Becamex IDC (Industrial Investment and Development Corporation, stock code: BCM, listed on HoSE) has recently announced its intention to exercise the right to purchase IJC shares in the upcoming offering of over 251.8 million shares by Becamex IJC Infrastructure Development JSC.

The share purchase ratio is set at 3:2, meaning for every 3 shares held, shareholders can acquire 2 new shares.

With its current ownership of nearly 188 million IJC shares, Becamex IDC is eligible to purchase approximately 125.3 million newly issued shares of Becamex IJC. The transaction is scheduled to take place between October 1, 2025, and October 23, 2025.

At an issuance price of 10,000 VND per share, Becamex IDC is expected to invest nearly 1,253.2 billion VND to acquire the registered number of shares.

Illustrative image

If the transaction is successful, Becamex IDC’s ownership in IJC will increase from nearly 188 million shares to approximately 313.3 million shares, representing a 49.76% stake in Becamex IJC.

In other developments, Becamex IDC recently disclosed the results of the first written shareholder vote in 2025.

Regarding the proposal to issue an additional 150 million shares to the public to increase charter capital, only 128 votes representing 2.85% of the total voting shares approved, while 6 votes representing 95.44% of the total voting shares abstained.

According to Clause 8, Article 22 of the Corporation’s Charter: A resolution is adopted through written shareholder voting if it receives approval from shareholders holding more than 50% of the total voting shares and is considered valid as if passed at a General Meeting of Shareholders.

Thus, the shareholders of Becamex IDC did not approve the proposal to issue additional shares to the public for capital increase.

Previously, Becamex IDC released documents for the second written shareholder vote in 2025.

The vote includes a proposal to rename the company from Industrial Investment and Development Corporation (Becamex IDC) to Becamex Industrial Investment and Development Group (Becamex Group).

Additionally, the company plans to relocate its headquarters to the 10th floor of mPlaza Saigon Building, 39 Le Duan Street, Saigon Ward, Ho Chi Minh City.

Becamex IDC shareholders listed as of August 28, 2025, are required to submit their written voting ballots to the company no later than 5 PM on September 29, 2025.

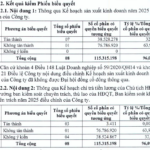

Insurance Firm Boosts Capital by 40% with Issuance of 29 Million Shares

The total number of shares surged from 72.3 million to 101.3 million, while the chartered capital increased by VND 289.6 billion, reaching a total of VND 1,013 billion.

Sonadezi Opposes Dowaco’s Two Critical Proposals

With nearly 64% of votes cast in opposition, the proposal to adjust the 2025 plan and the remuneration scheme for the Board of Directors and Supervisory Board of Dong Nai Water Supply Joint Stock Company (Dowaco, UPCoM: DNW) has been rejected. While the meeting minutes did not specify the reasons, the shareholder structure suggests that major shareholder Sonadezi was likely the opposing party.