I. MARKET ANALYSIS OF THE UNDERLYING STOCK MARKET ON SEPTEMBER 25, 2025

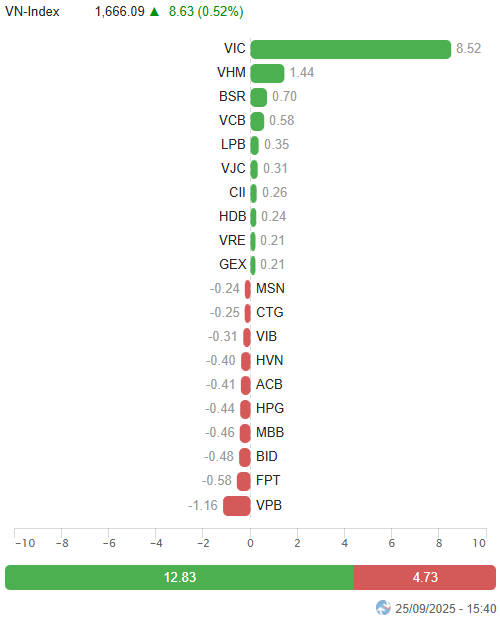

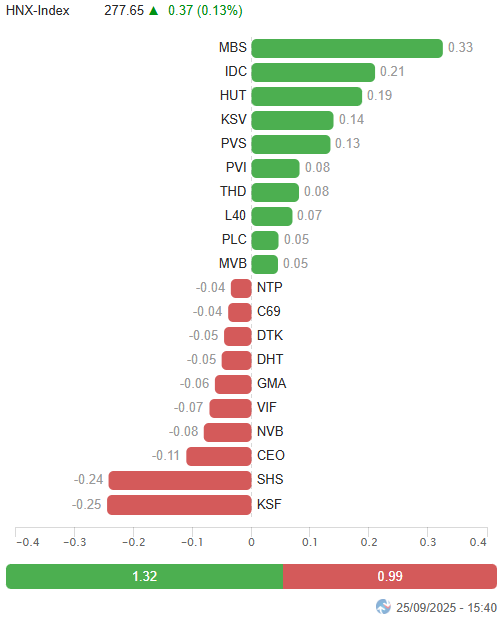

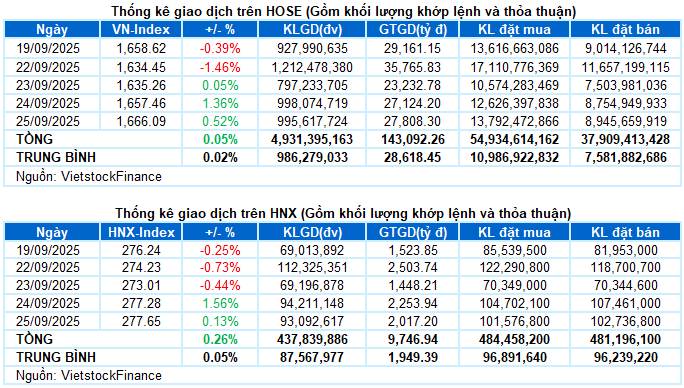

– Major indices maintained their upward momentum during the September 25 trading session. Specifically, the VN-Index rose by 0.52%, closing at 1,666.09 points, while the HNX-Index saw a modest increase of 0.13%, reaching 277.65 points.

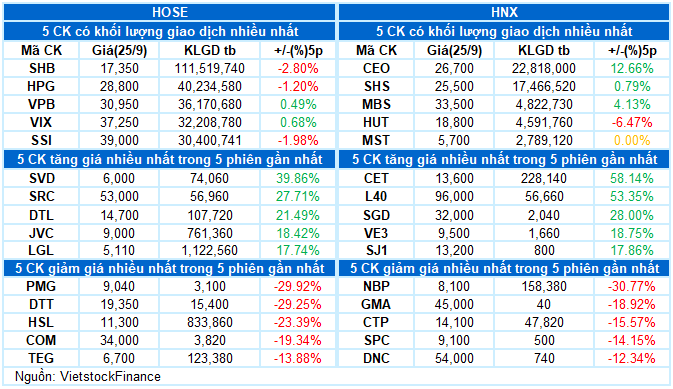

– Trading volume on the HOSE decreased by 2.9%, totaling nearly 915 million units. The HNX recorded over 86 million matched units, a 5.1% decline compared to the previous session.

