Shifts in consumer shopping habits, coupled with modern supply chain technology and an extensive retail network, are fueling further growth in this sector.

Consumer Trends: Prioritizing Safe and Traceable Food

Pork remains a staple in the Vietnamese diet, with an estimated per capita consumption of approximately 37 kg per person annually in 2024, ranking Vietnam fourth globally.

According to experts, Vietnamese consumer shopping habits are undergoing a significant shift. While unbranded pork previously dominated over 90% of the market, certified and traceable meat products are now gaining traction, particularly in major urban areas. Modern families and young consumers are willing to pay a premium for organic, certified, or QR-coded products. This reflects a new consumer mindset: eating not just for sustenance, but for health and trust in the products they consume.

As consumers increasingly prioritize food safety and transparency, controlling the origin and production process of pork has become critical. Each MEATDeli product from Masan MEATLife (a member of the Masan ecosystem, HOSE: MSN) features a label or QR code allowing consumers to trace the entire journey: the farm, slaughterhouse, production date, packaging, and quarantine information.

To achieve this, Masan MEATLife (MML), a pioneer in building a branded meat value chain in Vietnam, has established standards for chilled meat products and criteria for evaluating pig farms. This ensures a supply of Viet Gap / Global Gap-certified pigs.

Expanding Branded Meat Reach Through Modern Retail

Consumers can now easily purchase MEATDeli chilled meat at major Vietnamese supermarket chains like WinMart, WinMart+, and WiN through a strategic partnership with WinCommerce (WCM, a Masan subsidiary), Vietnam’s largest modern retail network by store count.

The brand’s presence in WinMart stores has yielded impressive results. In July 2025, MML’s average daily revenue per WCM store reached nearly 2.3 million VND. If expanded to all 4,200+ WCM stores, potential daily revenue could hit nearly 9.5 billion VND, highlighting significant growth opportunities in modern retail.

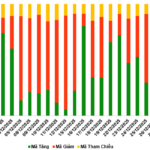

MML currently contributes 69% of WCM’s meat sales, up from 62% in Q2/2025 and significantly higher than previous years. This underscores MML’s growing importance in driving growth within the Masan retail ecosystem.

In August 2025, Masan MEATLife reported strong performance with a 12.9% year-on-year sales volume increase to 14,007 tons. Net revenue rose 11.1% to 999 billion VND, reflecting stable demand and growing contributions from modern retail. Operational efficiency improved significantly, with EBIT up 42.9% to 50 billion VND and net profit surging 60.5% to 35 billion VND. EBITDA also climbed 18% to 90 billion VND, indicating strengthened profit margins. These results confirm MML’s sustainable recovery post-restructuring, with improvements across both operational scale and financial performance.

Optimizing Supply Chains Through Technology

Masan MEATLife leverages Masan Group’s strengths to optimize costs, streamline operations, and enhance data-driven decision-making through advanced technology. The WiNARE automated ordering system has been implemented for chilled meat and FMCG products. By year-end 2025, nearly 70% of WCM’s product categories are expected to be automated or semi-automated, with plans to expand to frozen, fresh, seafood, produce, and processed foods.

Initial results from 614 stores in Ho Chi Minh City show a nearly 2% reduction in meat product waste as a percentage of revenue from May to August 2025, saving tens of billions of VND monthly. Shelf availability improved from 80% to nearly 90% by late August 2025 while maintaining optimal inventory levels, driving store revenue growth.

The combination of shifting consumer trends, technology adoption, and a robust distribution network presents significant growth opportunities for Vietnam’s branded meat sector, particularly for MEATDeli. Integrating technology into supply chains not only optimizes operations but also enhances consumer experience. With modern retail networks, safe meat products are becoming more accessible to Vietnamese families, laying a strong foundation for the branded meat market’s future growth.

Global Packaging Leader Champions Circular Economy Initiatives in Vietnam

Recently, Tetra Pak unveiled its Sustainability Report for the 2024 fiscal year (FY24), highlighting a 25% reduction in greenhouse gas (GHG) emissions across its entire value chain since 2019, with a further 5% improvement achieved since 2023.

Seized in Hanoi: 1,500 “3-No” Mooncakes at Shockingly Low Prices (2,000 – 3,000 VND Each) – No Label, No Brand, No Expiry Date

Discover the hidden truth behind the Mid-Autumn mooncake market. Some vendors import mooncakes at a mere $0.08–$0.12 per unit, only to resell them for $0.25–$0.29 each. Instead of openly displaying these products, they cunningly mix mooncakes of unknown origin into batches accompanied by official invoices and documentation, creating a deceptive facade of legitimacy.

Massive 6.5 Tons of Untraceable Food Seized in Hoa Lư City

During the inspection, authorities uncovered an additional 6.24 tons of frozen food stored in the warehouse, including various types of meat such as beef, chicken, buffalo, and pork. None of the products were accompanied by valid invoices or legal documentation.