HAG shares of Hoang Anh Gia Lai Group (HAGL) have been listed on the stock market since December 2008, with an initial market capitalization of VND 8,522 billion. After 17 years, HAGL’s market cap has doubled to VND 16,548 billion. However, this growth is primarily attributed to private placements issued by HAGL to investors.

Meanwhile, investors adopting a ‘penny-wise’ strategy—buying one HAG share daily—would still be at a loss after 17 years.

Specifically, an investor spending VND 92.2 million over 17 years would hold 5,358 shares, valued at only VND 83.8 million, resulting in a 9% loss.

Historical data reveals peak losses of 87% in March 2020. Conversely, the highest profit was recorded in September 2009, reaching 97% just under a year after HAGL’s IPO.

According to Q2/2025 financial reports, net revenue surged by over 50% year-on-year to VND 2,329 billion.

Consequently, gross profit and net operating profit nearly doubled compared to the same period last year. Post-tax profit reached VND 483 billion, up 86%.

For the first six months, HAGL reported VND 3,709 billion in net revenue and VND 824 billion in post-tax profit, increasing 34% and 73% respectively compared to H1/2024.

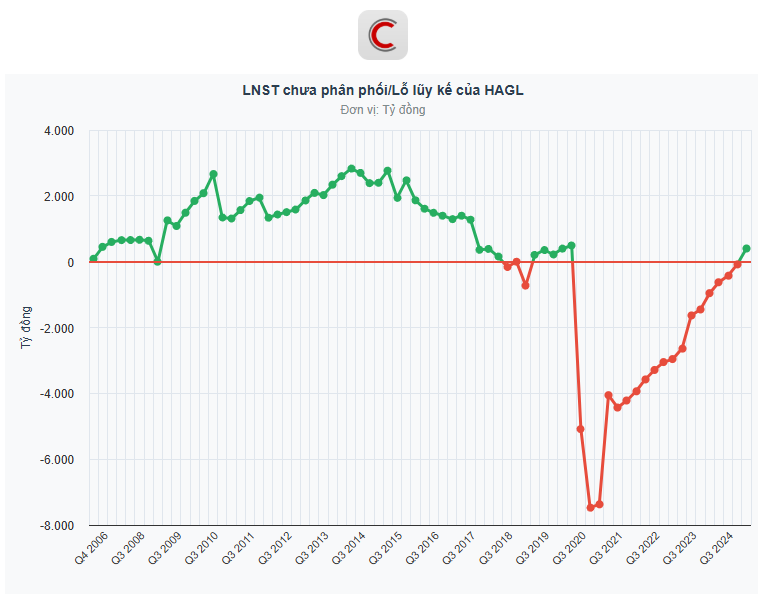

These results enabled HAGL to achieve VND 400 billion in undistributed post-tax profit as of June 30, 2025—the first time since Q4/2020 the company has escaped cumulative losses.

Previously, HAGL faced significant losses in 2015 and 2018. In 2020, despite reporting VND 492 billion in undistributed post-tax profit through Q3/2020, the figure abruptly shifted to -VND 5,085 billion in Q4/2020, further adjusted to -VND 6,301 billion in the audited report, shocking shareholders.

The Prodigal Son’s Strategic Maneuver: Unraveling the Persistent Accumulation of Hoang Anh Gia Lai Shares

“In a recent display of confidence in the company, Doan Hoang Nam, son of business tycoon Bầu Đức, acquired 27 million shares of HAG, the stock of Hoang Anh Gia Lai Joint Stock Company. Valued at approximately VND 426 billion, this transaction signifies a substantial investment. Now, Nam is poised to purchase an additional 25 million HAG shares from August 28 to September 12, boosting his ownership stake to 4.92% of the company’s capital, equivalent to a substantial holding of 52 million HAG shares.”

The Son of Vietnamese Tycoon ‘Bầu Đức’ Seeks to Invest an Additional 400 Billion VND in HAG Shares, Even Before His Previous Purchase Has Cleared.

“Doan Hoang Nam has just announced his intention to purchase an additional 25 million shares of Hoang Anh Gia Lai, bringing his ownership stake in the company to 4.92%. This significant acquisition underscores Mr. Nam’s confidence in the company’s prospects and his commitment to its long-term growth.”

The Thrilling Saga of “Bầu” Đức and Hoàng Anh Gia Lai: Unveiling the Latest Sensational Updates

“Vietnamese business tycoon, known as ‘Bầu Đức’, and his son have finalized a substantial stock transaction involving HAG shares, valued at approximately 400 billion VND. This significant deal underscores the dynamic nature of Vietnam’s evolving business landscape, where influential families continue to shape the country’s economic trajectory.”