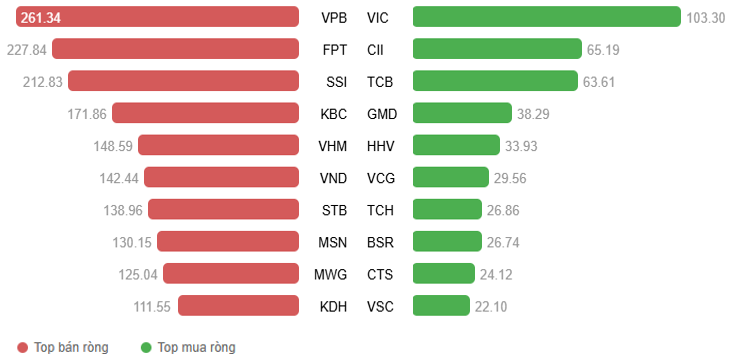

– Foreign investors intensified their net selling, with values exceeding VND 2.1 trillion on the HOSE and VND 141 billion on the HNX.

Daily Trading Value of Foreign Investors on HOSE, HNX, and UPCOM. Unit: Billion VND

Net Trading Value by Stock Code. Unit: Billion VND

– The market opened the September 25 session with mixed sentiments following yesterday’s strong recovery. While the overall breadth remained positive, weakness in large-cap stocks caused the VN-Index to hover around 1,660 points, trading within a narrow range during the morning session. This trend persisted into the afternoon, but a strong push from VIC and VHM propelled the index upward. The VN-Index closed at 1,666.09 points, a 0.52% increase from the previous session.

– In terms of influence, VIC stood out as the top contributor, adding 8.5 points to the VN-Index. Additionally, VHM, BSR, and VCB collectively contributed 2.7 points. Conversely, VPB exerted the most downward pressure, subtracting over 1 point from the index.

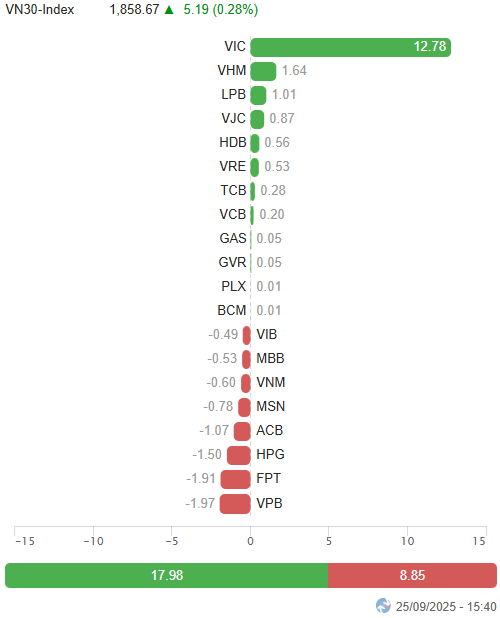

Top Stocks Impacting the Index. Unit: Points

– The VN30-Index rose by 0.28%, closing at 1,858.67 points. However, declining stocks outnumbered advancing ones, with 17 decliners, 12 advancers, and 1 unchanged. Notably, VPB and VIB saw significant declines of around 2%, while FPT, TPB, and ACB each lost over 1%. On the upside, VIC led with an impressive 6% gain, followed by VJC, VHM, VRE, and LPB, all rising by more than 1%.

Sector performance was mixed. The real estate sector led the gains, with standout performers including VIC (+6.04%), VHM (+1.53%), TCH (+2.3%), NLG (+2.25%), SJS (+2.25%), VRE (+1.38%), and SCR (+6.14%). However, several real estate stocks faced selling pressure, such as PDR (-0.6%), DIG (-0.78%), DXG (-0.85%), CEO (-1.11%), NVL (-0.93%), and LDG (-1.73%).

Notable gainers were primarily in the industrial sector, including VSC, HHV, CII, and LCG, all hitting their upper limits, along with VCG (+2.19%), VJC (+1.65%), GEX (+1.9%), GEE (+1.57%), DPG (+2.05%), and FCN (+3.78%).

Meanwhile, the information technology sector underperformed, declining by 1.39%, primarily due to pressure from leading stocks such as FPT (-1.51%), CMG (-0.75%), and ELC (-0.42%).

