I. MARKET DYNAMICS OF WARRANTS

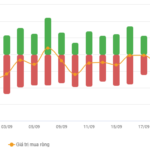

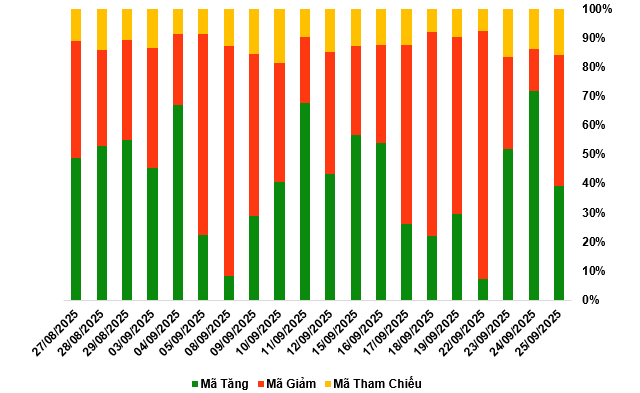

By the close of the trading session on September 25, 2025, the market recorded 96 gainers, 110 decliners, and 39 unchanged securities.

Market Breadth Over the Last 20 Sessions. Unit: Percentage

Source: VietstockFinance

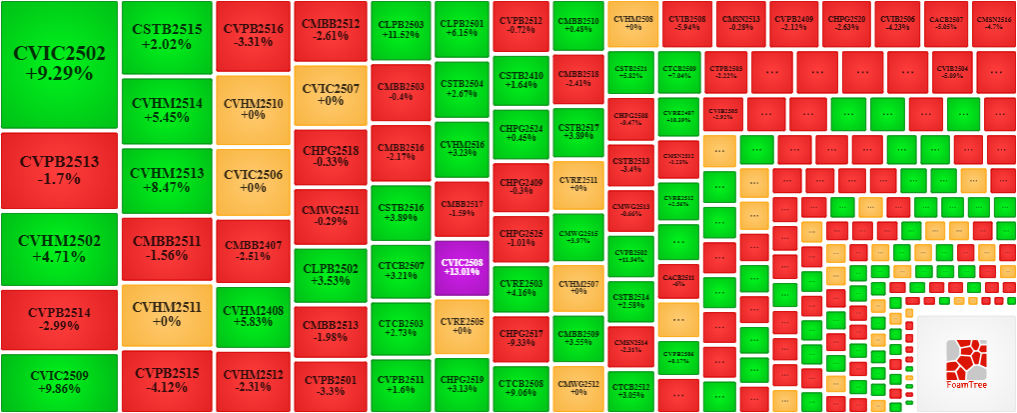

During the September 25, 2025 trading session, sellers regained control, driving most warrant prices downward. Notably, the largest decliners included CHPG2518, CVHM2512, CVPB2513, and CMBB2511.

Source: VietstockFinance

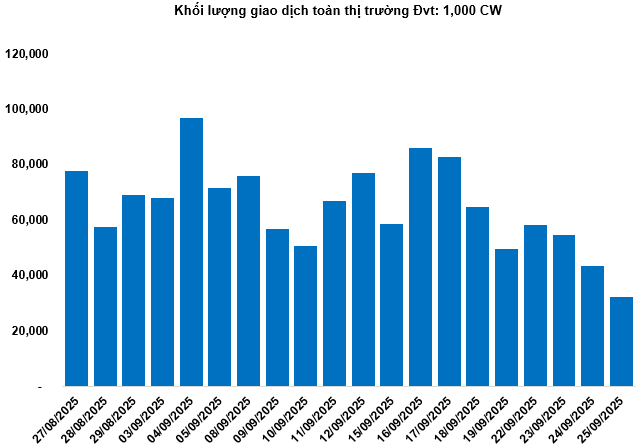

Total market volume on September 25 reached 32.31 million CW, down 25.37%; trading value hit 75.13 billion VND, a 20.55% decrease compared to September 24. CFPT2512 led in volume with 1.49 million CW, while CSTB2520 topped in trading value at 3.83 billion VND.

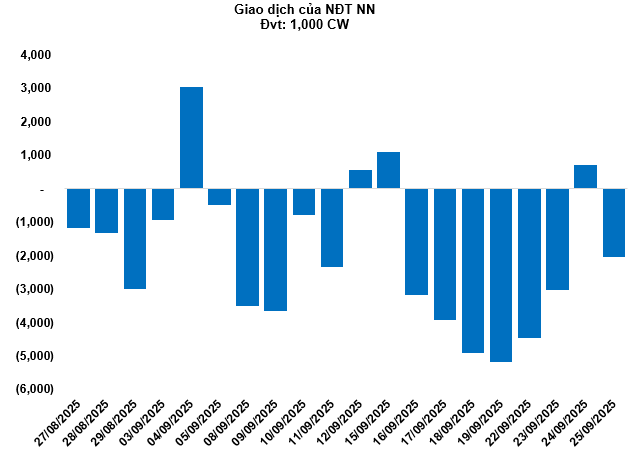

Foreign investors resumed net selling on September 25, totaling 2.05 million CW. CSHB2509 and CHPG2516 were the most heavily sold warrants.

