Time to Consider Post-Upgrade Adaptation – Illustrative Image

|

In recent days, efforts to promote the upgrade have been maximized – from Government Decree 245 on September 11, directly addressing the two remaining criteria; the Prime Minister’s decision on September 12 approving the upgrade plan; to Minister of Finance Nguyen Van Thang’s “confident” statement about the upcoming upgrade scenario during his recent London visit. Market sentiment is overwhelmingly positive.

However, amidst this heightened optimism, many investors are beginning to ponder a critical question: What comes after the upgrade? Or more familiarly, how should we prepare to navigate the “atmosphere” of the new Emerging Market playground without feeling overwhelmed?

If successfully upgraded to the Secondary Emerging Market (EM) status by FTSE Russell, Vietnam’s weighting is expected by many organizations and experts to fluctuate around 0.3–0.5% of the index’s total capitalization, significantly smaller than the approximately 25% in the FTSE Frontier Index (as of February 2025).

Nevertheless, this event marks a significant step toward a larger FTSE EM playground, with a total market capitalization of 7.7 trillion USD, 77 times larger than the now-outgrown FTSE Frontier Index.

For Vietnam’s stock market, the upgrade from Frontier to Secondary Emerging Market represents a choice to ascend to a “new tier” – one featuring larger markets, higher competition, and better alignment with prospects and expectations.

Following Minister of Finance Nguyen Van Thang’s “confident” remarks to Reuters about the upcoming upgrade scenario, the news outlet also reported that analysts expect FTSE Russell to gradually increase Vietnam’s weighting in the FTSE EM rather than doing so all at once. This approach allows international investors sufficient time to adjust portfolios and allocate capital to Vietnam’s market smoothly, avoiding significant volatility.

Analysts estimate that if upgraded, Vietnam’s stock market (currently valued at around 350 billion USD) could attract an additional 5–7 billion USD in foreign capital.

Minister Nguyen Van Thang (left) during his visit to the London Stock Exchange on September 15–16

|

Maintaining Status Post-Upgrade

Vietnam still faces challenges that need improvement to attract foreign investors. These include a market heavily skewed toward speculation; investor protection mechanisms (such as risk compensation) not meeting international standards, coupled with risks of sudden regulatory changes and uneven information disclosure.

Regarding securities, private enterprises are hesitant to list, while state-owned enterprises are slow to equitize; few FDI enterprises list due to a lack of specific legal regulations; limited high-quality securities, alongside a 49% foreign ownership cap (lower in sensitive sectors like banking, real estate, and aviation), have restricted strategic investment control; market diversity is low, with large capitalizations concentrated in banking, securities, and real estate.

In an OCBS report, Kuwait’s market – considered similar to Vietnam’s – serves as a “case study.”

Kuwait was upgraded to Emerging Market status by FTSE Russell in September 2020 and by MSCI in November 2020. Consequently, Boursa Kuwait – the country’s main stock index – surged 23% in 2020, despite COVID-19 impacts, with liquidity significantly increasing. Kuwait also saw a surge in foreign capital inflows post-upgrade, from 350 million USD in 2019 to 1.1 billion USD in 2020.

Kuwait’s Market Shows Positive Changes Post-Upgrade – Source: OCBS

|

Kuwait’s reforms in improving foreign investor access, enhancing liquidity and infrastructure, managing risks, and ensuring post-upgrade stability to avoid a “reversal effect” offer valuable lessons for Vietnam.

“Kuwait is not only a successful case study but also provides a practical roadmap for Vietnam, helping focus on technical barriers and economic benefits,” OCBS summarizes.

