According to statistics from the Vietnam Customs, in August 2025, Vietnam exported 331,520 tons of cassava and cassava products, valued at $101.77 million, marking a 73.3% increase in volume and a 17.5% increase in value compared to August 2024. This marks the seventh consecutive month of strong growth in cassava and cassava product exports year-over-year.

For the first eight months of 2025, cassava and cassava product exports totaled over 2.81 million tons, valued at $858.59 million, reflecting a 56.8% increase in volume and a 4.4% increase in value compared to the same period last year. The average export price of cassava and its products was $304.8 per ton, a 33.4% decrease from the same period in 2024.

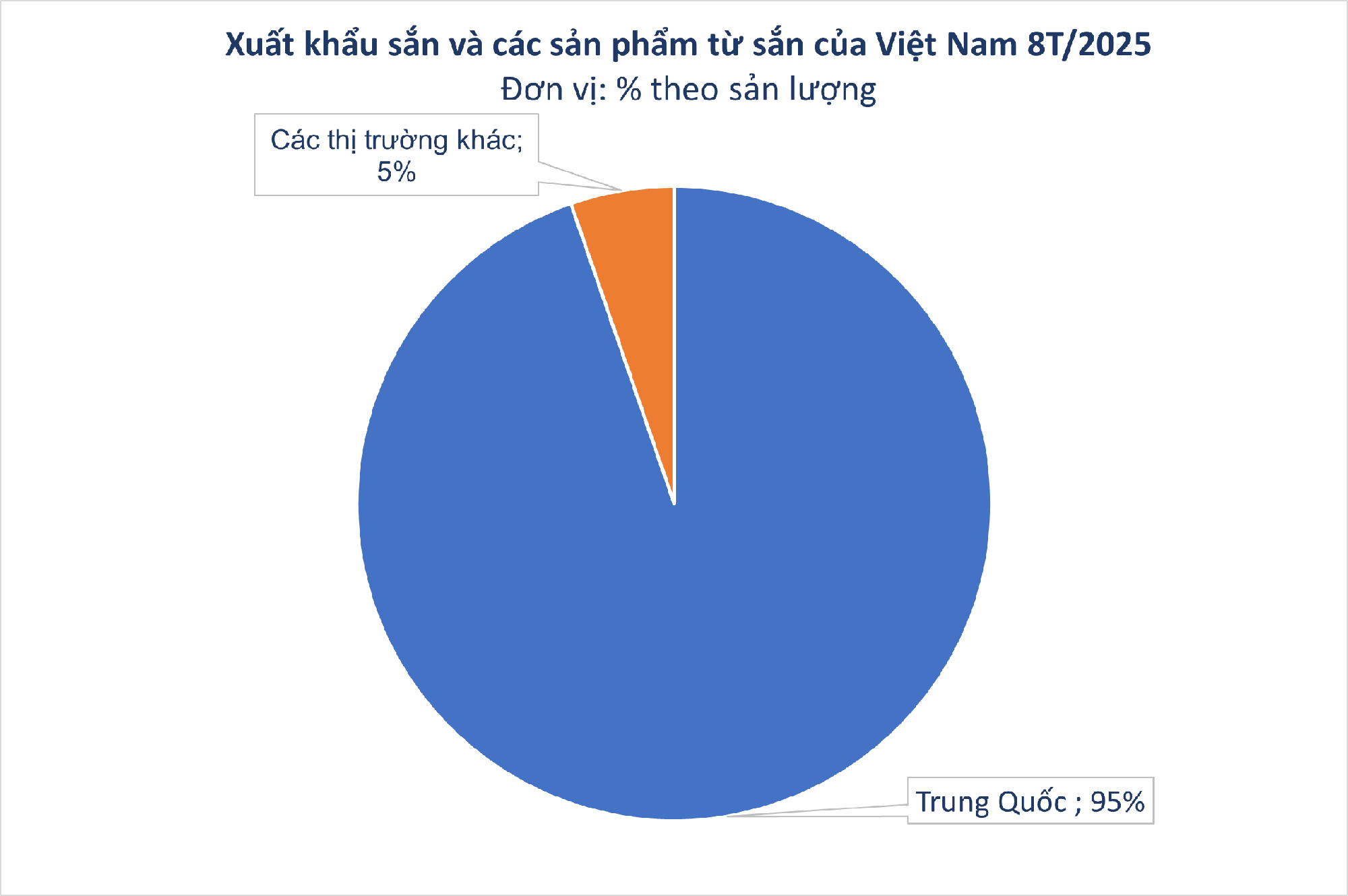

China remains the primary market for Vietnamese cassava exports in the first eight months of the year, followed by Taiwan and the Philippines.

Vietnamese cassava exports are projected to continue rising, driven by stable demand from China and expanding exports to new markets. However, the significant reliance on the Chinese market and the downward trend in cassava prices may pose challenges to export revenue.

Notably, Japan has emerged as the fastest-growing export market. In the first eight months of 2025, exports to Japan reached nearly 10,000 tons of cassava and cassava products, valued at $3.4 million, representing a 770% increase in volume and a 752% increase in value compared to the same period in 2024. In August alone, the growth surged to 1,015% in volume and 943% in value.

Currently, Vietnam ranks as the third-largest cassava exporter globally, consistently achieving export revenues exceeding $1 billion over the past five years. This contributes to the cultivation of 517,800 hectares of cassava nationwide, with an annual production of 10.5 million tons of fresh tubers.

To support the cassava industry, in 2024, the Ministry of Agriculture and Rural Development approved the “Sustainable Development Plan for the Cassava Industry by 2030, with a Vision to 2050.” By 2030, the plan aims to achieve a national fresh cassava production of approximately 11.5 to 12.5 million tons, with 85% of the fresh cassava used for deep processing into products such as starch, ethanol, and monosodium glutamate. The plan also targets 40-50% of cassava cultivation areas to use certified high-quality seeds, with cassava and cassava product exports reaching $1.8 to $2.0 billion.

In early September 2025, several factories in the Central Highlands region commenced the new 2025-2026 production season. However, high initial production costs, coupled with slow consumption and low prices, have placed economic efficiency pressures on cassava processing enterprises. In Gia Lai and Dak Lak, some cassava starch factories have begun purchasing raw cassava at prices ranging from VND 2,200 to 2,250 per kilogram.

Meanwhile, cassava starch trading activities at border gates, particularly in Lang Son, have been vibrant due to increased demand from China during the Mid-Autumn Festival. Cassava starch inventories at Chinese ports continue to decline, currently standing at approximately 430,000 tons, further stimulating imports from Vietnam.

It is anticipated that Cambodia’s cassava supply this year may exceed demand due to ongoing border tensions with Thailand, leading to increased direct sales to Vietnam and China.