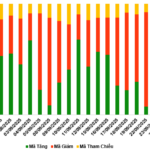

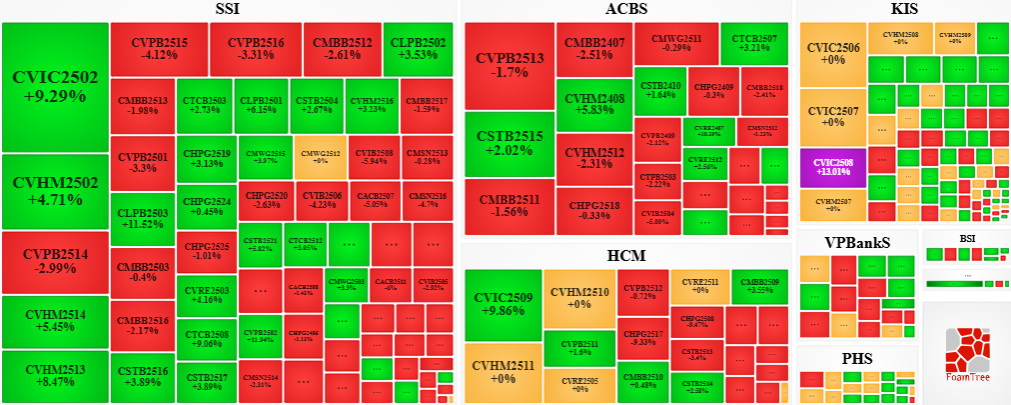

Securities firms SSI, ACBS, HCM, KIS, and VPBankS currently issue the most warrants in the market.

Source: VietstockFinance

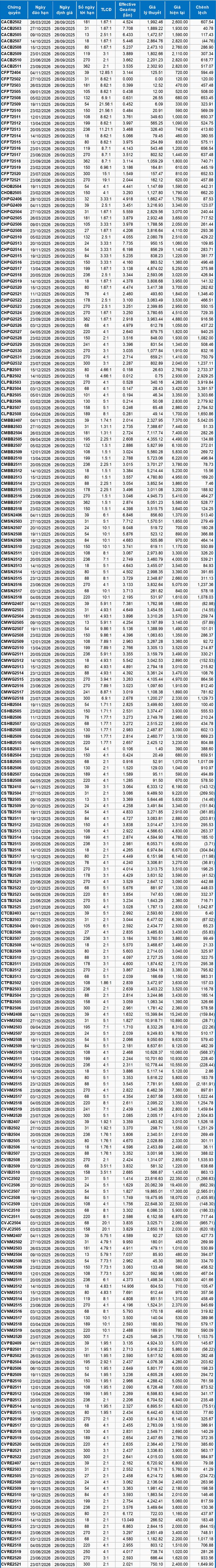

II. MARKET STATISTICS

Source: VietstockFinance

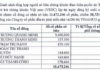

III. WARRANT VALUATION

Based on the valuation method applicable from September 26, 2025, the fair prices of actively traded warrants are as follows:

Source: VietstockFinance

Note: Opportunity costs in the valuation model are adjusted for the Vietnamese market. Specifically, the risk-free rate (government treasury bills) is replaced by the average deposit rate of major banks, with maturity adjustments for each warrant type.

According to the valuation, CVIC2507 and CVHM2515 are the most attractively priced warrants.

Warrants with higher effective gearing exhibit greater volatility relative to their underlying securities. Currently, CVNM2512 and CVRE2514 have the highest effective gearing ratios in the market.

Economic Analysis & Market Strategy Division, Vietstock Advisory Department

– 18:58 September 25, 2025

Unleashing Economic Potential: VCCI Advocates for Transformative Reforms in Vietnam’s Investment and Business Laws

This legislative draft embodies a bold spirit of reform, poised to establish a robust legal framework that will catalyze economic breakthroughs during this pivotal transition phase.

Market Pulse 24/09: VN-Index Successfully Rebounds, Reclaiming the 1,655-Point Milestone

At the close of trading, the VN-Index surged by 22.2 points (+1.36%), reaching 1,657.46 points, while the HNX-Index climbed 4.27 points (+1.56%) to 277.28 points. Market breadth favored the bulls, with 476 advancing stocks and 238 declining stocks. Similarly, the VN30 basket saw a dominant green trend, with 27 gainers, 2 losers, and 1 unchanged stock.

Warrant Market on September 25, 2025: Gaining Momentum with the Underlying Market

At the close of trading on September 24, 2025, the market saw 177 stocks rise, 36 fall, and 34 remain unchanged. Foreign investors returned to net buying, with a total net purchase of 703,300 CW.