South Korean crypto exchange Bithumb eyes pilot project in Vietnam, leveraging the country’s burgeoning digital asset market.

Recently, Business Korea reported that Bithumb is advancing plans to participate in a pilot cryptocurrency exchange project in Vietnam. This move underscores Vietnam’s growing appeal as a crypto hub.

Citing Vietnam Investment Review, Business Korea highlights Vietnam’s 17 million crypto holders and a market value exceeding $100 billion. Triple-A’s report further reveals Vietnam’s 17.4% crypto ownership rate, surpassing the global average of 6.8%.

“South Korean firms are strategically positioning themselves to lead in this emerging market,” noted an industry insider.

This initiative follows Vietnam’s Resolution No. 05/2025/NQ-CP, issued on September 9, 2025, which permits the establishment and operation of pilot crypto exchanges over the next five years.

Image: Forkast

Since the legalization of cryptocurrencies in June 2023, Vietnam has accelerated regulatory frameworks for the sector, according to Business Korea.

Bithumb plans to invest in the project through equity participation, adhering to the 49% foreign ownership cap mandated by Vietnamese regulations.

A South Korean financial official told Business Korea, “Bithumb has been quietly pursuing this venture for months… They’ll likely partner with local financial institutions and banks through equity investment.”

In August, Dunamu signed an MoU with MB Bank.

Bithumb’s rival, Dunamu (operator of Upbit), has also entered the fray by signing an MoU with MB Bank during the Korea-Vietnam Business Forum. Dunamu will support MB Bank in establishing an exchange, developing legal frameworks, and ensuring investor protection.

Market Overview and Key Players

Beyond Dunamu and Bithumb, South Korea’s BDACS has partnered with IDGX (IDG Capital Vietnam) to develop digital asset trading and custody infrastructure.

Domestic players like Techcombank’s TCEX, VIXEX (backed by VIX Securities), and CAEX (with VPBank Securities) are also gearing up for the competitive landscape.

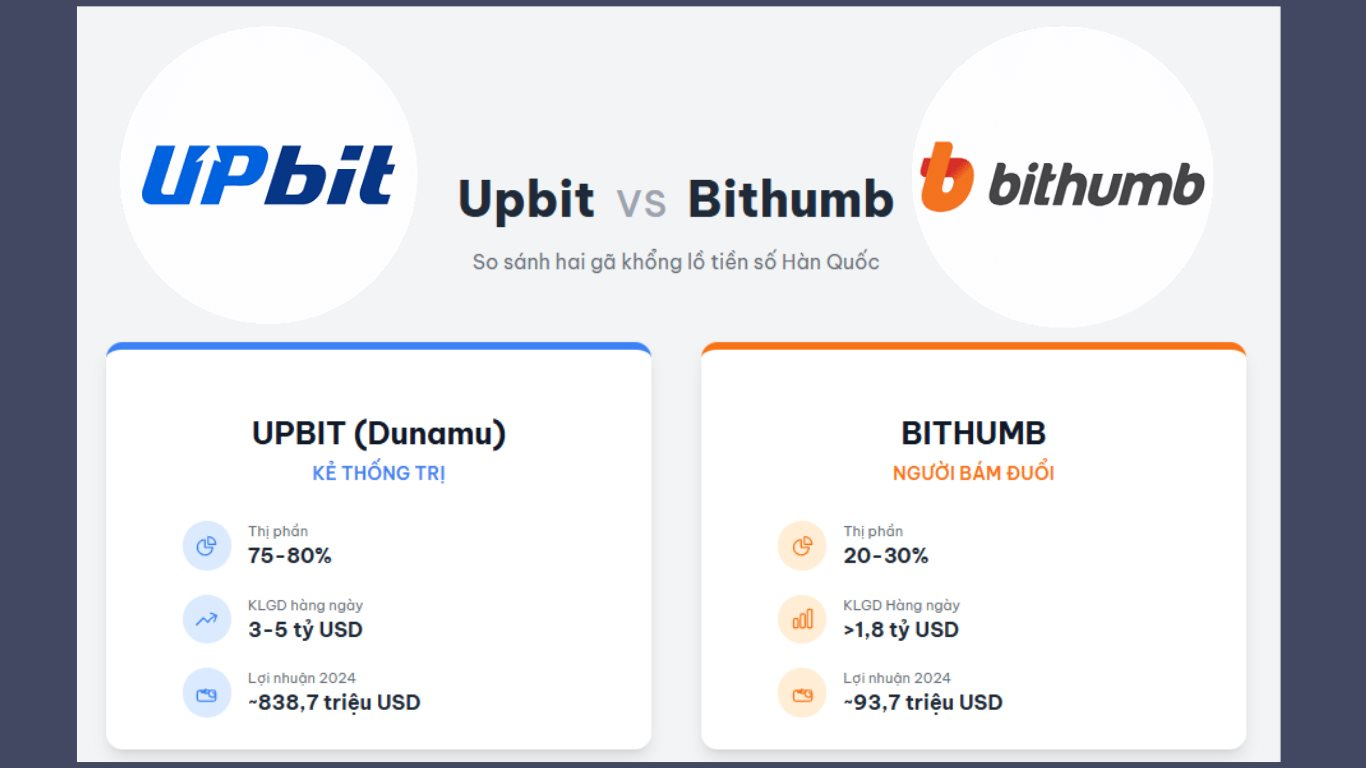

Dunamu, backed by Kakao Corp, dominates South Korea’s crypto market with Upbit’s 75-80% share. In 2024, Upbit’s trading volume surpassed $1.1 trillion, with daily peaks of $3-5 billion. Dunamu reported $838.7 million in operating profit for 2024.

In contrast, Bithumb, the second-largest exchange, faces volatility with a 20-30% market share, relying on fee waivers to compete. Despite daily volumes exceeding $1.8 billion, its 2024 profit was just $93.7 million, hindered by complex ownership and legal challenges.

The entry of these Korean giants into Vietnam’s nearly 100-million-strong market signals intense competition. The clash between Dunamu’s peak performance and Bithumb’s seasoned yet challenged approach will reshape Vietnam’s digital asset landscape.

$31 Billion in Private Equity Fuels Decade-Long Growth for Masan, Tiki, Equest, Golden Gate, and More

Recently, Vietnam’s private equity market has entered a phase of adjustment, characterized by a slowdown in capital flows and heightened investor scrutiny in decision-making.

Global Fund Gathers 200 Top Scientists, Offering Support to Elevate Bac Ninh Province to Centrally Governed City Status

The World’s Leading Scientists Development Fund in Shanghai, China, has announced its readiness to mobilize an international team of experts across various fields. Their mission is to provide consultation and support to Bac Ninh Province in realizing its ambition to become a centrally governed city.

iPhone 17 Pro Max Non-Orange Variant: Skyrocketing Prices, Even $10 Million Extra Might Not Secure a Purchase

The iPhone 17 Pro Max is currently priced significantly above its retail value, with markups ranging from $350 to $430 at select phone retailers.

Billionaire Nguyen Thi Phuong Thao Meets with NYSE Chairman as Market Surges 48 Points

New York, USA – September 22, 2025 – As part of the official visit coinciding with President Luong Cuong’s attendance at the United Nations General Assembly, Dr. Nguyen Thi Phuong Thao, Chairwoman of Vietjet and Vietnam’s leading female billionaire, toured the New York Stock Exchange (NYSE), the world’s largest and most historic financial hub.