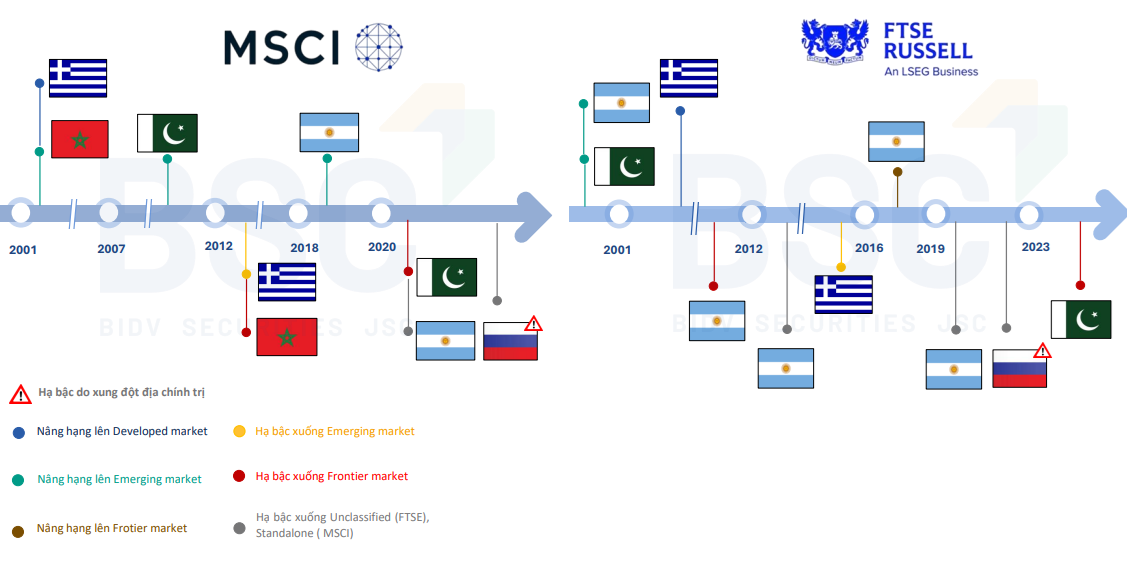

Vietnam must also be wary of another risk: downgrading. Between 2008 and 2024, FTSE downgraded a total of 9 times across 7 countries.

Many countries, after being upgraded, were quickly downgraded not only by FTSE but also by MSCI, largely due to issues significantly impacting their economies. Notable examples include Argentina, due to financial crises, public debt, and political instability; Greece, due to public debt crises; Pakistan, due to political instability and natural disasters; and Russia, downgraded to unclassified by both organizations following geopolitical conflicts with Ukraine.

Countries Upgraded Then Downgraded by MSCI and FTSE – Source: BSC

|

A New Era of Expectations: MSCI and Higher-Tier FTSE

If Vietnam swiftly surpasses the Secondary Emerging Market tier of FTSE, its stock market still faces a long development journey ahead, with newer and higher expectations to fulfill.

The recently approved plan to upgrade Vietnam’s stock market demonstrates the government’s strong commitment, aiming not only to meet FTSE’s Secondary Emerging Market standards this year but also to achieve MSCI’s Emerging Market status and higher-tier FTSE by 2030. However, these advancements – which will transform the position of Vietnam’s stock market – clearly require significant effort and time.

For MSCI, Vietnam still needs to improve many criteria to be considered for an upgrade. For foreign investors, key areas include ownership limits, equal rights, and room. The clearing and settlement system is still being monitored for the implementation of Non-Prefunding solutions. Short selling has yet to be implemented… Overall, the ability to meet these criteria remains uncertain, but Vietnam’s efforts to improve are undeniable, especially after the steps taken to “finalize” FTSE EM.

New goals and expectations open a completely different landscape for Vietnam’s stock market in the coming years – where the once-spacious “garments” will gradually become tight and need replacing.

– 08:14 25/09/2025

Saving for 25 Years, Yet the Dream of Homeownership Remains Elusive Due to Skyrocketing Prices

Soaring home prices are eroding the dream of homeownership for millions of hardworking individuals, particularly young families, forcing them into an uneven race against the escalating cost of real estate.

Launching and Commencing 10 Key Projects and Initiatives for APEC 2027

Deputy Prime Minister Nguyen Chi Dung emphasized that the projects serving APEC 2027 demonstrate the seamless coordination between the central government and local authorities, as well as between the state and businesses. With the upcoming synchronized infrastructure system, Phu Quoc will not only be the destination for APEC 2027 but also a symbol of an innovative and creative Vietnam, striving towards the goal of becoming a developing country with a modern industrial base by 2030.

Vietnam Overtakes China as Global Footwear Manufacturing Hub: Boston’s 90-Year-Old Firm Relocates to Dong Nai, with 40-50% of Nike and Adidas Shoes Now Made in Vietnam

Once an unshakeable titan, China’s decades-long reign as the world’s “sneaker factory” is facing unprecedented upheaval. A seismic shift in global supply chains is underway, with Vietnam emerging as the brightest new destination, magnetizing billion-dollar orders from industry giants like Nike and Adidas.