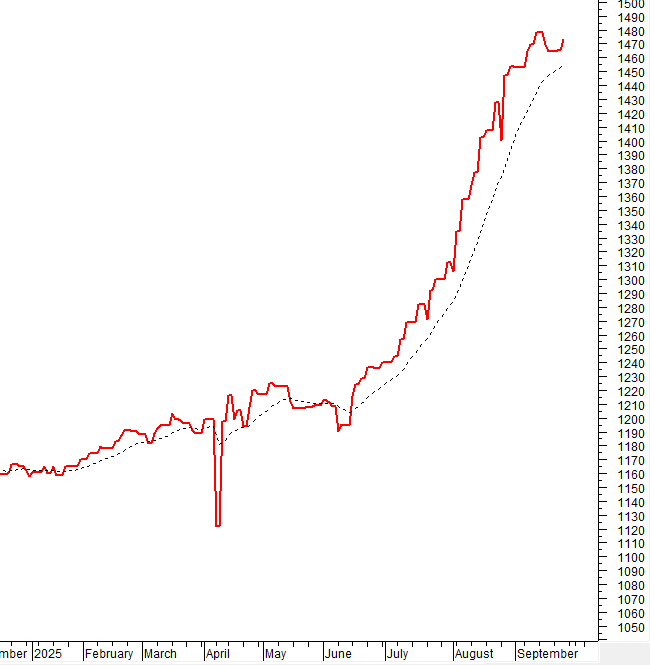

The VN-Index gained after a session of sideways movement, breaking above the Middle line of the Bollinger Bands. If the index maintains this level with trading volume surpassing the 20-day average, the short-term outlook will strengthen. Additionally, the Stochastic Oscillator is nearing a potential buy signal.

II. PRICE TREND AND VOLATILITY ANALYSIS

VN-Index – Breaking Above the Middle Line of Bollinger Bands

The VN-Index rose after sideways movement, surpassing the Middle line of the Bollinger Bands.

If the index sustains this level with trading volume above the 20-day average, the short-term outlook will be reinforced.

Furthermore, the Stochastic Oscillator is close to crossing the Signal Line, potentially generating a buy signal.

HNX-Index – Formation of a Doji Candlestick

The HNX-Index narrowed its gains, forming a Doji candlestick with a long upper shadow, indicating strong profit-taking pressure.

The index is likely to continue consolidating as a Triangle pattern emerges.

Liquidity Analysis

Smart Money Flow: The Negative Volume Index of the VN-Index remains above the 20-day EMA. If this trend continues in the next session, the risk of a sudden downturn (thrust down) will be mitigated.

Foreign Investor Flow: Foreign investors continued their net selling on September 25, 2025. If this trend persists in upcoming sessions, the outlook will become more pessimistic.

III. MARKET STATISTICS FOR SEPTEMBER 25, 2025

Economic & Market Strategy Analysis Division, Vietstock Advisory Department

– 17:46 September 25, 2025

Technical Analysis for the Afternoon Session of September 25: Holding Strong Above Key Support Levels

The VN-Index is currently fluctuating as it retests the middle band of the Bollinger Bands. However, the index has found stability after successfully testing the previous August 2025 low (around the 1,600-1,630 point range). Meanwhile, the HNX-Index shows even stronger momentum, with the Stochastic Oscillator generating a clear buy signal.

Surge in Brokerage Firm’s Proprietary Trading: One Stock Witnessed Unexpected Net Buying Spike on September 23rd

Proprietary trading firms recorded a net purchase of VND 61 billion on the Ho Chi Minh City Stock Exchange (HOSE), signaling a significant shift in market dynamics. This substantial investment underscores growing confidence in the bourse’s potential, as traders capitalize on emerging opportunities within Vietnam’s vibrant financial landscape.

When Will the Stock Market’s “Sawing Off the Table Legs” End?

The “lullaby of the sawing table leg” phenomenon is how many investors are describing the current state of the VN-Index. While the decline in the index isn’t substantial, the impact on investors’ portfolios is significant.

Market Pulse 24/09: VN-Index Successfully Rebounds, Reclaiming the 1,655-Point Milestone

At the close of trading, the VN-Index surged by 22.2 points (+1.36%), reaching 1,657.46 points, while the HNX-Index climbed 4.27 points (+1.56%) to 277.28 points. Market breadth favored the bulls, with 476 advancing stocks and 238 declining stocks. Similarly, the VN30 basket saw a dominant green trend, with 27 gainers, 2 losers, and 1 unchanged stock.