After a period of soaring highs, the VN-Index is struggling to surpass the 1,700-point threshold. Since its short-term peak in early September, Vietnam’s stock market has entered a sideways downtrend, marked by small recovery sessions followed by deeper corrections that erase previous gains.

Many investors describe the current state of the VN-Index as a “sawing off the table legs” phenomenon. While the index’s decline isn’t substantial, the impact on investors’ portfolios is significant.

According to Nguyễn Minh Hoàng, Director of Analysis at Nhat Viet Securities (VFS), this “sawing off the table legs” phase emerged after the VN-Index repeatedly failed to breach the 1,700-point mark. As of now, the market has corrected over 4%, equivalent to more than 70 points since its peak following a heated rally. This occurred despite positive news such as the Fed’s rate cut and the impending market upgrade announcement. Average daily trading value since early September stands at approximately VND 34 trillion, a 23% decline compared to the previous month.

The market’s tug-of-war and declining liquidity stem from several factors.

First, while the Fed’s rate cut and market upgrade are positive developments, they aren’t novel—the market has anticipated them for some time. These factors, combined with stable macroeconomic conditions, fueled the market’s previous rally. Consequently, when these events materialized, profit-taking activities under the “sell on news” effect became inevitable as investors sought to secure gains accumulated over recent months.

Second, market sentiment has turned cautious as stock prices, following a sharp rise, are no longer as attractive. Currently, the market trades at a P/E ratio of 14.87, higher than the 5-year average of 13.5.

Third, historically, the market tends to experience heightened volatility from late September to mid-October as ETFs rebalance their Q3 portfolios and Q3 business results begin to surface. This has led many investors to adopt a wait-and-see approach.

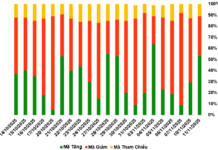

Past data indicates that September typically sees lower investment returns, and the VN-Index is currently influenced by this trend. Since early September, 214 out of 415 stocks on the HSX have declined, with 94 falling more sharply than the VN-Index’s -2.84%. Leading sectors like banking and securities have seen notable drops.

Technically, the VN-Index is trading below its short-term support level, the 20-day moving average (MA20). While declining liquidity reflects investor caution, it also suggests selling pressure isn’t overwhelming. Funds remain in the market, rotating across sectors in search of opportunities in individual stocks.

Thus, the market is likely to continue its “sawing off the table legs” phase and consolidate around 1,600 points until late September. The VN-Index may target higher levels in October when upgrade details become clearer.

In this sideways market, portfolio management is paramount. Investors should maintain a reasonable stock allocation and avoid leverage. Reducing exposure to underperforming stocks will preserve purchasing power.

New purchases should be selective. Investors should gradually deploy capital into stocks with strong fundamentals and positive Q3 earnings prospects. Technically, consider stocks successfully testing their MA20 support, particularly in sectors attracting inflows like construction, public investment, and real estate.

Market Pulse 24/09: VN-Index Successfully Rebounds, Reclaiming the 1,655-Point Milestone

At the close of trading, the VN-Index surged by 22.2 points (+1.36%), reaching 1,657.46 points, while the HNX-Index climbed 4.27 points (+1.56%) to 277.28 points. Market breadth favored the bulls, with 476 advancing stocks and 238 declining stocks. Similarly, the VN30 basket saw a dominant green trend, with 27 gainers, 2 losers, and 1 unchanged stock.

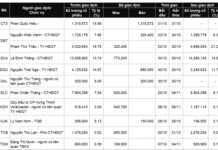

September 24th Session: Foreign Investors Continue Net Selling Spree, Offloading Nearly VND 1.6 Trillion – Which Stocks Took the Biggest Hit?

In the afternoon session, CII emerged as the most heavily net-bought stock across the entire market, with a remarkable value of 121 billion VND.