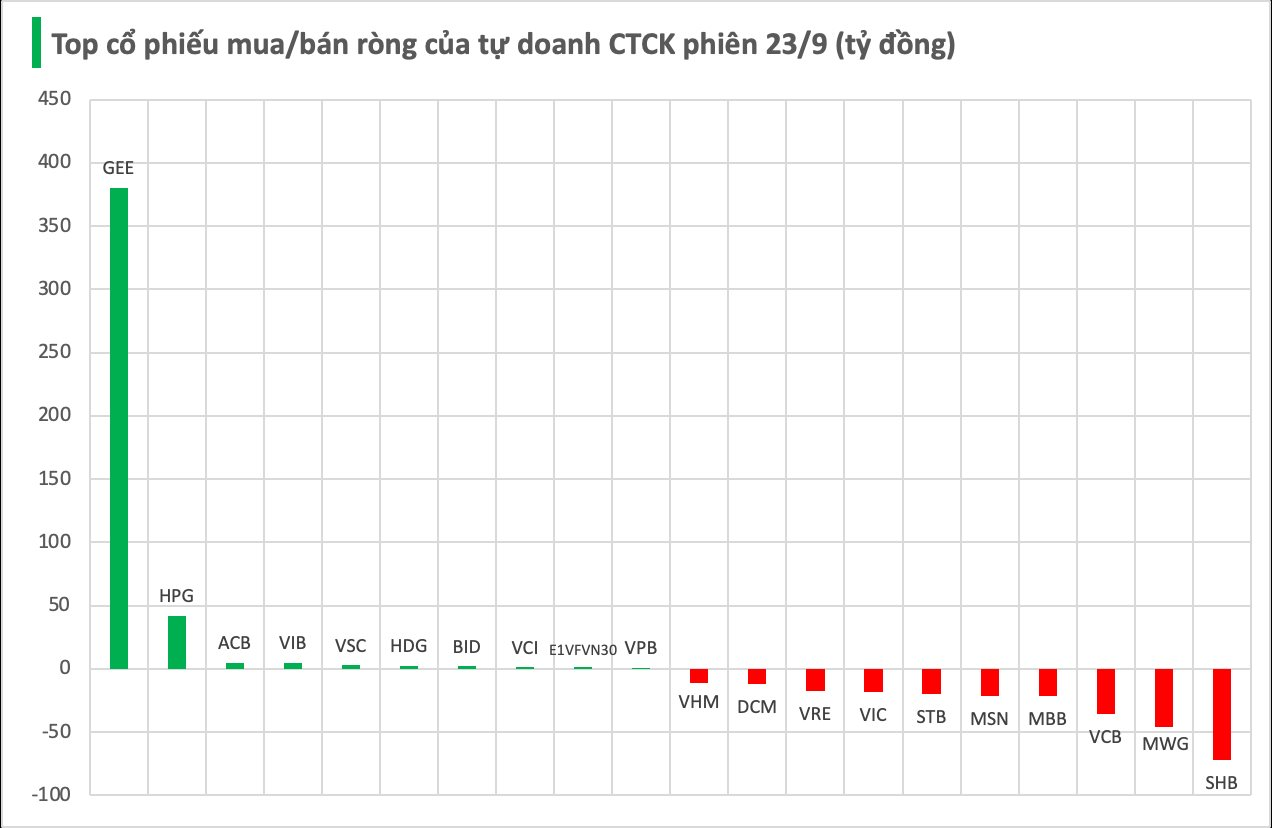

Securities firms’ proprietary trading desks recorded a net purchase of 61 billion VND on HOSE.

Specifically, GEE and HPG were net bought with values of 380 billion VND and 42 billion VND, respectively. They were followed by ACB (5 billion VND), VIB (5 billion VND), VSC (3 billion VND), HDG (2 billion VND), BID (2 billion VND), VCI (1 billion VND), E1VFVN30 (1 billion VND), and VPB (1 billion VND), all of which saw strong buying from securities firms’ trading desks.

Conversely, the strongest net selling by securities firms was observed in SHB, with a value of -72 billion VND, followed by MWG (-46 billion VND), VCB (-36 billion VND), MBB (-22 billion VND), and MSN (-22 billion VND). Other stocks also recorded notable net selling, including STB (-20 billion VND), VIC (-19 billion VND), VRE (-18 billion VND), DCM (-12 billion VND), and VHM (-11 billion VND).

Market Pulse 24/09: VN-Index Successfully Rebounds, Reclaiming the 1,655-Point Milestone

At the close of trading, the VN-Index surged by 22.2 points (+1.36%), reaching 1,657.46 points, while the HNX-Index climbed 4.27 points (+1.56%) to 277.28 points. Market breadth favored the bulls, with 476 advancing stocks and 238 declining stocks. Similarly, the VN30 basket saw a dominant green trend, with 27 gainers, 2 losers, and 1 unchanged stock.