The Supreme People’s Procuracy expresses concern that the classification of a “sole residence” as protected property may be exploited. Photo: LÊ VŨ |

The State Bank of Vietnam is seeking feedback to finalize the draft Decree outlining conditions for the seizure of collateral assets related to non-performing loans.

The Ministry of Justice and the Supreme People’s Procuracy have requested clarification on the Decree’s scope, arguing that collateral assets may belong to individuals, couples, households, or organizations, rather than solely to individuals as stated in the draft.

Article 3, which defines key terms, has sparked significant debate, particularly regarding the concepts of “sole residence” and “primary or sole work tool.” The Ministry of Home Affairs has called for clarification to avoid overlap with the 2023 Housing Law.

The Supreme People’s Procuracy notes that a “sole residence” could include villas or apartments with associated land-use rights, emphasizing the need to ensure a normal standard of living and consider “sole land-use rights.” The Ministry of Justice suggests removing vague terms such as “stable,” “long-term,” and “regular.”

Based on the feedback, the State Bank of Vietnam has revised the definition of “sole residence” to: “A legally owned residence where the individual is registered as a permanent or temporary resident; if seized, the guarantor will have no other place to live.”

For “primary or sole work tool,” the new definition limits it to movable assets valued up to 120 million VND, used to generate the individual’s primary income. Seizure of such assets would leave the guarantor without the means to earn the minimum regional wage.

Article 4, which outlines seizure conditions, has also received input from various ministries. The Ministry of Public Security proposes expanding the definition of “legal residence” to include ships, boats, and other vehicles.

The Supreme People’s Procuracy recommends adding protections when the asset is the primary residence or income source for a couple or household. The Ministry of Agriculture and Environment stresses the need for mechanisms to address discrepancies in collateral asset information.

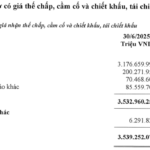

Incorporating these suggestions, the State Bank of Vietnam has categorized assets into two groups: those impacting social welfare (sole residence, sole work tool) and other assets. Both categories may only be seized if they fully meet the conditions outlined in Article 198a of the amended 2025 Law on Credit Institutions.

Bình Dương

– 06:24 25/09/2025

General Secretary To Lam: The Documents of the 14th National Congress Must Be a Strong Commitment to the People

On the afternoon of September 25th, at the Party Central Headquarters, General Secretary Tô Lâm chaired a working session with the Standing Committees of the Sub-Committees of the 14th Party Congress. The meeting aimed to provide feedback and finalize the draft documents to be submitted to the 14th Party Congress.

Unlocking Vietnam’s Blockchain Potential: Expert Nguyễn Ngọc Hưng Urges Builders to Shed “Outsourcing DNA”

During the 2020–2021 GameFi boom, fundraising for blockchain projects was so effortless that “a simple Pitch Deck, a white paper, or even a short demo video could secure millions of dollars in investment.”