Four new strategic resolutions are shaping a comprehensive reform, compelling Vietnam’s banking sector to undergo a robust transformation across technology, legal frameworks, and business models. Image: Lê Vũ |

The four pivotal resolutions, issued by the Politburo from late 2024 to mid-2025, each focus on a core reform pillar: Resolution 57 guides digital transformation and innovation, Resolution 66 targets legal and institutional reforms, Resolution 59 emphasizes international integration, and Resolution 68 positions the private sector at the heart of development strategies. Within this reform ecosystem, the banking sector is not only directly impacted but also serves as a critical link in realizing these reform objectives.

Unlike previous phases, where policies were largely encouraging and experimental, the current phase marks a clear shift with specific action plans, tight implementation timelines, and comprehensive monitoring mechanisms. The State Bank of Vietnam (SBV) is not only coordinating monetary policy but also pioneering new implementation frameworks, spanning legal, product, and technological infrastructure. As a key architect, the SBV is steering the banking system toward a modern, data-integrated, and technology-driven model, aligned with sustainable governance standards.

Four Key Resolutions and Their Implementation in the Banking Sector

To catalyze the economy in the new decade, Vietnam requires significant impulses to shape its economic environment, develop domestic resources, and leverage diverse external resources for upcoming economic growth. These resolutions have far-reaching impacts on the banking system’s capital allocation, shaping institutional, technological, legal, integration, and credit pillars for the next development phase.

Firstly, Resolution 57 identifies digital transformation, innovation, and technology as strategic breakthroughs to enhance national competitiveness. For the banking sector, this resolution lays the groundwork for a comprehensive digital shift, encompassing technological infrastructure, big data ecosystems, AI applications in credit assessment and customer advisory services, and pilot projects like peer-to-peer lending and digital assets. The SBV has operationalized Resolution 57 through Action Plan 1364/QĐ-NHNN dated March 5, 2025, and launched an innovation competition across the sector.

Resolution 59 outlines a comprehensive and deep international integration strategy, marking a strategic shift to strengthen Vietnam’s position in global value chains and enhance economic resilience. For banks, this resolution mandates adherence to international financial standards (Basel III, IFRS, ESG), bolsters local banks’ competitiveness, and establishes frameworks aligned with international commitments.

Resolution 66 is a legal and institutional breakthrough, aiming to remove legal barriers and enhance law-making and enforcement quality. It emphasizes decriminalizing economic relations and promotes ex-post checks over ex-ante controls, opening avenues for broad reforms in licensing, business conditions, and administrative procedures. For banks, this resolution supports a more sustainable legal framework, simplifies lending procedures, accelerates credit process digitization, and mitigates legal risks in corporate lending.

Resolution 68 positions the private sector as a key economic driver. In credit terms, it focuses on value chain and cash flow lending, promotes green credit, simplifies borrowing procedures, and integrates bank-tax-e-invoice data. It also expands collateral definitions to include intangible assets and future assets. The SBV has operationalized this resolution through action decisions and is revising the Law on Credit Institutions, integrating bad debt resolution mechanisms under Resolution 42 to facilitate private sector lending.

