Technical Signals of VN-Index

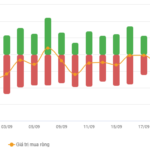

During the morning trading session on September 25, 2025, the VN-Index fluctuated while retesting the Middle line of the Bollinger Bands.

However, the index stabilized after successfully testing the August 2025 low (equivalent to the 1,600-1,630 point range), and concerns about a Triple Top pattern have also diminished.

Technical Signals of HNX-Index

During the morning trading session on September 25, 2025, the HNX-Index continued its recovery, surpassing the Middle line of the Bollinger Bands.

Notably, the buy signal from the Stochastic Oscillator was the most significant highlight. The short-term outlook is turning positive.

HHV – Deo Ca Infrastructure Investment Joint Stock Company

On the morning of September 25, 2025, the HHV stock price surged, accompanied by a Rising Window candlestick pattern and trading volume exceeding the 20-session average, indicating renewed investor activity.

Currently, HHV has successfully broken out of the Triangle pattern’s upper edge, with the MACD indicator signaling a buy. If technical signals remain positive, the potential price target is the 18,600-19,100 range.

PVT – Petroleum Transportation Joint Stock Corporation

During the morning trading session on September 25, 2025, the PVT stock price rose, forming a long-bodied candlestick pattern while remaining above the 20-day SMA. Trading volume exceeded the 20-session average, reflecting investor optimism.

Additionally, the stock price continues to track the upper band of the Bollinger Bands, while the MACD indicator maintains its upward trajectory after signaling a buy. This reinforces the recovery prospects.

However, PVT is approaching the August 2025 high (equivalent to the 19,200-19,600 range). If technical signals improve and the stock price successfully breaches this resistance level, the uptrend will be more sustainable.

(*) Note: The analysis in this article is based on realtime data as of the end of the morning trading session. Therefore, signals and conclusions are for reference only and may change after the afternoon session concludes.

Technical Analysis Department, Vietstock Advisory Division

– 12:03 September 25, 2025

Surge in Brokerage Firm’s Proprietary Trading: One Stock Witnessed Unexpected Net Buying Spike on September 23rd

Proprietary trading firms recorded a net purchase of VND 61 billion on the Ho Chi Minh City Stock Exchange (HOSE), signaling a significant shift in market dynamics. This substantial investment underscores growing confidence in the bourse’s potential, as traders capitalize on emerging opportunities within Vietnam’s vibrant financial landscape.

Bank Stock Plunges as Brokerage Firms Unload Hundreds of Billions in Surprise Sell-Off on September 24th

Proprietary trading firms reversed their position, offloading a net value of VND 251 billion on the Ho Chi Minh City Stock Exchange (HoSE).

Market Pulse 24/09: VN-Index Successfully Rebounds, Reclaiming the 1,655-Point Milestone

At the close of trading, the VN-Index surged by 22.2 points (+1.36%), reaching 1,657.46 points, while the HNX-Index climbed 4.27 points (+1.56%) to 277.28 points. Market breadth favored the bulls, with 476 advancing stocks and 238 declining stocks. Similarly, the VN30 basket saw a dominant green trend, with 27 gainers, 2 losers, and 1 unchanged stock.