Smart Cash Flow Management: An Inevitable Trend

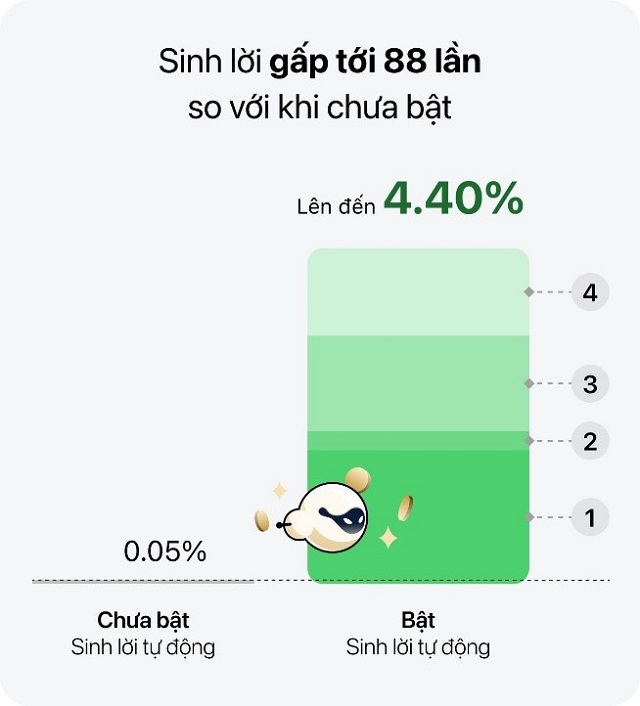

Clearly, beyond banks’ efforts to develop “Auto Profit” products, the shift in customer behavior and awareness is the primary driver of this wave’s popularity. In a context of economic growth and rising literacy, people are becoming more financially savvy, more attuned to profit opportunities, and less willing to let money sit idle at a mere 0.05% annual interest rate. Customers, especially the tech-savvy Gen Y and Gen Z, are constantly seeking flexible solutions that optimize cash flow profitability while enabling 24/7 spending. This shift reflects a new perception of money: it’s no longer just a transaction tool but an asset that must work efficiently anytime, anywhere.

Secondly, the development of digital banking and the population’s technological sophistication act as catalysts for this trend. According to the Ministry of Information and Communications, by the first half of 2024, Vietnam’s internet usage rate reached 78.1%, with over 100.7 million smartphone users. Data from the State Bank of Vietnam shows that many credit institutions have recorded digital transaction rates exceeding 90%. Products like Auto Profit leverage technology to automatically scan balances, transferring idle funds into profitable channels without manual intervention. Users can transact anytime, monitor balances, and manage profits directly on mobile apps.

The growth of digital banking and technological literacy fuels Auto Profit as an inevitable trend.

|

Thirdly, the benefits of this model solidify its appeal. For customers, profit rates surpass traditional deposit rates (up to 4.4% annually vs. 0.1-0.5%), boosting income without sacrificing liquidity. For banks, especially those with strong technology and governance systems, this model increases CASA ratios, reducing capital mobilization costs. Once dormant, these funds now fuel production and business development, optimizing economic benefits.

Globally, banks have long offered products like Sweep Accounts (automating transfers between primary cash and secondary investment accounts) and Multiplier Accounts (combining payment, investment, and insurance). Vietnam’s financial market is inevitably localizing such globally favored products.

When Pioneers Are Embraced

“We invested over 18 months in research and testing to ensure the product’s functionality, safety, and alignment with Vietnamese needs,” shared a Techcombank representative. This “strategic move” revitalizes the bank’s CASA offerings.

With yields up to 4.4% annually and instant liquidity—no thresholds, every penny and every day counts—this is a banking breakthrough. Beyond superior profitability and 24/7 flexibility, it ensures safety through multi-layered protections: legal compliance, SBV oversight, deposit insurance, and international-standard risk management.

Customers like Ms. Thu Thủy (Hanoi) praise its convenience: “Techcombank’s reputation reassures me. My money earns profits automatically while remaining accessible anytime—safe, convenient, and profitable!”

Ms. Nhu Ngoc (Ho Chi Minh City) highlights its safety: “My balance earns profits effortlessly, with monthly reports via the app. Flawless service and security prove technology truly serves people!”

|

Techcombank’s Auto Profit won 1 Gold and 2 Bronze Stevie Awards in 2025 for Product of the Year, Best AI Application, and Financial Service Excellence. Dubbed the “Business Oscars,” these awards affirm its global competitiveness.

A Profit Revolution in Finance

Techcombank’s pioneering efforts paid off, with 4.1 million customers activating Auto Profit and impressive digital banking metrics. This spurred industry-wide change, as nearly a dozen banks launched similar products like “Super Yield Accounts” and “Smart Investment Accounts,” diversifying profit-driven solutions.

Techcombank’s Auto Profit secured 3 Stevie Awards, the “Business Oscars.”

|

Ms. Nguyen Van Linh, Techcombank’s Retail Banking Deputy Director, stated: “Stevie Awards validate our commitment to optimizing customer value. We’ll continue enhancing features and security, staying true to our ‘daily excellence’ spirit.”

Auto Profit sets new financial standards, akin to the “Zero Fee” revolution a decade ago. Just as cashless payments became habitual, Auto Profit reshapes financial management for Vietnamese: smart, secure, and flexible.

Services

– 12:28 25/09/2025

Vietnamese Billionaire Receives Additional Trillions in Dividends

Vietnam Exhibition Fair Center JSC played a pivotal role in securing approximately VND 6,000 billion in dividends for Vingroup, the conglomerate led by billionaire Pham Nhat Vuong. Similarly, Nguyen Dang Quang and Masan Group reaped substantial dividends totaling thousands of billions of Vietnamese dong from Techcombank, Vinacafé Bien Hoa, and Net Detergent.

Masan’s Nguyen Dang Quang and Ecosystem Poised to Secure Trillions in Dividend Payouts

As of the latest Forbes update on September 20, 2025, Mr. Nguyễn Đăng Quang holds a net worth of approximately $1.2 billion.