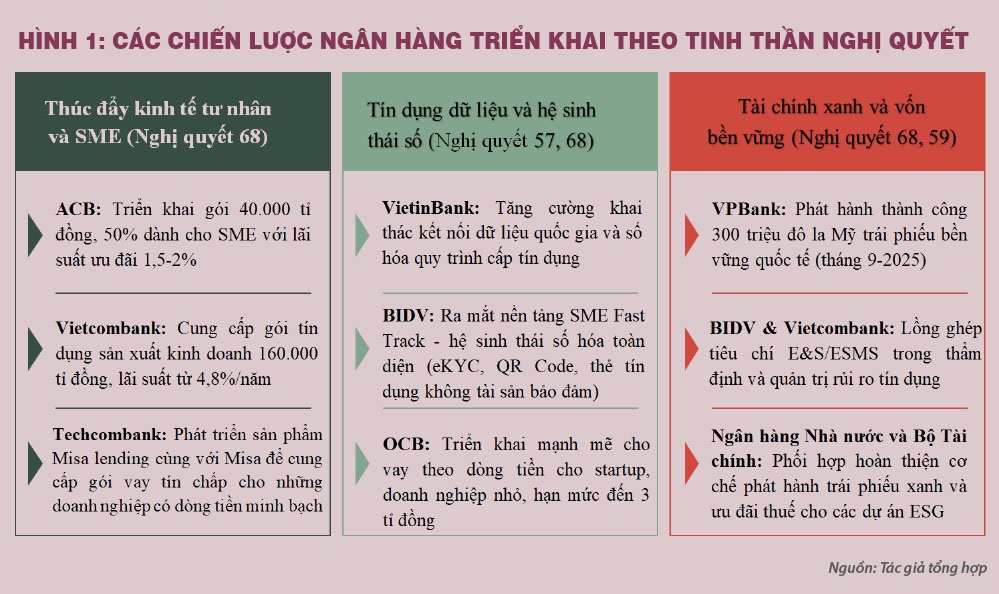

Specific Action Strategies of Individual Banks

While past policies were seen as macro-level guidelines, the new resolutions create immediate pressure, requiring banks to translate institutional thinking into concrete actions. The government and SBV expect credit institutions to lead and innovate, especially in unprecedented areas like green credit, cash flow lending, and cross-sector data integration.

However, realizing these expectations amid market challenges is no small feat. Banks face high capital costs, shrinking credit growth margins, and increasing competition from fintech companies. Success requires a deep restructuring, from mindset to business models. Several commercial banks have taken proactive steps, emerging as leaders in this new landscape.

Following Resolution 68, ACB Bank launched a VND 40 trillion credit package, with 50% allocated to SMEs at rates 1.5-2% below market. Notably, Techcombank and BIDV partnered with Misa Corporation to offer unsecured loans to SMEs based on cash flows from accounting and sales software. Vietcombank introduced a VND 160 trillion business credit package at just 4.8% annually. VPBank focused on individual business households, developing the CommCredit ecosystem with loans up to VND 1 billion without collateral, alongside accounting software, digital signatures, and e-invoicing services.

These programs reflect a strategic push into the private sector, especially SMEs. VietinBank enhances national data connectivity and credit process digitization, expanding digital disbursement channels for businesses. BIDV launched SME Fast Track, a comprehensive digital ecosystem for SMEs, featuring eKYC account opening, QR code revenue collection, and unsecured credit cards.

Beyond product deployment, major banks are expanding internationally for sustainable capital. In September 2025, VPBank successfully issued $300 million in sustainable international bonds, dedicated to green and inclusive finance projects. This milestone secures international capital and sets ESG standards across domestic credit portfolios, paving the way for Vietnam’s sustainable finance market.

Mid-sized banks like OCB are also innovating credit models, shifting from asset-based to cash flow-based lending, targeting SMEs, startups, and potential models lacking traditional collateral. OCB offers unsecured loans up to VND 3 billion with 12-month terms, approved based on stable cash flows and viable business plans. Proven startups can access medium-term unsecured loans, disbursed in phases.

Since early 2025, the SBV has mandated banks to establish environmental and social risk assessment systems and report green credit structures periodically. By June 2025, VPBank led with VND 31.7 trillion in green loans, up 44.5% from 2024. BIDV and Vietcombank have integrated E&S/ESMS criteria into credit risk management. The SBV is also collaborating with the Ministry of Finance to refine green bond mechanisms and tax incentives for ESG projects, fostering Vietnam’s green capital market.

These actions highlight Vietnam’s banking sector’s dynamism in preparing for upcoming changes. Growth drivers are shifting from credit expansion to digitalization, data utilization, ESG governance, and flexible policy implementation. The four resolutions create a unified policy ecosystem, necessitating comprehensive restructuring across mindset, technology, legal frameworks, and products.

Lê Hoài Ân – Võ Nhật Anh

– 13:00 26/09/2025

Revolutionizing Finance & Real Estate: Citics and VPBank Partner to Build a Digital Ecosystem

On September 19, 2025, in Hanoi, Citics Group Joint Stock Company (Citics) and Vietnam Prosperity Joint Stock Commercial Bank (VPBank) officially signed an expanded cooperation agreement, marking a strategic milestone in combining financial and banking strengths with real estate technology expertise.

Unlocking Vietnam’s Green Bond Market: Tackling the Biggest Bottleneck

For Vietnam’s green bond market to truly flourish, a synchronized approach is essential. This includes refining the legal framework, implementing targeted financial support policies from the government, and fostering proactive corporate governance practices focused on sustainability.